Third straight day of rally faces pressure after-market: US Dollar, S&P 500, USD/SGD, USD/CNH

Near-term reprieve in the US dollar and broad-based decline in Treasury yields provided some room for US equities to continue with its rally, but after-market sentiments saw some jitters.

Source: Bloomberg

Source: Bloomberg

Market Recap

Worse-than-expected US economic data overnight have driven a near-term reprieve in the USD, along with a broad-based decline in Treasury yields, with brewing expectations that the faster-than-expected moderation in economic conditions will call for some cooling off in the Fed’s rate hike process. To recall, US home prices recorded a heavier decline (-1.6% month-on-month versus -0.7% expected) for the second straight month while US consumer confidence data also moderated quicker than forecast in October (102.5 versus 106.5 expected). The weaker US dollar and retracement in Treasury yields provided some room for US equities to continue with its third straight day of rally.

For the US dollar index, it has fallen below a near-term upward trendline, failing to pick up significantly despite the higher-than-expected US Consumer Price Index (CPI) reading two weeks back. The upward trend remains intact for now, but further downside may leave a retest of the 108.70 level on watch next. This is where a key 23.6% Fibonacci retracement level stands alongside its 100-day moving average (MA). The US 10-year yields have also closed below a bearish shooting star formed last Friday, potentially leaving further downward moves on the cards.

Source: IG Charts

Source: IG Charts

That said, after-market sentiments seem to see some jitters, with earnings releases from Microsoft and Alphabet pushing back against some hopeful bets of big tech resilience. A pullback in spending from advertisers has driven both a top and bottom-line miss for Alphabet. While this has already been presented in Snap’s results last week, some hopes were for Alphabet to hold up, which could see some unwinding tonight. The underperformance leaves further ad spending slowdown on the table for the coming quarters, with Alphabet’s share price down 6.7% after-market. Microsoft is not spared as well. Despite outperforming in both revenue and earnings, markets took issue with the weaker-than-expected guidance for second-quarter revenue, once again highlighting the weaker growth story ahead.

For now, hopes for a near-term recovery are not totally lost yet. The US 500 has pushed to a new near-term higher high yesterday but are headed into a zone of resistance, where a confluence of key Fibonacci retracement levels lies in place. The 3,800 level may have to see some defending ahead, which will leave further big tech earnings in focus over the coming days.

Source: IG Charts

Source: IG Charts

Asia Open

Asian stocks look set for a positive open, with Nikkei +0.87%, ASX +0.36% and KOSPI +0.26% at the time of writing. The weaker US dollar could have a positive knock-on impact on Asian indices, with risk sentiments potentially riding on their general inverse correlation. Chinese equities are attempting to stabilise yesterday, with the Nasdaq Golden Dragon China Index closing higher by 4.6% but the gains may still pale in comparison to the 14% decline the day before. Overall environment around Chinese equities could still remain cautious until we are able to see further follow-up in supportive measures, but it could still take a significant deviation from current policies to reassure markets of a more sustained growth ahead.

On another note, Singapore’s core inflation continues to surprise on the upside yesterday, which should leave further tightening on the table into next year (stronger SGD). Along with a weaker US dollar overnight, the USD/SGD has headed into a new lower low since the start of the month, breaching the 1.420 level. Further pullback could leave the 1.407 level on watch next, where a 61.8% Fibonacci support is in place.

Source: IG Charts

Source: IG Charts

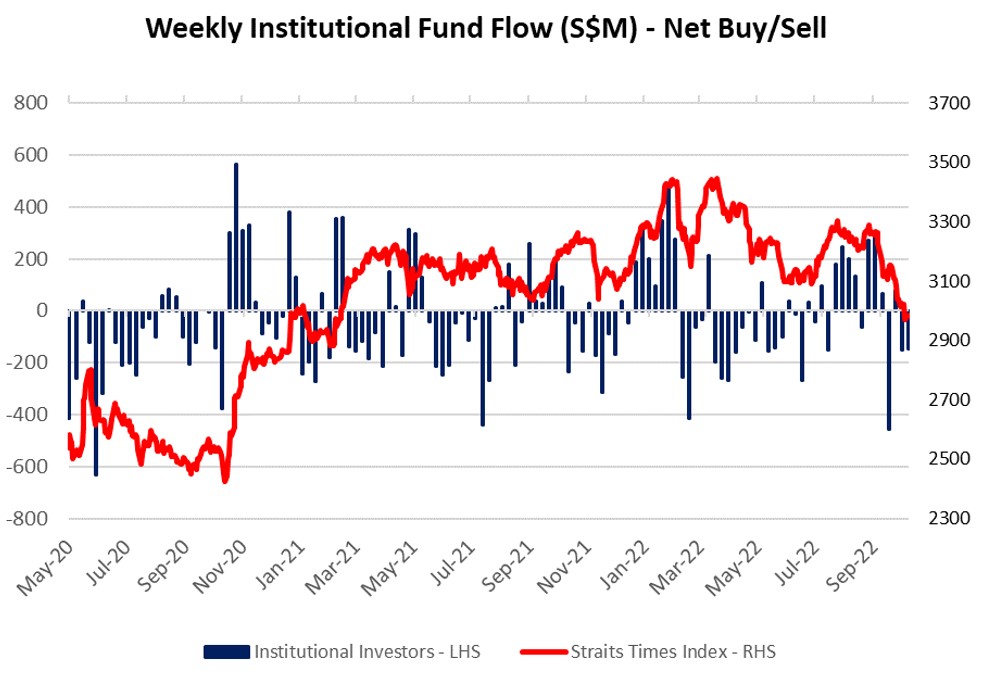

For the Straits Times Index, holding onto the key psychological 3,000 level continues to be a struggle. Some dip-buying efforts were attempting to hold the line, but any recovery could still seem to be more of a move on oversold technical conditions, rather than a more sustained rebound. The latest SGX fund flow data revealed another week of net outflows (-S$149mn) from institutional investors.

Source: IG Charts

Source: IG Charts

Source: SGX, IG

Source: SGX, IG

On the watchlist: Bearish shooting star formation puts USD/CNH’s ascent on pause

Since April this year, movement in the USD/CNH has been heavily correlated with the yield spread between the 10-year Treasuries and 10-year Chinese government bond, driven by the ongoing Fed tightening while China’s growth picture faced rising uncertainties. Following that, the 3.5% retracement in US 10-year yields overnight seems to have put a pause on the USD/CNH’s ascent, leading to a formation of a bearish shooting star. The previous time a bearish shooting star was formed in late September this year, the pair retraced by 2.7% before resuming its upward trend. This leaves any confirmation close below the 7.300 level on watch over the coming days. Breaching the 7.300 level could potentially pave the way to retest the 7.220 level next.

Source: IG Charts

Source: IG Charts

Tuesday: DJIA +1.07%; S&P 500 +1.63%; Nasdaq +2.25%, DAX +0.94%, FTSE -0.01%

.jpg.27c55ea07d5a17683fbdbda06b8fcace.jpg)

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now