-

Posts

13,207 -

Joined

-

Last visited

-

Days Won

556

Content Type

Profiles

Forums

Blogs

Events

Community Tutorials

Store

Posts posted by Caseynotes

-

-

14 hours ago, Markokucic said:

Why btc market closed? never closes

Even the crypto exchanges have to shut down occasionally for updates etc, IG have a weekly routine shutdown of all their platforms for for a few hours for the same reason.

-

- Popular Post

- Popular Post

To make your trading plan and trade strategy just answer these questions then move on to the testing section below.

1/ TRADING PLAN

a) System

What type of trader will I be? Swing, trend trader, trend follower, day trader, Elliot Wave, Fibonacci, option trader, another, or a combination?

What time frame will I be trading on?

What will I be trading?

Will I trade long or short or both?

What has to happen to invalidate my trading system and make me look for flaws in my thinking?b) Psychology

How big of a position size can I mentally and emotionally handle trading?

Does my chosen trading method fit my personality for activity and risk tolerance?

Do I actually enjoy trading?

Do I have the mental strength to persevere until successful in trading?c) Risk

How much of my trading capital will I risk per trade?

How many losses in a row with this level of risk will lead to blowing up my trading account?

How much will I lose at one time if all my open positions go against me at the same time?

How correlated with each other are all your open positions and your potential trading vehicles that are on your watch list?2/ TRADING STRATEGY

What signals my entry?

What will signal my exit?

Where will the initial stop loss go?

Do I use a trailing stop or a price target to lock in profits?

What is the probability of my trade working out based on historical data? (see testing below).

STRATEGY TESTING

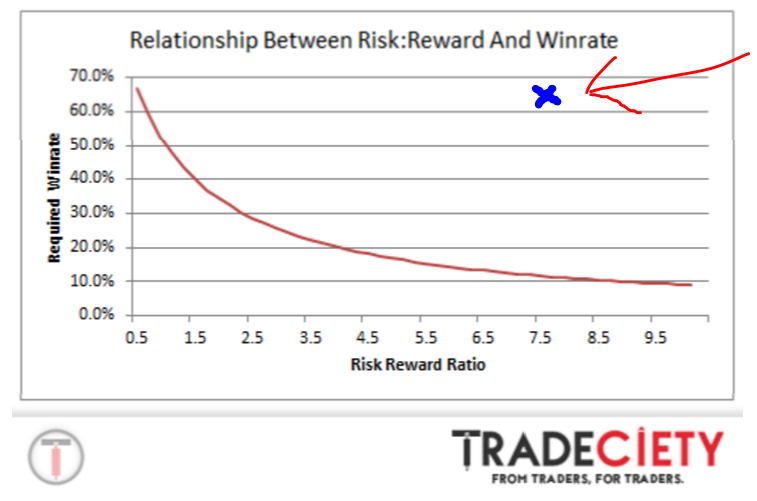

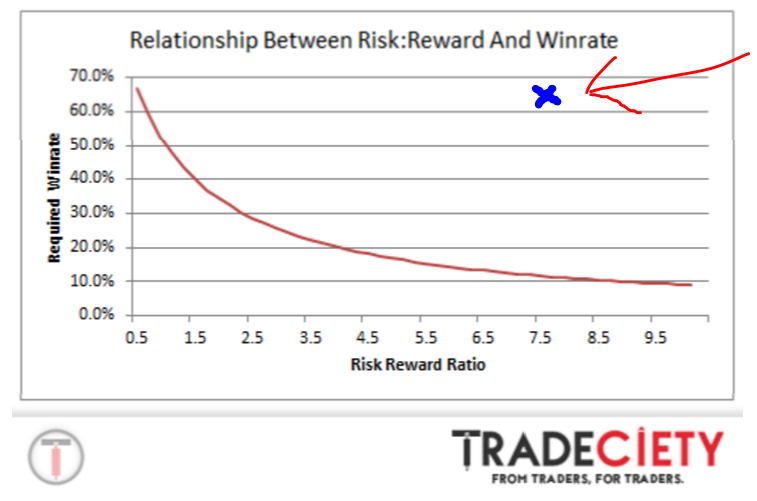

Ok, so you've discovered that a random approach doesn't work so you've found a strategy but you'll have no confidence to trade with real money until you've proved to yourself it actually works and that means testing and collecting data over a number of trades on demo first.The simplest data to collect are the win rate and the average risk/reward ratio of say 20 demo trades, you can then plot these onto a profitability graph to see if the strategy actually works before you risk real money.

To collect the trade data you will need a simple spread sheet, try this one https://forums.babypips.com/t/free-excel-trading-journal/52738

Just fill in these 9 green boxes for excel to auto calc the Win rate and the average Risk/Reward Ratio.

The date is by drop down box as is the asset, you can change the list of assets to whatever on the 'List Variables' tab.

Use the Take Profit as the exit price even if it's a loss and leave the Exit Price column blank.

Take the Win Rate and the Average RRR and plot them on the graph, anywhere above the red line is profitable, below the line is not.

NB/ The journal works fine on windows excel but if opening it in Windows 10 OpenOffice you will get the 'invalid entry' pop up for columns G,H, and I, click on the letter to highlight (G, H & I) > data > validity and uncheck the 'show error message'. OpenOffice has also allocated the currency dropdown box for G, H & I so just ignore.

So now you have a trading plan, that probably won't change much unless your circumstances change, and you also have a trading strategy to bolt onto the plan, you may have 2 or 3 of them, say a buy the dip strategy and a breakout strategy, and you also have a means to test that strategy on demo to gauge if it really does have a chance of working out on a live account.

You may go through a number of strategies or make changes and retest again and again before finding something to test on a live account but at least you're not losing real money to find out if it really works or not because if it doesn't work on demo it won't work live.

Best of Luck

-

7

7

-

-

-

On 17/06/2019 at 07:21, Caseynotes said:

This is a good article, 20 questions you need to be able to answer;

20 Questions For Help Building a Trading Plan

System

- What type of trader will I be? Swing, trend trader, trend follower, day trader, Elliot Wave, Fibonacci, CAN SLIM, option trader, another, or a combination?

- What time frame will I be trading on?

- What are my trading rules?

- What signals my entry?

- What will signal my exit?

- Do I use a trailing stop or a price target to lock in profits?

- What will I be trading?

- Will I trade long or short or both?

- What is the probability of my trade working out based on historical data?

- What has to happen to invalidate my trading system and make me look for flaws in my thinking?

Psychology

- How big of a position size can I mentally and emotionally handle trading?

- Does my chosen trading method fit my personality for activity and risk tolerance?

- Do I truly believe that my method will work and be profitable?

- Do I enjoy trading?

- Do I have the mental strength to persevere until successful in trading?

Risk

- How much of my trading capital will I risk per trade?

- How many losses in a row with this level of risk will lead to blowing up my trading account?

- How much will I lose at one time if all my open positions go against me at the same time?

- How correlated with each other are all your open positions and your potential trading vehicles that are on your watch list?

- Do you fully understand the potential risk in what you are trading?

The list mention was posted in this thread not the Technical Analysis thread, here it is again.

-

1

1

-

27 minutes ago, dmedin said:

What if your well-planned rule-based system results in losing lots of money?

If you are losing lots of money stop what you are doing because you are doing it wrong and start on a new plan 🙂

-

1

1

-

-

15 minutes ago, dmedin said:

What should those rules be?

The rules for a system don't have to be extensive because really there are only so many ways a trade can play out.

Before that though you must decide what type of trading system the rules are to be applied to, the broad basics, swing or reversal or day trading, that list I posted recently in the Technical Analysis thread covers it.

So you have already decided type, time frame, time to trade, amount to risk etc well before looking at the charts.

Then it's just a list of simple rules to govern the actual trade, if this happens then I do that, that are applicable to the type of trading you have decided on.

For example,

I will enter long if ?MA crosses above ?MA when both are above the upward sloping long term ?MA.

I will set a stop loss at the most recent swing low.

If the trade progresses the ?MA will act as my trailing stop and I will exit when price closes below it.

It really can be as simple as that, if it works on demo over 20 trades (has a risk/reward ratio and win rate plot on the profitable portion of the graph (ask if you want to know more about this)) then go ahead and trial it live at minimum size.

So with rules in place all you need to do is act the robot, follow the rules and keep the emotional wreak you really are well away from the decision making process 🙂

-

2

2

-

-

21 minutes ago, nit2wynit said:

I see what you're saying Casey. What I mean is the fear got me first therefore the system failed . Not the system itself but the process.

I have a checklist. My problem again today was an old one. Anticipate the drop instead of riding it.

So what I mean is I failed to apply the system.

I was just making general comment rather than referring directly to your system, what you say is experienced by almost everyone at some stage. People think they should develope a 'feel for the thing' and once they get that all will be fine but the reality is that you need to expel emotions from the equation because they will always be inconsistent and it's the inconsistency that causes the failure. Having a playbook of rules means the on the spot decision making is excluded and is the only way to the constancy you need to succeed. A bit like programming an algo to trade for you.

-

1

1

-

-

41 minutes ago, davidbrister said:

@nit2wynit It is dangerous beast to train and control, and even with the strictest rules set in place, (type type them up and print them out, stick on PC side or wall above monitor) once you press the Go Button, doubt and 2nd guessing yourself turns you into a monster.

Even now with my Auto Trading, im analyzing the open trades too much and get that fear of should i adjust something instead of just let it go. I dont touch it, but by god do i want too, lol.😂

-

You don't have a system unless you have a set of rules that govern every step for every trade. Most people's system actually comes down to 'I'll pull the trigger when I think things look right', that's not a system, you are instead relying on emotion to make consistently correct decisions, when the decisions become inconstant self doubt creeps in and then the fear, you may as well stop right there.

As I said further back, you need to get scientific, otherwise you are shooting from the hip at shadows.

Develope a rule based system, test it to prove it's validity and then trial it live. If you are not doing this you are wasting your time.

-

1

1

-

-

-

2 trend trade entries;

-

1

1

-

-

18 minutes ago, nit2wynit said:

I have The FEAR lol

2 trades running for £1pp.

Wow, I can't believe how much this effects me for only £2. I spent £20 last night on Wine and Food. Jeeez what is the problem here....hahaThe problem is either you don't trust your system because you haven't tested it properly or that you don't trust yourself to stick to it.

You should all ready know what's going to happen after you've entered the trade, when price does this I do that, when price does that I do this.

The actual result of one trade doesn't matter, what matters is the collective results of many trades, like what you did for testing 😶

-

Be aware that the explosion and fire today at the oil refinery in Philadelphia might have an impact on US Oil price, the refinery had a capacity of 330,000 barrels per day.

-

-

-

-

2 minutes ago, cryptotrader said:

Which means if you bought at any time other than those 87 days in the 10 year history, you'd be making money.

BTC $50k within 18 months. Whoop whoop.

Can't wait, not sure why you're being so conservative though 🙂

-

1

1

-

-

-

-

"IT'S TOO MUCH, TOO FAST!" $SPX is up +25.9% within the past 125 trading sessions so I put together a chart showing every time that happened since electronic trading began in 1983. It's not bearish unless you squint and lie to yourself.

-

-

-

3 hours ago, nit2wynit said:

I've assumed Volatility as in Volcanic Eruption i.e Market open or News...as you've stated....where the Candle shoots up and down. This is a 5hr chart of 300pts. only 3.7% on the day. That's 0.74% per hour.

II will watch ALL vids on the Academy, but what am I missing that I will understand from IG Acedemy vids?

At this stage in my learning, what I posted earlier is no way near a volatile Chart.

Seriously confused. I will research Volatility and come back to this question.

By all means anyone else chime in.On the daily dashboard thread the screen shots list some 80 odd assets, how many move over 3% on the day, usually none, maybe 1.

If the spread seems 'unreasonably' high on an asset you should not be trading it because there is a 'reason', it's just that you don't know what it is, if you are signaled that you are missing information on an asset you are about to buy you should not be buying it.

True it may be that the asset is about to turn from an ugly duckling into a swan and that's the reason for increased volatility and lower liquidity and if you know all that then you may well be prepared to pay the premium as the spread is not then 'unreasonably' high. But if you don't know stay out, treat the spread as a potential warning signal and red light to taking a trade.

Is spread betting for fools?

in New to IG Community

Posted

If it's a UK company keep an eye on the Weekend FTSE, it doesn't appear to have moved much so far but if it looks like taking off in the wrong direction you might consider a taking out a hedging trade on it.