S&P 500, Nasdaq 100 await Google and Microsoft’s earnings, FOMC & US GDP eyed

The S&P 500 ekes out small gain; Nasdaq 100 falls for the second day in a row; Microsoft and Alphabet’s earnings to steal the spotlight on Tuesday and the FOMC monetary policy decision will take the center stage on Wednesday.

Source: Bloomberg

U.S. stocks were mixed on Monday amid cautious sentiment in a session devoid of major drivers or extreme volatility ahead of key corporate earnings from big tech names and high-impact economic events, such as the July FOMC monetary policy decision (Wednesday) and the U.S. second-quarter gross domestic product report (Thursday).

At the closing bell, the S&P 500 advanced 0.13% to 3,966, with the energy sector outperforming across the board on the back of a solid rally in oil and natural gas prices. The Nasdaq 100, for its part, declined 0.55% to 12,328, losing ground for the second day in a row, dragged down by rising U.S. Treasury yields and a sharp decline in Nvidia, Meta Platforms and Adobe share prices.

Looking ahead, there are several catalysts to keep an eye on that that could spark volatility in the equity space this week. On Tuesday, traders should parse financial results from two heavy hitters: Microsoft and Alphabet, Google’s parent company. Both companies, with a combined market capitalization in excess of $3 trillion, are heavily weighted in the S&P 500 and Nasdaq 100, meaning that their stock performance could set the tone on Wall Street.

For Microsoft (MSFT), analysts forecast EPS of $2.28 on sales of $52.87 billion. Meanwhile, Alphabet (GOOGL) is seen reporting earnings per share of $1.28 on revenue of $70.78 billion. While quarterly execution will certainly matter, it is pivotal to pay closer attention to profit guidance to see if these large technology firms are preparing for a significant downturn, considering that they have eased up on hiring.

On Wednesday, all eyes will be on the FOMC interest rate decision. The Fed is expected to raise interest rates by 75 bp to 2.25%-2.50% as it presses ahead with aggressive monetary tightening to curb inflation. This move is fully priced in, so traders should focus on Chair Powell’s comments during his press conference.

With U.S. consumer prices expected to cool in the coming months following the recent sell-off in commodity prices and growing recession risks, Powell is unlikely to drop any new hawkish bombshells.This scenario may be somewhat favorable for equities, although earnings and economic activity developments may prove more important for risk assets in the short term.

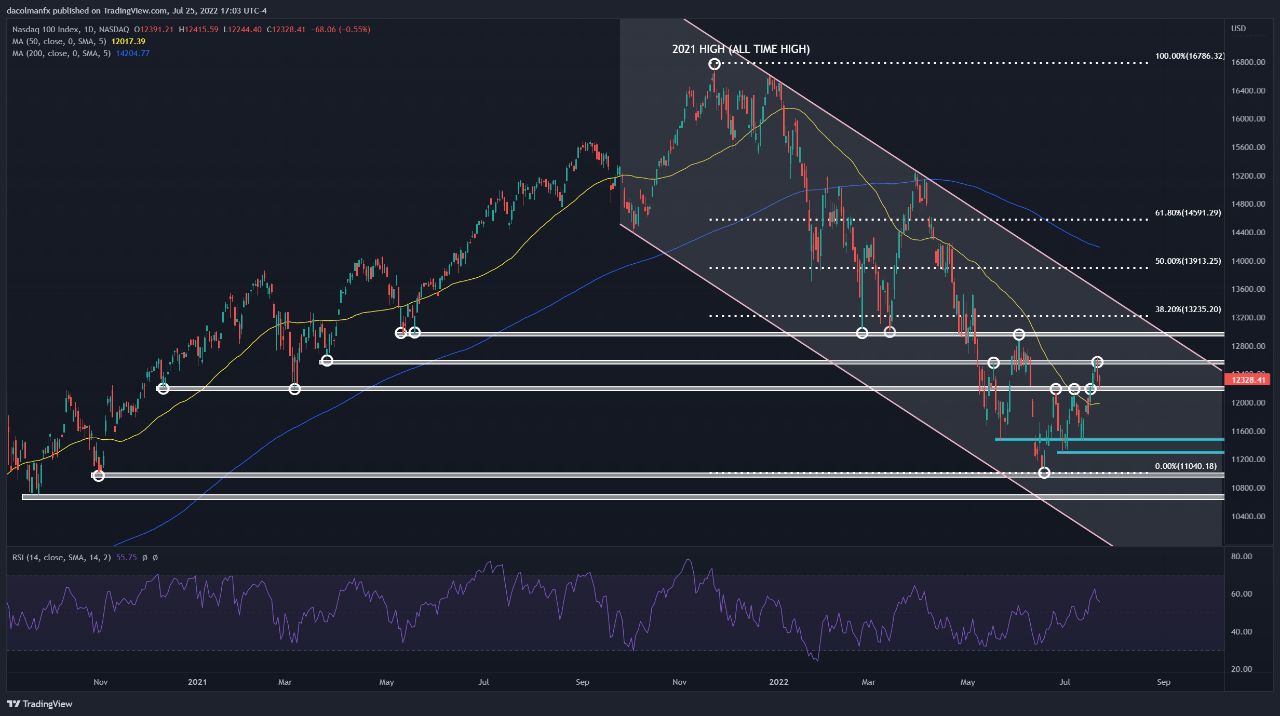

NASDAQ 100 technical analysis

The Nasdaq 100 rallied strongly early last week, but the upside momentum faded after prices failed to break above resistance near 12,600. From those levels, the index has begun to pullback, falling for two straight sessions on Monday. If selling interest accelerates in the coming days, initial support rests at 12,250. On further weakness, the tech benchmark could slide towards the psychological 12,000 mark, challenging its 50-day simple moving average.

On the flip side, if buyers regain control of the market and trigger a bullish reversal, the first resistance to consider appears around the 12,600 area. If this ceiling is breached, we could see a move towards the 13,000 zone.

NASDAQ 100 technical chart

Source: TradingView

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Diego Colman | Market Analyst, New York

26 July 2022

.jpg.27c55ea07d5a17683fbdbda06b8fcace.jpg)

.png.02f0e5e742ffe3a81b011c17df3009ee.png)

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now