CharlotteIG

Administrators-

Posts

1,702 -

Joined

-

Last visited

-

Days Won

20

Content Type

Profiles

Forums

Blogs

Events

Community Tutorials

Store

Everything posted by CharlotteIG

-

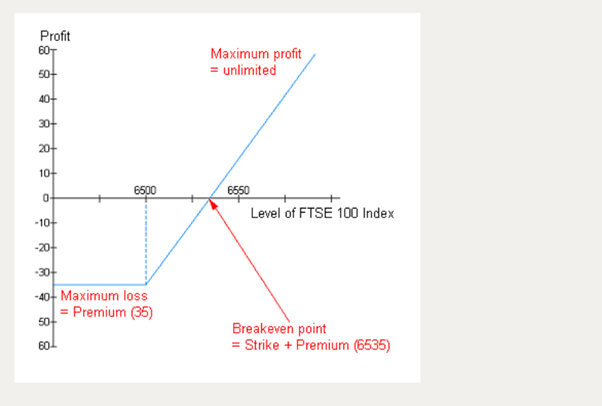

@dmedin- I luckily have a run down of the risks and rewards when selling a puts Some people will sell calls/puts if they believe they're sure of the outcome so they can receive the premium. Buying calls though have limited risk and potentially unlimited profits.

-

Elliot Wave Principle

CharlotteIG replied to Welshman's topic in General Trading Strategy Discussion

DailyFX also have some guides if that would help but if you have some questions specifically I can see if our TV team can get a specialist in to discuss Elliot wave video. https://www.dailyfx.com/free-trading-guides#beginnerGuides -

Hey @SkyTrader, If it was lagging can you tell me how many tabs you had open for IG and what you needed them for. We do, like you said, advise clients to use Chrome because it is more compatible with our platform. If however, you want to use Safari you can email us and get some troubleshooting steps that should improve the speed. If you could possibly get some screenshots of the issues that would be great to take to our projects team to better ourselves. We really appreciate your feedback to help us look for solutions in the future.

-

When buying a call/ selling a put you're betting on the market going up. If you're buying a call you have limited risk. The maximum you can lose is the deposit (premium). You've bought the right but not the obligation to buy at a certain price. Selling a put has max risk losses if the market hits 0. When buying a put or selling a call, same principle applies. If you're buying a put you have limited risk. The maximum you can lose is the deposit (premium). You've bought the right but not the obligation to sell at a certain price. If you're selling a call all you can win is the premium from the buyer no matter how low the market goes. If you're selling a call all you can win is the premium from the buyer no matter how high the market goes. Meaning selling a call has unlimited losses The margin when buying a call/ put is the maximum loss. The margin when selling put/call is the margin for the underlying market.

-

-

Hey @dmedin, our analysts did a piece on this yesterday you might be interested in. https://www.ig.com/uk/news-and-trade-ideas/what-will-happen-to-the-premier-oil-share-price-after-the-electi-191210

-

@jamesleo1 When buying a call/ put your maximum risk is the premium you put down. In the case below: If you're buying a call at 7110, and the price is around there it means you're buying at the current price. Your break even point is 7130, (Strike + premium) if the market expires above that price you're in the money. If the price settle out of the money, the maximum you can lose is 20 x bet size. If you're buying a put at 7110, and the price is around there it means you're buying at the current price. Your break even point is 6990, if the market expires below that price (Strike -Premium) you're in the money. If the price settle out of the money, the maximum you can lose is 20 x bet size. Lets say you were doing £1 per point. If the market were to settle at 7110, you would lose the £20 on each, but if market settles either above 7150 or below 6970 you will lose £20 on one side but it would be outweighed by the profit on the other side. ^ Settling at 7150 you would have a £20 profitable position, but the lost on the other side (max loss of £20) ^ It's not about spread it's about finding the break even point using the price you paid for that option at the time. Below you can find some diagrams showing you how to work out break even points. Let me know if you need anything else clarified.

-

No problem. If you want anything else let me know by @ me

-

Fed rate unchanged but USD Monthly Budget Statement (Nov) : Prev: -$134B Est: -$196.5B Actual: -$209B

-

Fed rate out in 4 minutes but expected to not change.

-

How to trade the UK election

CharlotteIG replied to CharlotteIG's topic in General Trading Strategy Discussion

Just because we have posted about trading on market news, I thought it would be good to add DailyFXs technical analysis on EURGBP. Find the full story by following the link below: https://www.dailyfx.com/forex/technical/home/analysis/eur-gbp/2019/12/11/EURGBP-Braces-for-a-Possible-Price-Correction-Euro-to-British-Pound-Forecast-MK.html -

We're not offering trade analytics on MT4, just CFD, FSB and forex. The project manager informed me of some options they're looking into going forward. Do keep in mind that these are not definite but I wanted to share the future options they're considering: Ability to tag individual trades We're discussing showing a chart of the underlying during the lifetime of the trade Chart your PnL over time The ability to drill into markets to see a trade by trade breakdown

-

Hey, I've never head the issue that it will amend the old working order. Make sure you have net off selected. If the two working orders are the same direction and same price level it may just aggregate the working order. So if you had two contracts to open at 'X' and then wanted another 2 contracts at the price 'X' it may aggregate the working orders to 4 at 'X' price. Let me know if that works

-

How to trade the UK election

CharlotteIG replied to CharlotteIG's topic in General Trading Strategy Discussion

@Mercury posted this in ‘What is the USD doing?’. Nice to see someone look at the impact outside the UK markets that we’ve been analysing. -

How to trade the UK election

CharlotteIG replied to CharlotteIG's topic in General Trading Strategy Discussion

Imagine if it comes out closer to 7am, but we will all have to be awake at 4am just in case 🕓 -

How to trade the UK election

CharlotteIG replied to CharlotteIG's topic in General Trading Strategy Discussion

It’s nearly time! The General election is taking place tomorrow. If you're looking to trade over the election check out all general election articles we've written to help you with trade ideas, keep you informed and protecting yourself during volatility. These pieces include specific stocks that maybe affected as well as the FTSE and sterling pairs. General election articles Jeremy Naylor will be doing two live shows about the election results - on Friday 13th at 6am and 7:30am (GMT). You can find them on the platform live or in the IGTV on Demand tab shortly after. Check out our podcast, that I advertised earlier in this forum, on 'Stocks to watch around the general election'. As always, the content is not advisory it's just for trade ideas. Let the community know what you're thinking of watching/ trading. 🐮🐻 -

Thank you for the feedback. I will let the project manager know your points. It is in the testing stage at the moment so the project managers are looking for feedback on IG analytics.

-

How to trade the UK election

CharlotteIG replied to CharlotteIG's topic in General Trading Strategy Discussion

Hey guys, just a gentle reminder that whilst we all have differences of opinion when it comes to politics, please make sure you're aware of the Community terms of service and keep any discussion on topic, and friendly. -

Where do I find the order book

CharlotteIG replied to a topic in General Trading Strategy Discussion

No problem at all, I thought it was either going to be cost or the look of the order book considering it ticks in cents. -

How to trade the UK election

CharlotteIG replied to CharlotteIG's topic in General Trading Strategy Discussion

@dmedin thank you for your opinions. Did you have a quick listen on the podcast? Would love to hear your thoughts. Also @Mercury, let me know what you think. If you want any other analysis on FX or other markets leading up to the election let me know so I can speak with our analysts. -

Where do I find the order book

CharlotteIG replied to a topic in General Trading Strategy Discussion

That's correct we only offer L1 data for US exchanges. After speaking with the desk they confirmed that L2 data for US exchanges are too expensive. We do pass the cost of L2 data on to clients and we don't think it will be something many clients will be willing to pay (looking over one hundred per month). -

How to trade the UK election

CharlotteIG replied to CharlotteIG's topic in General Trading Strategy Discussion

For the stock traders out there, we've produced a podcast 'Stocks to watch around the election'. This is only 7 minutes long and runs through different sectors and specific stock that could be positively or negatively impacted around the election on Thursday. Even if you're not a stock trader it's worth a listen. You can find these podcasts on Spotify, Apple Podcast and Google Podcast by searching IG Trading the Market. Google Podcast: Stocks to watch around the election Spotify Podcast: Stocks to watch around the election Apple Podcast: Stocks to watch around the election Let me know what you think of it! -

@dmedin, I completely agree. I've spoken with them about adding the tickers back into the new web platform and will keep you updated.

-

How to trade the UK election

CharlotteIG replied to CharlotteIG's topic in General Trading Strategy Discussion

We have a short piece you may find interesting but no opinions from Joshua, just analysis: Markets prepare for Conservative win as polls play key role Let me know what you think and what pieces you may want from us leading up the the election. -

Jeremy Naylor has done a short piece on Goldman Sachs retains forecasts and where you may find some trading ideas with gold. Gold's down 6% since high earlier on this year. I are not telling you which way to trade, just to keep you informed.