Struggle between inflation ‘relief’ and recession fears: S&P 500, Brent crude

US equity markets closed the last day of the second quarter in the red, as a struggle between some inflation ‘relief’ and growing recession fears largely ensued.

Source: Bloomberg

Source: Bloomberg

Market Recap

US equity markets closed the last day of the second quarter in the red, as a struggle between some inflation ‘relief’ and growing recession fears largely ensued. The release of the US personal consumption expenditures (PCE) price index may have kept some hopes of a potential peak in inflation alive, with the May’s data staying unchanged from April with a 6.3% increase year-on-year while the core PCE price index came in lower than expected (4.7% versus 4.8% forecast). While this may provide a pocket of optimism that inflation is not as bad as feared, the current figures still tower above the Fed’s inflation target of 2%, which should leave Fed’s aggressive tightening path undeterred for now. Rate hike expectations continue to point towards the more probable scenario of a 75 basis-point hike in the July’s Federal Open Market Committee (FOMC) meeting.

What is more attention-grabbing may be the worst-than-expected decline in real consumer spending (-0.4% versus -0.3% forecast), which shows that demand is clearly moderating in light of elevated prices and tighter liquidity conditions. This drove recession fears to take greater control of sentiments yesterday, reflected in the broad-based plunge in US Treasury yields as market participants continue to seek for bond cover. The US 10-year Treasury yields moved 8 basis points lower to trade at 3.01%.

Since July last year, a head-and-shoulder formation seems to be in place for the S&P 500 and the completion of the pattern points to the 3,500 level as an area where some dip buying sentiments may surface for another potential relief rally. This level also marks a confluence of support, where a key 50% Fibonacci retracement rests in place, if drawn from the Covid-19 bottom to the S&P 500’s record peak at the start of the year.

Source: IG charts

Source: IG charts

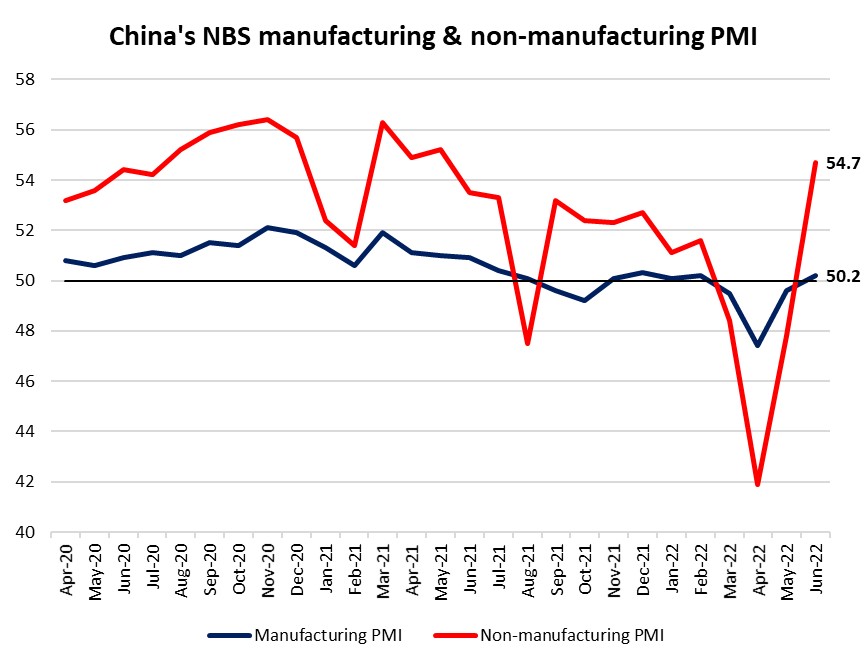

Asia Open

Asian stocks look set for a largely muted open, with Nikkei -0.08%, ASX +0.48% and KOSPI +0.39% at the time of writing. Hong Kong market will be closed for holiday today. The overall dampened mood in the risk environment may continue to drive a cautious session in Asia, but with yesterday’s sell-off largely pricing for Wall Street weakness, along with some resilience in Chinese equities, losses may seem more limited. The Nasdaq Golden Dragon China Index started the US session sharply lower but were quick to pare back on its losses to close 0.3% in the red overnight. Further recovery in China’s economic conditions remains the catalyst in instilling more market confidence towards Chinese equities, with its latest June’s purchasing managers' index (PMI) backing away from contraction territory as expected and providing some hopes that the worst may be over for now.

Source: Refinitiv

Source: Refinitiv

A series of manufacturing PMI releases from S&P Global was released this morning, with the broad-based decline in manufacturing PMI figures across the region reinforcing the global moderation in economic activities as a result of policy tightening. Taiwan may be the standout, with PMI falling into contractionary territory of 49.8 – the first since July 2020. The China’s Caixin manufacturing PMI will be in focus later today, with the data being more focused on private firms compared to the official data released yesterday. Expectations point to a reversion to expansionary territory to 50.1 from 48.1 in May and one should watch if markets will tap on any signs of growth for a near-term relief.

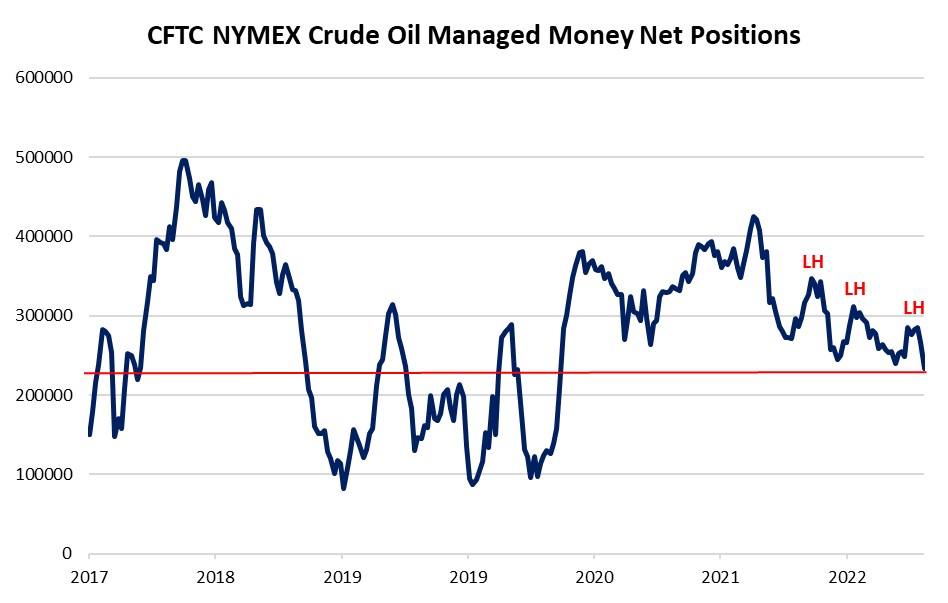

On the watchlist: Recent rally for Brent crude came short-lived

The conclusion of the Organization of the Petroleum Exporting Countries Plus (OPEC+) meeting saw the group sticking to its previous stance of increasing production by 648,000 barrels per day in July and August, with no policy guided for subsequent months. As the no-change may be largely expected, the 3.2% drop in oil prices seems to be attributed more to recession concerns as US Treasury yields moved lower. On the technical front, yesterday’s sell-off seems to follow through from a bearish pin bar on Wednesday, which suggests the strong presence of sellers. Longer-term, last week’s Commodity Futures Trading Commission (CFTC) data revealed net-long positions among money managers to be at its lowest since April 2020, suggesting that money managers may seem to find less conviction with each oil rally. This will leave the formation of any lower low ahead on watch, as markets continue to struggle with concerns of recession.

Source: IG charts

Source: IG charts

Source: Bloomberg

Source: Bloomberg

Thursday: DJIA -0.82%; S&P 500 -0.88%; Nasdaq -1.33%, DAX -1.69%, FTSE -1.96%

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now