Gold and Silver Hold Breath for FOMC Minutes, Geopolitical Tensions in Focus

GOLD PRICE OUTLOOK:

- Gold and silver prices held gains ahead of Wednesday’s FOMC meeting minutes

- Disappointing US retail sales data and rising geopolitical tensions in Afghanistan boosted demand for gold

- Prices are eyeing $1,785 for immediate resistance, breaching which may open the door for further gains

Gold extended higher during Wednesday’s APAC session after gaining 3.3% over the last 5 trading days. Risk sentiment turned sour after the US Commerce Department released poorer-than-expected retail sales figures for July. This suggests that the stimulus- and reopening-fueled economic rebound is probably losing steam. A automobile supply shortage and the spread of the Delta variant of Covid-19 may have also contributed to the decline, pointing to a tepid growth outlook in the third quarter. This strengthened the case for further extension of the Fed’s current stimulus efforts, buoying precious metals.

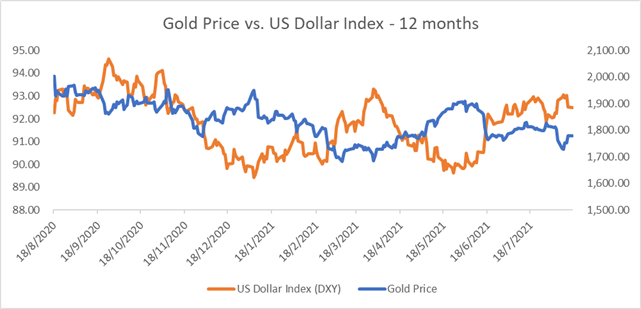

Meanwhile, rising geopolitical tensions in Afghanistan and the Taiwan Strait have also boosted demand for gold and silver, which were perceived as hedges against those risks. The DXY US Dollar index retreated from a 4-month high, underpinning their prices. Gold and the US Dollar exhibited a historic negative relationship, as a weaker USD makes the yellow metal more appealing to investors holding a foreign currency.

Gold Prices vs. DXY US Dollar Index – Past 12 Months

Source: Bloomberg, DailyFX

Looking ahead, traders are eyeing Wednesday’s FOMC meeting minutes for details about the Fed’s policy outlook. Besides, Eurozone inflation and US housing starts figures are also in focus.

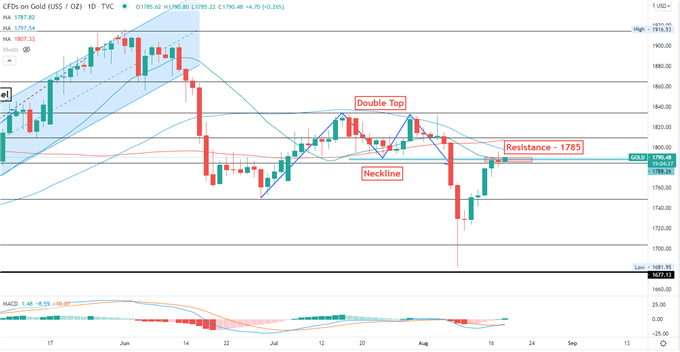

Technically, gold prices rebounded from a 4-month low and extended higher. Prices is challenging an immediate resistance level at 1,785 – the 61.8% Fibonacci retracement. A failed attempt to breach 1,785 may lead to a pullback towards 1750 for immediate support. The MACD indicator formed a bullish crossover, suggesting that upward momentum is building.

Gold - Daily Chart

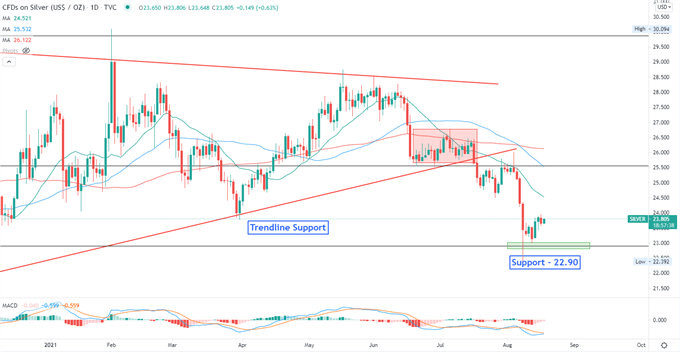

As for silver, prices breached below a trendline support and plunged to a key support level at $22.90 – the 38.2% Fibonacci retracement. The overall trend remains bearish-biased, as suggested by the downward sloped SMA lines. The MACD indicator trended lower beneath the neutral midpoint, underscoring bearish momentum.

Silver – Daily Chart

Written by Margaret Yang CFA, Strategist for DailyFX.com. 18 August 2021.

.jpg.27c55ea07d5a17683fbdbda06b8fcace.jpg)

.png.02f0e5e742ffe3a81b011c17df3009ee.png)

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now