Hang Seng Index technical outlook: strong upward momentum

Upward momentum in the Hang Seng Index is strengthening; rising odds that the worst could be over for HK/China stocks and what are the key levels to watch?

Source: Bloomberg

Source: Bloomberg

Hang Seng Index technical outlook: bullish

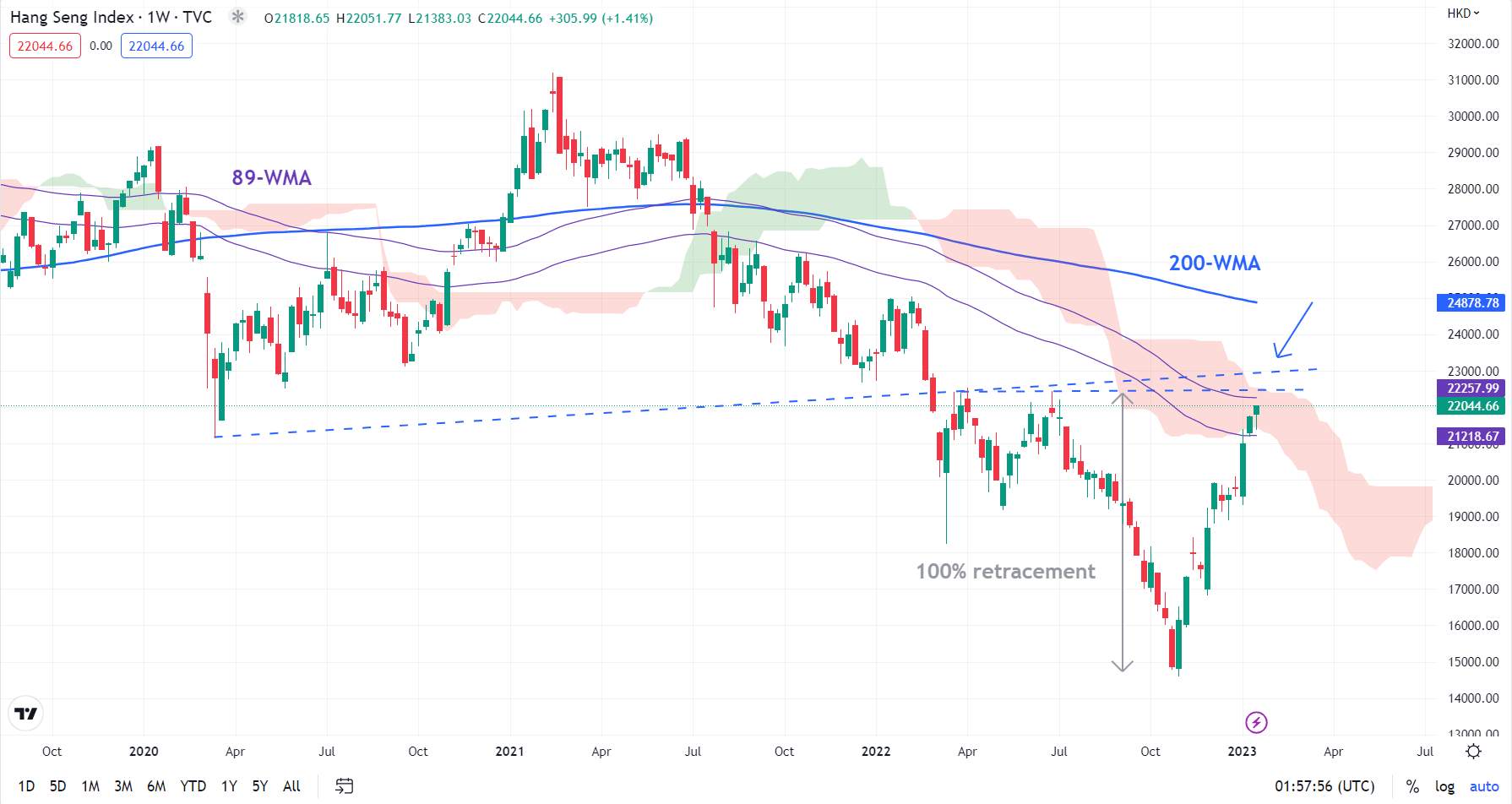

Higher highs registered on the weekly charts suggests that the Hang Seng Index’s trend remains up on optimism related to China’s economic reopening.

Technicals

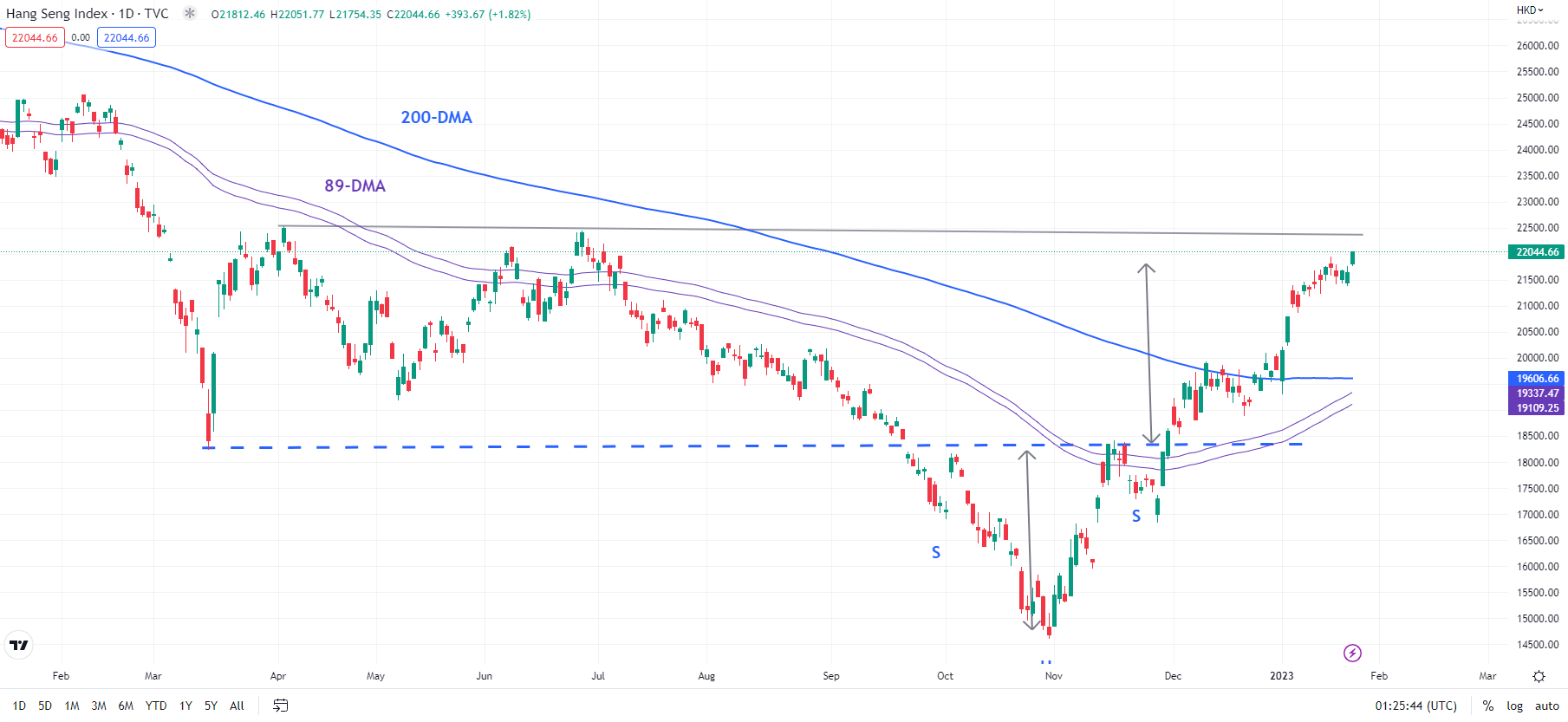

The Hang Seng Index (HSI) rose to a new six-month high last week. This coupled with still-strong upward momentum on the daily charts following the break earlier this month above the 200-day moving average confirms that the short-term trend is bullish.

Sentiment

In only three weeks of 2023, foreign buying of Chinese stocks exceeded last year's total.

Narrative

- China's ending of its zero-Covid policy is prompting re-rating of economic growth prospects, while the jump in copper prices is pointing to a swift economic rebound in China.

- Moreover, less regulatory pressure on China's internet and gaming sectors is supportive.

- Notwithstanding the recent rebound, HK stocks were trading at the cheapest level in more than 10 years.

- Risk: from a longer-term perspective, structurally subdued Chinese economic growth on deteriorating demographics poses a headwind.

Technical analysis

The Hang Seng Index (HSI) rose to a new six-month high last week (Hong Kong markets reopen on Thursday after the Lunar New Year holidays). This coupled with still-strong upward momentum on the daily charts (the 14-day Relative Strength Index is above 75) confirms that the short-term trend is bullish.

The index has achieved the price objective of a reverse head & shoulders pattern triggered last month – scenario 2 highlighted in November - the break mid-December above resistance at 18415 triggered the bullish pattern (the left shoulder is the early-October low, the head is the end-October low, and the right shoulder is the November 22 low), paving the way toward 21800, the target of the pattern.

The Hang Seng Index is now approaching another barrier at the April and July 2022 highs of 22450-22500. Any break above could open way toward the 200-week moving average (now at about 24875).

Hang Seng Index daily chart

Source: TradingView

Source: TradingView

From a medium-term perspective, the strong rebound from the end of last year raises the odds that the worst could be over for HK/China stocks. The index has retraced 100% of the July-October 2022 slide – a sign that bears are getting exhausted. This is further reinforced by the surge in inflows this month as China's ending of its zero-Covid policy is prompting re-rating of economic growth prospects (see table highlighting the broader narrative).

Hang Seng Index weekly chart

Source: TradingView

Source: TradingView

Take your position on over 13,000 local and international shares via CFDs or share trading – and trade it all seamlessly from the one account. Learn more about share CFDs or shares trading with us, or open an account to get started today.

.jpg.27c55ea07d5a17683fbdbda06b8fcace.jpg)

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now