Is the Netflix share price a buy at current levels?

A sharp drop in the Netflix share price has seen brokers rerating the stock.

Source: Bloomberg

Source: Bloomberg

Is the Netflix share price a buy?

The share price of Netflix has fallen around 36% since the release of first quarter (Q1) 2022 results. The short-term move lower furthers the drop seen since the November 2021 highs to roughly 69%.

In this article we breakdown recent events that have affected the Netflix share price, look at the company’s forecasts, broker ratings and price targets for the stock.

Key takeaways

- The Netflix share price has fallen around 70% since November 2021

- Short term losses have been extended following Q1 2022 results

- Subscriber numbers have contracted and are expected to contract again in Q2 2022

- The group is looking at new pricing models to help mitigate subscription losses

- Consensus broker ratings on the stock have moved to ‘hold’ from ‘buy’ recently

- The share price of Netflix is however trading at a steep discount to a mean of long term price targets

- The weekly price chart of Netflix suggests that selling on the share could be reaching a point of capitulation

Why the Netflix share price decline?

While the Q1 results for Netflix saw revenue and earnings per share (EPS) in line to slightly ahead of consensus estimates, markets have drawn caution from the first drop in subscriber numbers noted in more than a decade. The groups outlook for the second quarter has been cause for further investor distress as Netflix anticipates another 2 million paying subscribers will be lost over the upcoming reporting period.

Q1 subscriber numbers fell by 200 000 net paid memberships. Important to note that the group did cut its service in Russia, resulting in around 700 000 accounts being lost. It also affects onboarding from the region until such time as we see resolve in the current Russia Ukraine conflict. Excluding the 700 000 clients lost in Russia, the group would have actually added net paid subscriptions of 500 000.

Even if we exclude the Russian accounts, 500 000 memberships would still be considered a soft number. Netflix had forecast more than 2 million subscribers for the quarter. Increased competition and account sharing have also been cited as some of the headwinds the company facing as well.

Remedial action to boost revenue and memberships

To tackle the subscriber issue, Netflix is looking to address the account sharing issue noted. The company estimates that in addition to the 222 million paid subscriptions it has globally, approximately 100 million extra households are making use of existing subscriptions. The group has already started to test new features such as allowing households the choice of adding lower cost additions to existing household subscriptions.

Where cost might be a factor, Netflix is also looking at offering new memberships at reduced costs at the expense of adding advertising to these streams.

The varied new price points suggested will change investor focus from net paid subscribers to an average revenue per member.

While cost initiatives are being looked at, the company will also look at doubling down on high viewership content which has been at the forefront of the businesses success in the past.

A competitive landscape

Over the eight months or so (May 2021 to February 2022), Netflix has actually seen its share of viewing (TV) time in the US increase from 6% to 6.4%, that’s according to Nielson marketing and research. The Disney+ share of viewing time in the US has moved from 1% to 1.7%, while Prime Video has also gained over the period from 2% to 2.3%. Hulu’s share of US viewing time appears to have plateaued at 3%, while Youtube streaming has declined from 6% to 5.7%.

Netflix notes that the ‘other’ category of online streaming players is growing in realization of the migration thereto. Amongst the younger audience there is also a case to be made for increased gaming adoption and applications like Tik Tok which are competing aggressively for viewership time.

Guidance for Q2 2022 results

The group has issued the following guidance for the second fiscal quarter of 2022 ending in June 2022:

- Revenue to increase by 9.7% year on year (YoY) to $8.053 billion

- EPS of $3.00 (vs $2.97 in Q2 2021)

- Global paid memberships to decline by 2 million to 219.64 million

Netflix rerating

Since the release of Netflix’s latest results on 19 April 2022, we have seen a number of banks, investment and research houses rerating the stock. A summary of these new ratings sourced from Yahoo Finance are as follows:

In terms of downgrades:

- Loop Capital, Edward Jones and DZ Bank have downgraded the stock from ‘buy’ to ‘hold’.

- JP Morgan, Piper Sandler, UBS and Atlantic Equities have downgraded the stock from ‘overweight’ or ‘buy’ to ‘neutral’

- Oppenheimer has downgraded the stock from ‘outperform’ to ‘perform’

- KGI Securities has downgraded the stock from ‘outperform’ to ‘neutral’

- Pivotal Research has downgraded the stock from ‘buy’ to ‘sell’

- Bank of America Securities has downgraded the stock from ‘buy’ to ‘underperform’

Only one ratings upgrade has been noted since the results

Needham has upgraded the stock from ‘underperform’ to ‘hold’

Some have reaffirmed ratings:

- Morgan Stanley and Barclays maintain ‘equal-weight’ ratings

- Citigroup, Canaccord Genuity and Guggenheim maintain ‘buy’ ratings

- Evercore ISI maintains ‘in-line’ rating

- Goldman Sachs, Credit Suisse, Wedbush and Rosenblatt maintain ‘neutral’ ratings

- BMO Capital and Cowen & co. maintain ‘outperform’ ratings

- Deutsche Bank maintains ‘hold’ rating

Source: Refinitiv

Source: Refinitiv

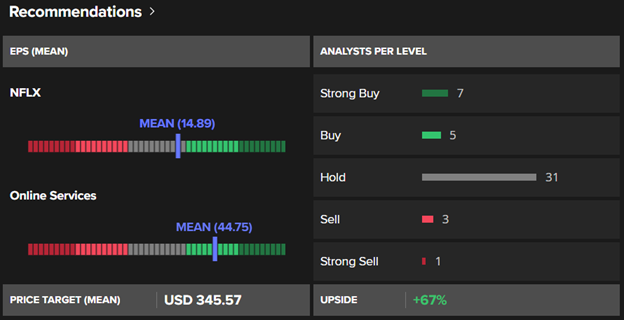

A Refinitiv poll of 47 analyst broker ratings as of 25 April 2022, arrives at a long term consensus of ‘hold’. A mean of long-term broker price targets suggests a fair value of $345 for the share. This price target suggests that the current share price of Netflix trades at a 67% discount thereto. A Refinitiv poll of 47 analyst broker ratings as of 25 April 2022, arrives at a long term consensus of ‘hold’. A mean of long term broker price targets suggests a fair value of $345 for the share. This price target suggests that the current share price of Netflix trades at a 67% discount thereto.

Netflix – Technical view

Source: IG charts

Source: IG charts

The above weekly chart of Netflix shows how aggressive the decline has been since November 2021. Historical trend line support comes in at around $189. A break below this level would see $131 as a possible further target.

The chart does however suggest that there might be some capitulation in weakness and as we remain in oversold territory.

Long term investors looking to get involved in the stock might prefer to wait for some confirmation that the price is starting to reverse. This could come in the form of a bullish price reversal and move out of oversold territory.

However the sharp nature of the decline suggests that we may see some form of consolidation at these lower levels before renewed gains can be assumed.

Traders might consider the extent of the recent decline to have already moved too far to consider short entry. Contrarian traders looking for a rebound from current levels might be inclined to snap at gains if the high risk opportunity is afforded.

.jpg.27c55ea07d5a17683fbdbda06b8fcace.jpg)

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now