RBNZ meeting preview: 50bp hike expected after three-month break

The Reserve Bank of New Zealand are expected to bring another 50-basis point hike on Wednesday in a bid to drive inflation lower

Source: Bloomberg

Source: Bloomberg

The Reserve Bank of New Zealand (RBNZ) provide traders with a fresh central bank focus this week, as the bank announce their latest monetary policy decision on Wednesday 22 February. Coming at a time where US and European economies have proven resilient enough to raise future rate hike expectations, traders will be looking for any notable differences with the experiences in New Zealand.

Inflation remains an issue despite higher rates

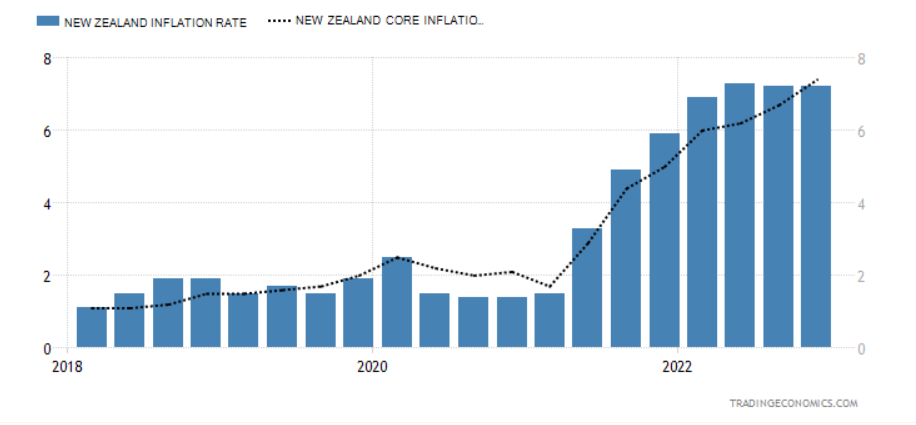

Inflation remains the key concern for the RBNZ, with CPI remaining stubbornly high despite the bank having pushed interest rates to the highest level since 2009. This meeting is particularly notable because of the time that has passed since their last decision, with the November 75-basis point hike a distant memory. Last week saw inflation expectations ease back somewhat, with the two-year outlook now down to 3.3% (from 3.6%). However, with core inflation continuing to rise (currently 7.4%), and headline CPI treading water at 7.2%, it is clear that the RBNZ have more to do.

Elsewhere in the economy, unemployment remains depressed (3.4%), the composite PMI remains within expansion territory (51.5), and retail sales are up 4.9% year-on-year. Thus, there is a positive backdrop that allows the RBNZ to raise rates further if they deem in necessary.

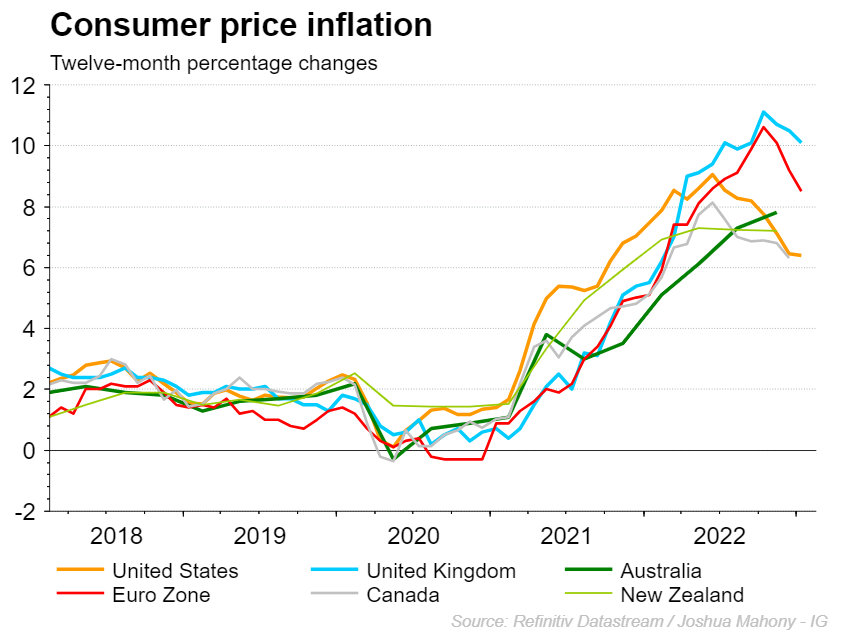

Given the role of the US dollar in relation to risk attitudes, it can be interesting to look at New Zealand in relation to other countries aside from the US. The image below highlights how New Zealand finds itself somewhere in the middle of pack, with CPI flatlining as others reverse lower. However, some continue to see CPI pick up steam, with Australia providing a particular example.

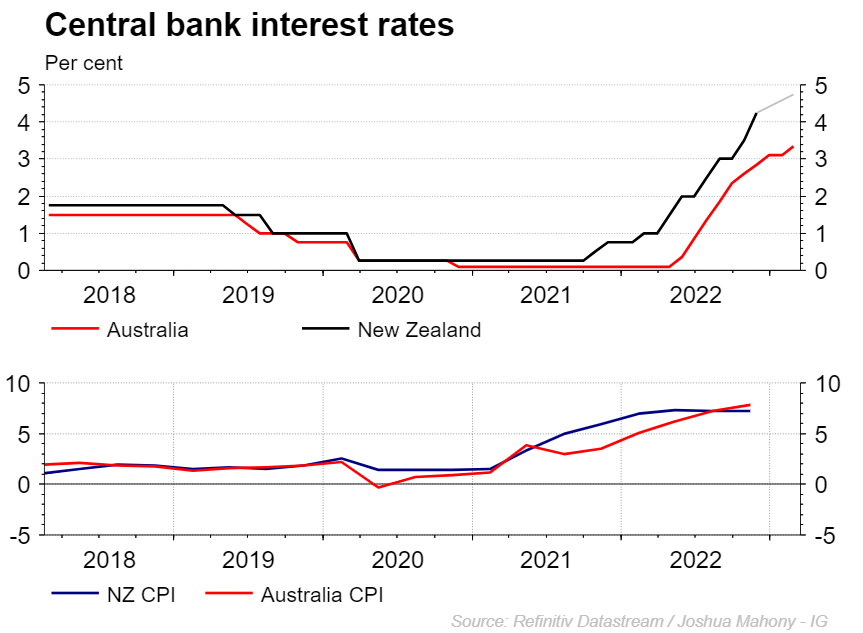

When putting the two neighbors into focus, we can see that market expectations of a 50-basis point hike from the RBNZ would maintain the 150bp gap in rates between the two countries. However, the fact that Australian inflation continues to push higher does bring expectations of a more prolonged period of upside for rates.

What to expect from the RBNZ

The RBNZ are widely expected to enact a 50-basis point hike, with markets pricing in a 95% chance of such a move. The remaining 5% comes in favour of a smaller 25bp hike. With the economy remaining largely undamaged thus far, it does seem likely that the bank will maintain their tightening path in a bid to drive down price growth.

AUDNZD technical analysis

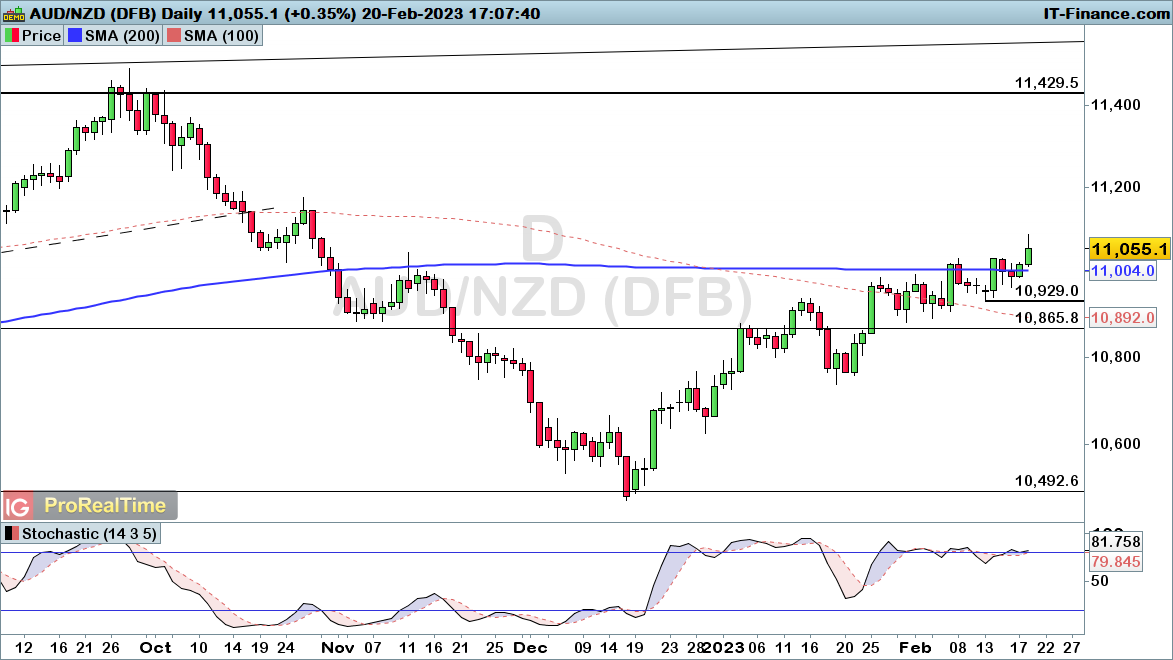

The AUDNZD pair has been driving higher of late, with the recent widening in inflation rates bringing upside for the pair. With price having pushed into a fresh three-month high, there is a good chance we will see further upside from here. Should the RBNZ decide to bring about a smaller 25-basis point hike, there is a good chance we see a strong move higher for the pair. Aside from that unlikely event, the uptrend looks likely to persist unless we see price fall back below the 1.0929 swing-low.

Source: ProRealTime

Source: ProRealTime

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now