Would a stamp duty cut prove cause to start buying UK housebuilder stocks?

UK housebuilders are back in focus on speculation that stamp duty rates could be cut. With recent declines taken into account, could this be time to dip a toe in for longer term investors?

Source: Bloomberg

Source: Bloomberg

Stamp duty cut mooted but will it be enough to protect house prices?

Friday brings a hotly anticipated mini budget from the new Chancellor of the exchequer Kwasi Kwarteng, with many of the main elements already largely known. The desperate need to limit the implications of rising energy prices looks likely to have resulted in a cap in costs for both businesses and households.

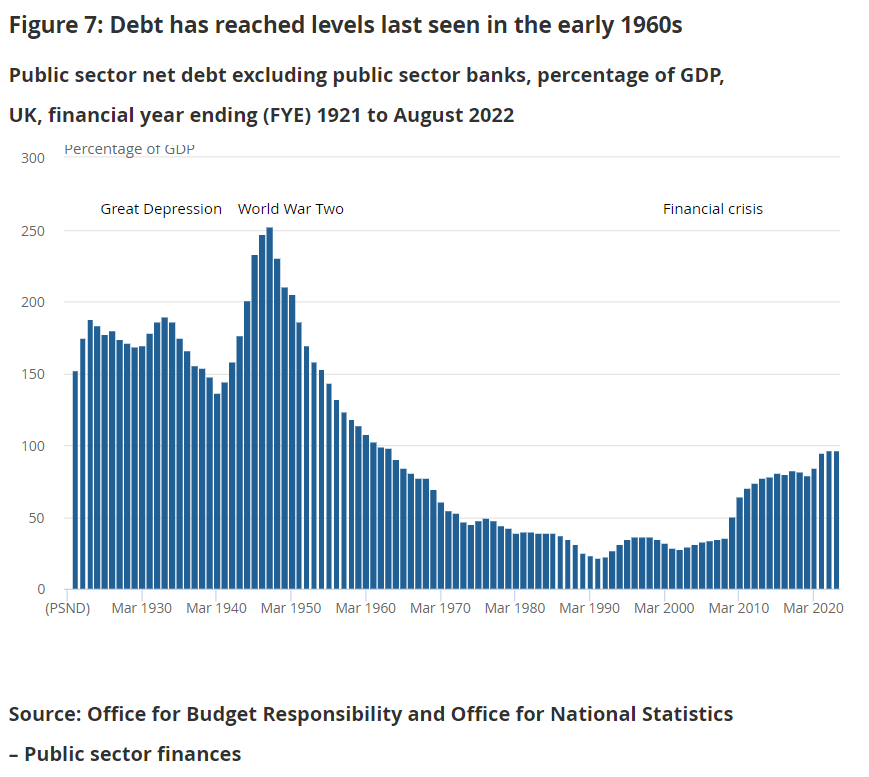

That should help stave off the predicted spike in prices next month, although there are concerns around the implications from a fiscal stability standpoint given the higher-than-expected UK government borrowing figure reported this week. That borrowing is only going to get worse, with rising interest payments exacerbating the problem debt situation as the government seeks to ramp up spending and cut taxes.

However, we are now hearing talk of a potential stamp duty cut within this budget, with many speculating that this could be a big-ticket item that had been kept under wraps thus far. The experience throughout the Covid-19-pandemic highlighted how the decision to reduce stamp duty brought life back into the housing market, as the ‘stamp duty holiday’ brought a swathe of transactions. While we can see that the recent experience has been somewhat stable, demand is likely to have propped up by buying in a bid to lock in rates before they go up further.

Capital economics have speculated that we could see house prices fall by as much as 7% over the coming two years, with rising interest rates, increasingly costly building work, and recessionary effects denting demand. Therefore, the question is whether a cut in taxes for housing purchases will impact transactions in a similar manner. The size of any stamp duty cut would be key in determining the impact on affordability, demand and transactions. Meanwhile, it is notable that the ‘holiday’ element did force people to move quickly and hastily in a bid to take advantage of that shift in rates.

Source: HM Revenue & Customs

Source: HM Revenue & Customs

The weakness seen throughout that sector can be highlighted through the FTSE 350 household goods and home construction index, which is currently 43% down this year alone. Markets have obvious concerns given the fact that costs have increased to the detriment of margins, with demand likely to drop and prices paid taking a hit.

Source: ProRealTime

Source: ProRealTime

Another look at the sector can be seen below, with the chart highlighting the trajectory of homebuilders over the course of the Covid-19-pandemic. Notably, we are seeing many of these stocks heading back down towards the lows of 2020.

Source: TradingView

Source: TradingView

Price to earnings

From a historical perspective, this recent decline has taken price-to-earnings (P/E) ratios back down into the levels seen at the height of the crisis prior to the market recovery. The fact that we are seeing P/E ratios around the lowest levels seen over the past five years does signal a potential buying opportunity.

However, it is worthwhile noting that expectations of weaker earnings over the coming year could mean that investors see price-to-expected earnings as being significantly higher and less attractive. Nonetheless, for those with a longer-term view, the prospect of earnings returning to normal after this period of volatility does highlight an attraction to these stocks over the longer term. Thus, some will undoubtedly see value around these levels.

Source: Eikon

Source: Eikon

Summary

There is clearly a case for the bulls over the longer term in this sector, with interest rates likely to drop once inflation has been brought under control and the Bank of England (BoE) decides its time to start reinflating the economy. A cut to the stamp duty rate does provide the basis for potentially stronger demand than some had predicted going forward, with the rise in mortgage costs somewhat negated by a drop in transaction tax. The size of any stamp duty cut will be key if it does come to fruition, but it would shine a light on homebuilders as a potential area for investment.

However, with the UK expected to pass into a recession next year, and concerns over the length of time needed to resolve the inflation issue, there is still risk of further downside volatility ahead. Traders will therefore look to potentially make the most of this prologued period of weakness and uncertainty to short these stocks, but we are undoubtedly seeing prices at levels that investors with a decent timeframe in mind decide to start averaging-in to stocks within this sector.

.jpeg.98f0cfe51803b4af23bc6b06b29ba6ff.jpeg)

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now