Q3 US Earnings Season review: 3 things we learned this reporting period

Q3 earnings season propelled the S&P 500 to fresh record highs; although company’s flag concerns about the impact of higher costs on future profits.

Source: Bloomberg

When does the US reporting season come to an end?

Q3 US earnings season will come to an end in the next fortnight, with 92% of companies having reported as of November 12, 2021.

What are the 3 biggest issues this quarter?

Earnings and revenue growth beats analyst forecasts

Earnings and revenue exceeded expectations in the quarter, with financial data company FactSet Research Systems Inc putting earnings growth for the quarter at 39.1%, and revenue growth at 17.5%. This bested the consensus estimate heading into the quarter’s results of 27.4% and 14.9%, respectively. Although not as robust as the previous quarter’s earnings growth of 87%, which benefitted from the base effects of the Covid-19 recession a year earlier, it was still the third highest EPS growth rate for the US 500 in over a decade.

Inflation at risk and high costs threaten profit margins

Although both the bottom and top lines of S&P 500 companies delivered better than expected results for the quarter, there remained some cautionary messages from company’s when it came to the issues of inflation. Based on data from FactSet, the number of corporates mentioning inflation in earnings calls was at more than a decade high in Q3, with the threat of higher costs lowering analyst estimates for future profit margins. The impact is expected to materialize in coming quarters, with margin estimates revised lower, despite company’s exceeding analysts’ profit margins forecasts for Q3.

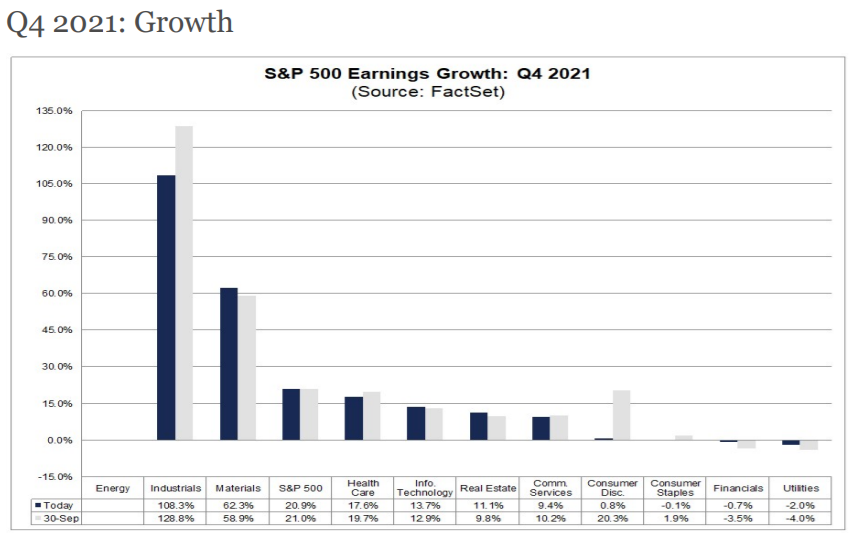

Beat/miss ratio falls while Q4 profits get revised

There are signs that earnings momentum may be slowing for S&P 500 companies, with slower growth and higher costs likely to weigh on profits in the future. The beat/miss ratio for S&P 500 companies dropped to 81% this quarter from around 87% in the previous one, while earnings growth for Q4 was revised lower very modestly to 20.9% from 21%. This comes despite an estimated increase in revenue growth next quarter, with the slowing momentum in profits coming due to the expected squeeze on margins from rising costs.

Source: FaceSet

S&P 500 rallies through earnings season as profits push index to record highs

Earnings season proved a major boost for the S&P 500, which has managed to climb by 6.5% between Monday 11th October and Friday 12th November. The rally pushed the S&P 500 into technically overbought territory, with the index pulling back in recent days as momentum turned lower, breaking trendline support in the process. With earnings season no longer a driver of sentiment, and concerns about inflation and interest rate hikes from the Fed seizing the narrative, the S&P 500 could pull-back further as upside momentum fades. A break of support at ~4645 could see the index revert to its 20 DMA just above 4600, with the key level below that 4545. A break above ~4715 and to fresh record highs would confirm the bulls remain in control of the index.

Source: TradingView

Take your position on over 13,000 local and international shares via CFDs or share trading – and trade it all seamlessly from the one account. Learn more about share CFDs or shares trading with us, or open an account to get started today.

Kyle Rodda | Market Analyst, Australia

16 November 2021

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now