Canadian Dollar Latest: CPI Higher, CAD Faces Upside Risks

Canadian Dollar Analysis & News

- Canadian Inflation Continues to Edge High – BoC Vigilant

- Upside Risks to CAD as Oil Edges Higher

Canadian Inflation Continues to Edge High – BoC Vigilant

Canadian Inflation data printed above expectations on both the monthly and yearly rates at 0.2% (vs 0.1%) and 4.1% (vs 3.9%) respectively. Meanwhile, the BoC’s preferred measure (average of median, trim and common CPI) rose to 2.56% from 2.46%. Unlike the Fed, the BoC are seemingly more attentive to inflation risks with Governor Macklem stating that he will be closely watching inflation data. Now while this will unlikely alter the decision for the BoC to taper the pace of asset purchases at the October meeting, the figures are likely more important in regard to the timing of a rate hike, which as it stands is priced in for H2 2022. Therefore, should inflation remain elevated risks are for earlier tightening presenting upside risks for the Loonie.

Market Reaction: Overall, a relatively muted reaction in the Canadian Dollar with greater attention placed on risk appetite. That being said, given where oil prices are trading, CAD is looking relatively cheap.

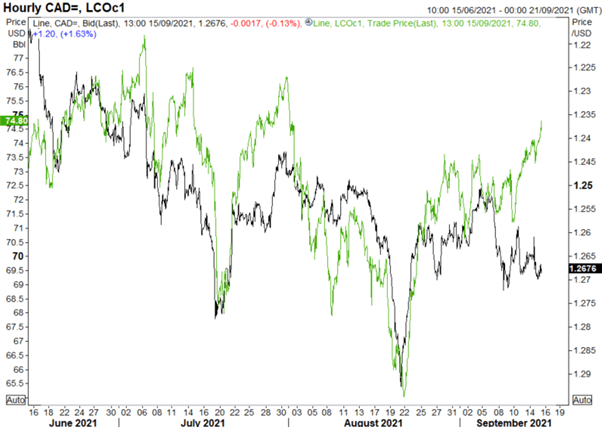

USD/CAD (Inv) vs Brent Crude Oil

Source: Refinitiv

By Justin McQueen, Strategist, 15 September 2021. DailyFX

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now