Bank of Japan (BoJ) preview: Final BoJ meeting helmed by Kuroda to bring more wait-and-see

The BoJ is set to hold their monetary meeting across 9 – 10 March 2023, with expectations that the central bank may hold off from making further policy adjustments while awaiting the new leadership transition.

Source: Bloomberg

Source: Bloomberg

What to expect at the upcoming Bank of Japan (BoJ) meeting?

At the upcoming meeting, the BoJ is expected to stand pat on its policies, likely maintaining its short-term interest rate at -0.1% and holding off from making further adjustments to its 10-year bond yield cap (currently 0.5%), at least for now. Being the last BoJ meeting helmed by current Governor Haruhiko Kuroda, further rocking the boat after December’s yield band adjustment seems like the less likely scenario, while the central bank awaits the new leadership transition. Governor Haruhiko Kuroda’s term will end on 8 April, while the incumbent deputy governors, Masayoshi Amamiya and Masazumi Wakatabe, will also see their terms coming to an end soon on 19 March.

Policy shift remains a question of when, but timeline sees some pushback

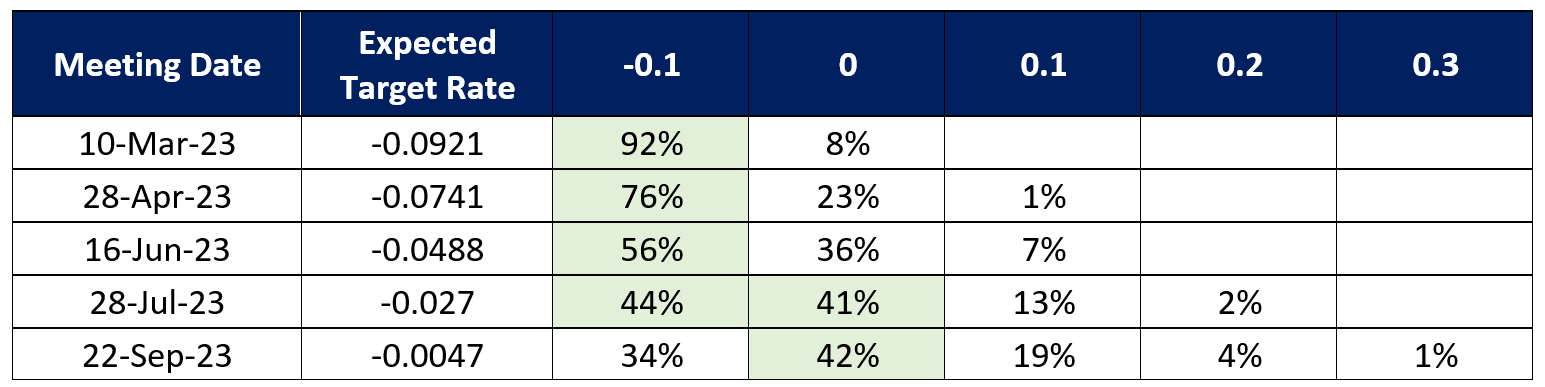

That said, an eventual policy shift remains a question of when, and not if. Current market pricing suggests that a rate hike may be delivered either in the July or September meeting, which is a pushback in timeline from previous pricing of the April meeting. This follows as bets of a quicker policy shift were challenged by BoJ governor nominee Kazuo Ueda just recently, who sang the same tune as current policymakers. He believes that it is "appropriate" to continue easing and suggested that a move toward normalization could come once the central bank's 2% inflation target is in sight.

Nevertheless, there are mounting pressure for an eventual policy shift. Japan’s core inflation has not seen any signs of peaking yet, rising to its fastest pace in 41 years to more than double the central bank’s target (4.2%). At least for now, average cash earnings have recently disappointed to the downside (0.8% versus 1.9% forecast) this week, which allows the BoJ to stick to its ‘transitory inflation’ narrative to justify its easing stance in the near term.

Source: Refinitiv

Source: Refinitiv

April meeting will carry greater significance

Incoming BoJ Governor Kazuo Ueda will chair the April policy meeting (27-28 April), which will provide further clarity on how he intends to exit from Japan’s ultra-easy policy eventually. The quarterly Outlook Report for fiscal 2025 will also be released then, with any signs of a pick-up in growth and inflation on the radar. Previous projections in January were still supportive of a dovish stance. The annual wage negotiation season (Shunto) will also conclude by then, with a 3% wage growth being laid out previously as a precondition to tighter policies.

USD/JPY: Hovering less than 2% from its key 200-day MA

Following a 7% surge since mid-January this year, the USD/JPY is hovering just less than 2% away from its key 200-day moving average (MA). This places the 138.00 level on watch as a key resistance to overcome, with the MA-line standing in coincidence with a key 38.2% Fibonacci level. A bearish crossover on moving average convergence/divergence (MACD) points to some moderating upward momentum for now, while a projection from previous channel breakout suggests that the rally may have reached a potential near-term peak. Whether we can see a renewed bull run for the pair may hinge on any subsequent break above its 200-day MA. Failure to do so may keep the overall downward trend intact, with near-term support on watch at the 133.40 level.

Source: IG charts

Source: IG charts

Nikkei 225: Back to retest its November 2022 high

The Nikkei 225 has kickstarted 2023 on a strong footing, rallying more than 10% year-to-date to head back to retest its November 2022 high. This places the 28,400 level as a key resistance to overcome, where a 61.8% Fibonacci level has held the index down on at least four occasions over the past one year. A break above the 28,400 level may pave the way to retest the 29,200 level next, but market participants will have to digest the near-term overextended Relative Strength Index (RSI). That may raise the odds of a near-term retracement for the formation of a higher low at the 27,600 level.

Source: IG charts

Source: IG charts

.jpg.27c55ea07d5a17683fbdbda06b8fcace.jpg)

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now