Singapore banks Q4 2022 earnings preview – Resilient earnings but mixed view on economic outlook

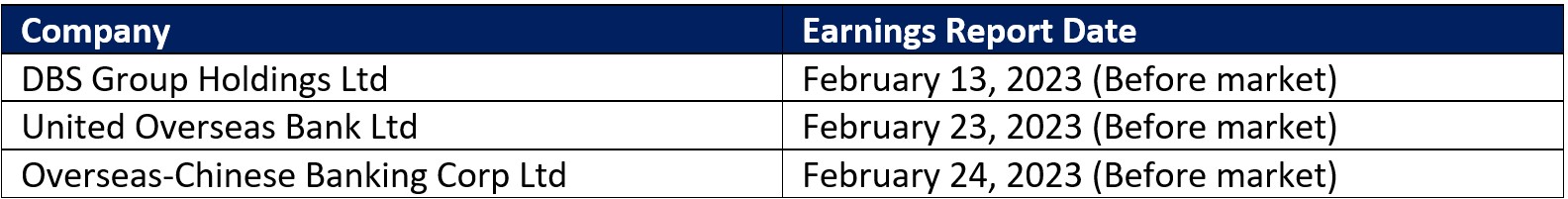

The three local banks are set to report their Q4 2022 earnings in February 2023, with DBS leading the pack.

Source: Bloomberg

Source: Bloomberg

Source: Refinitiv

Source: Refinitiv

The three local banks are set to report their quarter four (Q4) 2022 earnings in February 2023, with DBS leading the pack. Year-to-date performance has seen DBS (5.5%) and OCBC (6.2%) largely trading in line with the Straits Times Index to kickstart the new trading year, with UOB seemingly the underperformer (-3.0%). That said, UOB’s underperformance comes on the back of stronger gains since October 2022, partially accounting for the recent divergence in performance with its peers. Much will depend on the upcoming earnings releases to determine if a retest of their respective 2022 highs can be in sight.

Source: Refinitiv

Source: Refinitiv

Source: Refinitiv

Source: Refinitiv

Another quarter of heavy-lifting by interest income but will momentum taper ahead?

In Q4 2022, the US Federal Reserve has raised rates by 125 basis-points (bp) overall. Taking the cue from an in-tandem rise in Singapore’s three-month SORA and SIBOR, our local banks could be on track to enjoy another quarter of expansion in net interest margins (NIM). Previous guidance from our local banks has laid the ground for their net interest income (NII) portion to benefit from the rising interest rate environment, with DBS the clear forerunner in being the most sensitive to rate increases.

That said, the Fed Funds futures markets are pricing for at most one more 25 bp hike in March this year before the Federal Reserve (Fed) keep rates on hold, suggesting that the rate hike cycle is likely coming to an end. That could bring about an upcoming moderation in growth momentum through 2023, further pressured by an upward revision in funding costs.

Source: The Association of Banks in Singapore (ABS), Monetary Authority of Singapore (MAS)

Source: The Association of Banks in Singapore (ABS), Monetary Authority of Singapore (MAS)

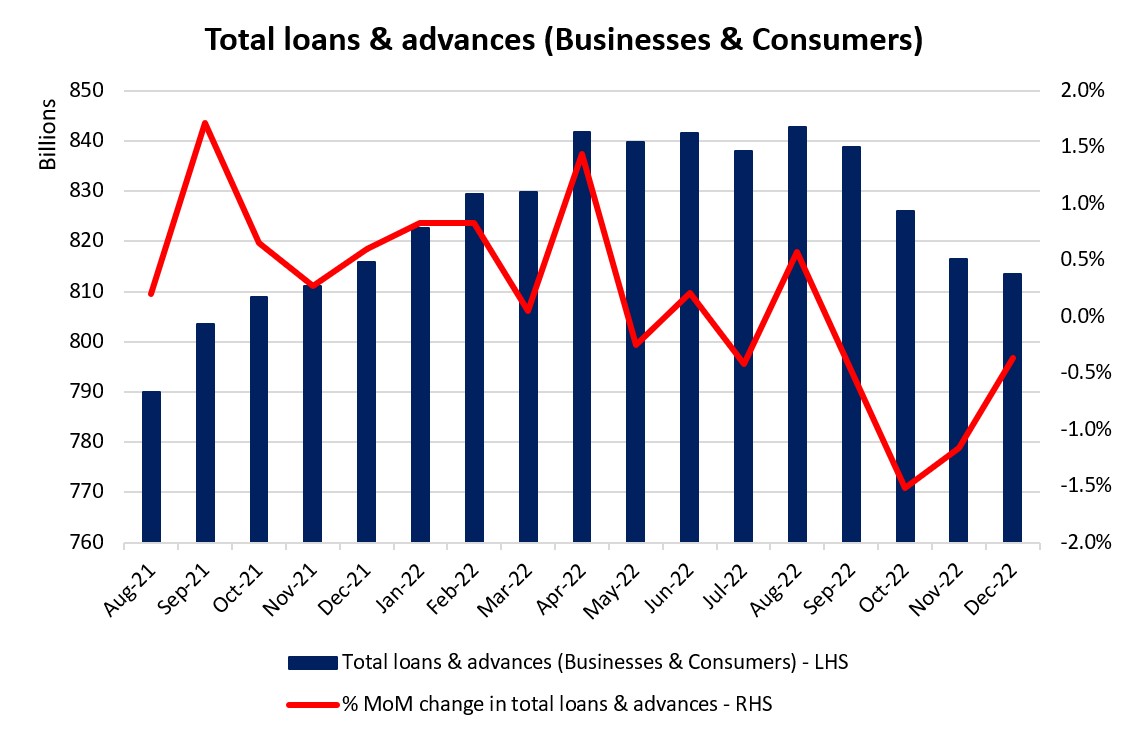

Moderation in loan demand playing out in Q4 2022

Based on Singapore’s bank lending data, the demand for loans and advances has shown a clear moderation in Q4 2022 as businesses and consumers adjusted to higher lending costs. The October-December period has marked three consecutive quarters of month-on-month declines and while the latter half of the quarter saw a lesser extent of contraction, the uncertain global economic outlook could still bring the risks of further moderation in loan demand. China’s reopening narrative may be looked upon to provide some cushion, but recovery on that front may be more gradual than swift.

Source: Refinitiv

Source: Refinitiv

As of quarter three (Q3) 2022, non-performing loan (NPL) ratio for all three banks have reflected some resilience with a concurrent downtick from the previous quarter (DBS, OCBC at 1.2%, UOB at 1.5%). Any rise in NPL ratio will remain on watch as higher debt costs continue to challenge economic conditions in the period measured. This could bring about a higher-than-expected rise in loan losses provision, which could come at an expense of reported earnings. The pocket of optimism is that our local banks have been prudent in reversing any provisions since the Covid-19 pandemic, leading to more limited build-ups required ahead.

Source: DBS, OCBC, UOB

Source: DBS, OCBC, UOB

Non-interest income likely to stay muted for now

Still-cautious risk environment in Q4 2022 could drive muted interest in wealth management products but potential for recovery is presented in 2023, as sentiments has improved since January. For now, the VIX has struggled to stay above the key 20 level, which points towards optimism in the US markets. On another note, China’s reopening shift has also lifted confidence across the region, with the strong consensus that the worst is over. However, this will have to be balanced with a sharp slowdown in consumer spending and hence, spending in card fees. The banks’ outlook will once again be in focus here. Previous quarter’s releases were still met with signs of optimism in management’s outlook commentaries, with one to watch if similar optimism can likewise be presented in the upcoming results.

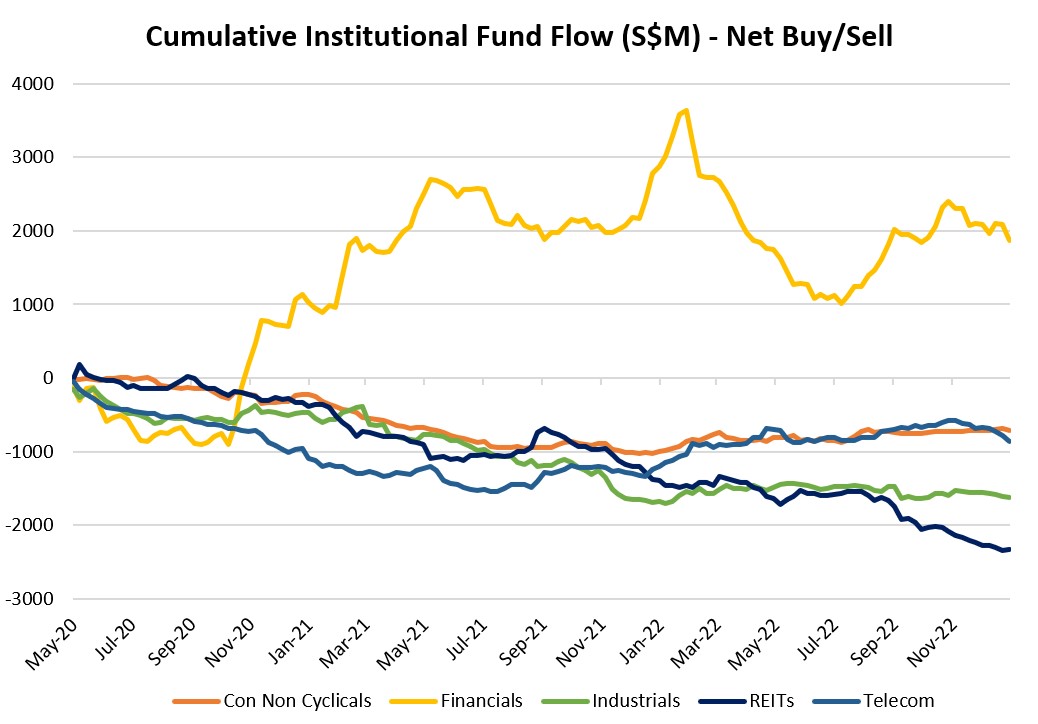

SGX institutional fund flow data saw slight paring of exposure over past month

The SGX fund flow data has revealed consistent net institutional inflows into the financial sector since July 2022, but inflows have since taken a pause in recent months. This seems to point to some slight paring of exposure into the upcoming earnings, coupled with the aftermath of the recent Federal Open Market Committee (FOMC) meeting prompting a sell-off in the local banks on softer rate hike bets. Current dividend yield for all three banks is hovering around the 4.1%-4.4% range, which could find traction as a dividend play on further downside, as Singapore’s 10-year risk-free rate has moderated from its October peak to hover around 2.9%.

Source: SGX, IG

Source: SGX, IG

DBS share price: Technical analysis

Following a brief period of consolidation, DBS share price has failed to move past the S$36.00 level in the aftermath of the recent FOMC meeting. The higher lows since its July 2022 bottom could still point to an overall upward bias for now, but a retest of the S$34.45 level could have to see some defending. This level is where an upward trendline support stands in coincidence with a key 61.8% Fibonacci retracement. Its 100-day moving average (MA) is also on close watch, having supported prices on two occasions since December 2022.

Source: IG charts

Source: IG charts

OCBC share price: Technical analysis

Likewise, OCBC share price is facing strong resistance at the key S$13.00 level, where a 76.4% Fibonacci retracement level resides. Moderation in the Relative Strength Index (RSI) from previous overbought region to more neutral levels may raise the odds of further retracement, along with the risks of a potential bearish crossover in its moving average convergence/divergence (MACD). That could leave the S$12.60 level on watch as the next line of support, in line with a 61.8% Fibonacci retracement.

Source: IG charts

Source: IG charts

UOB share price: Technical analysis

For UOB share price, a period of consolidation since November 2022 was marked with a downward break, which points to sellers potentially regaining control after its 21% surge in late-October. Recent downside seems to reveal the formation of a new lower high as share price is struggling to stay above the S$29.60 level for now. This level marks a 50% Fibonacci retracement. Failure to sustain above S$29.60 could pave the way for a new lower low as a reiteration of its near-term bearish bias and leave the S$28.70 level on watch next.

Source: IG charts

Source: IG charts

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now