British Pound (GBP) Price Outlook: GBP/USD Edging Lower But Range Holds

GBP PRICE, NEWS AND ANALYSIS:

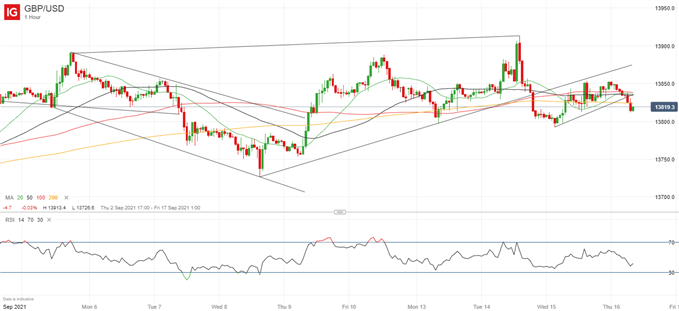

- GBP/USD is edging lower in early European trade Thursday but remains within the range between just over 1.39 and just under 1.38 that has contained price action for the past week.

- News of an extensive Cabinet reshuffle by UK Prime Minister Boris Johnson has had little impact on GBP.

GBP/USD EASES BACK

GBP/USD is slipping back modestly Thursday, with small losses recorded in Asian trade continuing into the European session. However, it remains in the range between Tuesday’s high at 1.3913 and the 1.3792 low recorded Wednesday; a range that has held since September 9.

For now, there is little sign of the range breaking, although Friday’s UK retail sales data for August could give the pair a nudge. The consensus among economists is that sales grew by 2.7% year/year, up from July’s 2.4% increase.

GBP/USD PRICE CHART, ONE-HOUR TIMEFRAME (SEPTEMBER 2-16, 2021)

Source: IG (You can click on it for a larger image)

GOVERNMENT RESHUFFLE

The big news in the UK Wednesday was a Cabinet reshuffle by Prime Minister Boris Johnson. Robert Jenrick, Robert Buckland and Gavin Williamson lost their jobs as Secretaries of State for Communities, Justice and Education respectively, while Dominic Raab was demoted from Foreign Secretary.

However, many ministers also kept their jobs, including Chancellor Rishi Sunak, Home Secretary Priti Patel and Health Secretary Sajid Javid, providing some stability in government and thereby ensuring that there was no impact on the Pound.

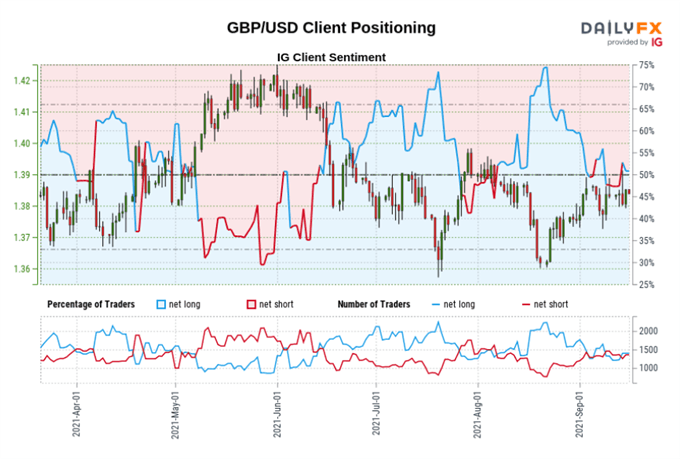

BULLISH SENTIMENT SIGNAL

Turning to market sentiment, IG client positioning data suggest a recovery in GBP/USD. The retail trader data show 50.58% of traders are net-long, with the ratio of traders long to short at 1.02 to 1. The number of traders net-long is 3.58% lower than yesterday and 17.38% lower than last week, while the number of traders net-short is 9.42% higher than yesterday and 13.22% higher than last week.

Here at DailyFX, we typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that GBP/USD may soon reverse higher despite the fact traders remain net-long.

Written by Martin Essex, Analyst, 16 September 2021. DailyFX

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now