Gold Price Forecast: XAU/USD Rises as Bullion Traders Brace for Jackson Hole

GOLD, XAU/USD, US DOLLAR, JACKSON HOLE - TALKING POINTS

- Gold prices point higher as the trading week kicks off

- Bullion investors sharply focused on Jackson Hole

- Chair Powell’s signal on tapering key to XAU direction

Gold prices got off to a solid start this week, benefiting from a weaker US Dollar and a small bump in Treasury buying. XAU/USD climbed 1.36% on Monday, with prices now tracking for a third weekly rise, although last week’s gain was marginal. Still, the yellow metal has held up rather well considering the upward price action seen in the US Dollar. A stronger USD typically acts as a headwind for gold prices.

The US Dollar’s upside reaction last week was due to increased bets that the Federal Reserve will begin reducing its pace of asset purchases, a move that is seen prefacing rate hikes. At the same time, increasing Covid cases around the globe, driven by the Delta variant, sent a wave of risk aversion through markets. That was likely responsible in part for underpinning gold prices as the metal attracts haven flows.

Comparing gold to a different currency base, such as the Euro, highlights the safe-haven flow seen last week, with XAU/EUR rising 0.91%. Bullion investors will be keenly focused on the Jackson Hole Economic Policy Symposium later this week when Federal Reserve Chair Jerome Powell will speak. Mr. Powell may send the markets an answer on balance sheet tapering, which has been front and center for market focus over recent weeks.

However, the Fed Chief may brush off questions on reducing the pace of asset purchases amid the ongoing Delta wave of Covid and instead defer to the September FOMC meeting. That would likely bode well for gold prices as it could be seen as a dovish move, which would likely drag the US Dollar lower along with Treasury yields.

Last week, Dallas Federal Reserve President Robert Kaplan expressed doubt over a rollback of the pace of purchases if the Covid pandemic slows economic growth this year. This week will also see inflation figures cross the wires, an event that would normally command much attention. Core PCE – which strips out volatile food and energy items—is expected to rise 3.6% for July, according to a Bloomberg survey. While markets will likely be hyper-focused on Jackson Hole, an outsized surprise may hit gold prices.

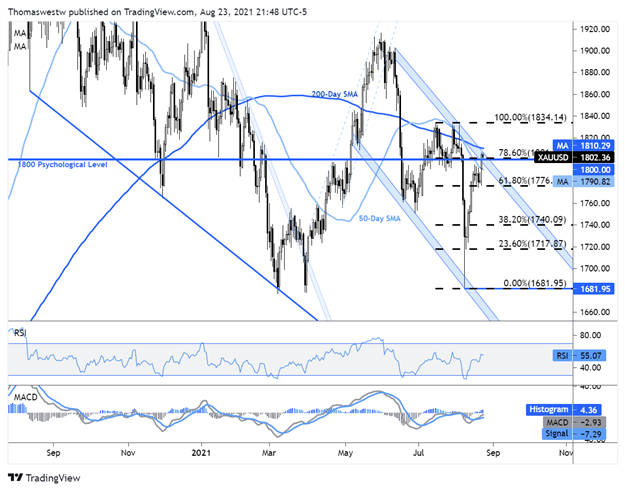

GOLD TECHNICAL FORECAST

Gold has clawed its way higher after a sharp drop earlier this month. XAU/USD is now trading at the upper bound of a descending channel after overtaking the 50-day Simple Moving Average (SMA) at the start of the week. The 78.6% Fibonacci may support prices, and perhaps allow XAU to consolidate its way out of the channel. A break lower, however, will likely put prices back to the 50-day SMA, with the 61.8% Fib below that.

GOLD DAILY CHART

Chart created with TradingView

GOLD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

- Subscribe to the DailyFX Newsletter for weekly market updates

Written by Thomas Westwater, Analyst for DailyFX.com. 24 August 2021.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now