-

Posts

88 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Blogs

Events

Community Tutorials

Store

Posts posted by Ludwik Chodzko-Zajko IG

-

-

-

Hey,

Underlying exchange is shut due to public holiday - reopens Wednesday:

Mid-Autumn Festival: The market is closed from September 19 (Sunday) to September 21 (Tuesday) for holidays, and on September 18 (Saturday) for weekends. The market will open as usual from September 22 (Wednesday). No after-hours trading will be carried out on the night of September 17 (Friday).

-

Monday 6th September

- US index futures close early at 6pm. We’ll make out-of-hours prices on Wall Street, US 500, Russell 2000, US Fang Index and US Tech until they re-open at 11pm

- US and Canadian equities, and soft commodities, will be closed

- The VIX will close early at 4.30pm

- London Sugar closes early at 5pm

- US rates, Euribor and the Dollar Index close early at 6pm

- US metals and energies, including Nymex Crude, Gold and Silver close early at 6pm

- Brent Crude, London Gas Oil and ICE WTI close early at 6.30pm

Tuesday 7th September

- US grain futures open at 1am

- Lumber futures open at 3pm, livestock at 2.30pm

- All other markets open as normal

Have a good one!

-

1

1

-

Hi all,

Some info on what to expect this evening. Obviously these are my views, and should be taken as such (not advice etc).

Good luck!

Many states now on a knife-edge - meaning this could easily turn into a landslide (hate the term) at the slightest shift.

The “Toss-up” States

High quality polls seem to be putting Texas & Nevada out Biden & Trump’s reach respectively. Yes Texas might swing, but no point reading this if it does.

Georgia may spike the Trump campaign. It is still marginal “Toss-up” / Lean Rep. due to a late drift to Biden, does appear this will revert to mean (not many high quality polls).

Polls close

Close (GMT)

First Results (GMT)

College votes

Texas

20:00:00

01:00:00

01:00:00

38.00

Georgia

20:00:00

01:00:00

01:00:00

12.00

Nevada

23:00:00

04:00:00

04:00:00

6.00

Assuming these fall as expected leaves you with:

Polls close

Close (GMT)

First Results (GMT)

College votes

North Carolina

19:30:00

00:30:00

00:30:00

15.00

Ohio

19:30:00

00:30:00

00:30:00

18.00

Florida

20:00:00

01:00:00

00:00:00

29.00

Pennsylvania

20:00:00

01:00:00

01:00:00

20.00

Michigan

21:00:00

02:00:00

01:00:00

16.00

Wisconsin

21:00:00

02:00:00

02:00:00

10.00

Arizona

21:00:00

02:00:00

03:00:00

11.00

North Carolina remains the most important state of the night (it’s out early – without it Trump cannot win)[1].

Ohio is, as usual, vital. Trump does just seem to be edging it here – again it’s a must win.

FL & PA

States

Polls close

Close (GMT)

First Results (GMT)

College votes

North Carolina

19:30:00

00:30:00

00:30:00

15.00

Ohio

19:30:00

00:30:00

00:30:00

18.00

Florida

20:00:00

01:00:00

00:00:00

29.00

Pennsylvania

20:00:00

01:00:00

01:00:00

20.00

Michigan

21:00:00

02:00:00

01:00:00

16.00

Wisconsin

21:00:00

02:00:00

02:00:00

10.00

Arizona

21:00:00

02:00:00

03:00:00

11.00

Pennsylvania (Biden’s backyard) has been getting all the love /media attention recently. Trump is struggling to catch Biden here.

For Trump to win either the polling is very inaccurate (more so than 2016), or turnout surges heavily in his favour.

Even the Trafalgar group have Trump struggling here in all but their most recent polls. Without PA again he can’t win[2].

Florida is Florida, Trump looks competitive, but must win it. Biden can live without, but might indicate where Arizona falls.

MI, WI, AZ

Michigan

21:00:00

02:00:00

01:00:00

16.00

Wisconsin

21:00:00

02:00:00

02:00:00

10.00

Arizona

21:00:00

02:00:00

03:00:00

11.00

Michigan & Wisconsin now look very difficult for Trump (Biden 4-6pts ahead in high quality polls). If Biden’s winning elsewhere its safe to write these off.

Final sting in the tail is Arizona – if Trump’s losing elsewhere then this is largely moot. Assuming he’s won Ohio, Florida & one more of the above, Arizona may still trip him up. -this hasn’t change, it’s close.

“What if the polls are wrong?”

They’d have to be very wrong – in a way that ruins credibility of the major pollsters. A high turnout (now inevitable) will skew this to an extent.

The “shy tory” phenomenon of 2015 fame has reappeared in the vocabulary of American pundits. There is little hard evidence of this in the states (plenty of anecdotal evidence). This & turnout will still likely be the talking points overnight.

Why are betting odds for Trump shorter than polls suggest?

Probably combination of Trump buyers & the above.

How best to watch / keep track of results?

On twitter:

@DailyFXTeam

@IGSquawk

Live DFX discussion on November 3rd at 11:00 AM ET here: https://bit.ly/2TNILnO

Online:

https://ig.ft.com/us-election-2020/

These state maps were useful last time, updated links to follow(on the wiki):

http://edition.cnn.com/election/results/states/florida

[1] Yes it’s *possible*- but you’d be 0 bid on the chance.

-

1

1

-

-

-

9 hours ago, dmedin said:

I would post links to some ebooks but might get into trouble for it.

Go ahead - we don't endorse anything external, but happy for you to link.

Just nothing paid for please.

-

1

1

-

-

On 03/09/2020 at 17:54, zala said:

Looking for the USD/SEK pair.

Morning,

You can see these in platform, this post shows where:

Shout if any questions.

Cheers,

Ludwik

-

1

1

-

-

Still in process. Should you wish to amend your book cost once re-booked (share dealing accounts) - this link shows you how to do so:

https://www.ig.com/uk/help-and-support/investments/share-dealing-and-isas/how-do-i-edit-my-book-cost

-

As below:

To all IG clients with $TSLA & $AAPL positions, we intend to book the stock splits throughout the morning. Should you see your shares temporarily booked off - please don't worry.

Corp actions estimate they'll be finished early PM, but subject to change.

Any questions, just ask.

Have a good one.

Ludwik

-

Looks like you're trying to place a limit order on a SETSqx equity - won't work unless you're in one of the auction periods.

Info below:

LSE exchanges and why only at quotes is available?

1.SETS (Stock Exchange Electronic Trading Service) - is the London Stock Exchange’s flagship electronic order book, trading FTSE100, FTSE250, FTSE Small Cap Index constituents, Exchange Traded Funds, Exchange Trading Products as well as other liquid AIM, Irish and London Standard listed securities. The Exchange also operates a version of SETS on a modified trading cycle that supports Securitised Derivatives.

2. SETSqx (Stock Exchange Electronic Trading Service – quotes and crosses) - is a trading service for securities less liquid than those traded on SETS. SETSqx combines periodic electronic auctions each day with standalone non-electronic quote-driven market making providing guaranteed liquidity in at least one Exchange Market Size (EMS). Essentially it is a hybrid of a quote driven order book and an electronic order book. Quote driven for part of the day and at different dimes of the day there are auctions (uncrossing: 8AM, 9AM, 11AM, 2PM, 4:35PM ). You can participate in the auction as if it were an electronic order book. On our L2 deal ticket you will not see market depth so you know it’s either SETSqx or SEAQ. The strip at the bottom with the uncrossing times tells you it’s a SETSxq stock.

3. SEAQ - is London Stock Exchange's non-electronically executable quotation service that allows market makers to quote prices in AIM securities (not traded on SETS or SETSqx) as well as a number of fixed interest securities. Purely quote driven.

-

For those not aware – swap bands for undated commodities are now visible in platform.

You’ll need to add a watchlist to your workspace and un-hide the relevant columns.

The values snap at 1600 BST to reflect what we expect to adjust by that evening. Naturally this means that before 1600 BST the rates will reflect the previous day’s funding.

Swap bands are inclusive of a 2.5% admin charge.

Any questions, please ask.

-

1

1

-

-

On 14/05/2020 at 10:50, greenscorpio1000 said:

caseynotes is an employee of IG

I can confirm that Caseynotes is not, in fact, an employee of IG.

@Caseynotes your contrubutions are very much appreciated however!

-

1

1

-

-

Here's the JUN-JUL spread - into positive territory for the first time since Feb.

-

1

1

-

-

Trading resumed

-

1

1

-

-

Dax futures remain in auction - GXM0 indicating 10711.5 ATM

-

-

Morning all,

Downside price limits for US futures:

At present we have hit the 5% circuit breaker. US futures limits increase to the main session levels at 1330 UK time (0830 Chicago).

https://www.cmegroup.com/trading/price-limits.html#equityIndex

Clients are not able to sell (either to open or close) when futures are suspended in this state.

Please note this is a function of the underlying exchange. This will apply globally for all brokers, not just for clients of IG.

-

1

1

-

1

1

-

-

Hihi,

Are you able to provide any details (market, order type, trade size, date & time, direction)?

-

Afternoon all,

To be clear - we don't weight cryptocurrency prices, based on either client trades or positions. We don't "stop hunt" client positions.

It is not in our interest to do so. Such behavior would - among other things - be harmful to our reputation, unfair, and would lead to intervention by the relevant regulator.

We price our crypto pairs by taking price feeds from exchanges, and combining them into a blended price.

Any given combination of feeds will ultimate produce a "best price" which we would use as our mid. This price is created by taking an average bid and offer price from our exchange price feeds, and wrapping a fixed spread around the new mid.

We weight these feeds in a normal distribution to reduce the impact of a spike in any single price feed. (Very rough chart from when this was in testing to give you a visual aid).

This distribution means that the feeds closest to the mean will have the largest price impact, preventing the majority of price spikes that could otherwise be caused by individual feeds.

Where there is a price spike we will determine whether it is valid reflection of the underlying market- and reverse trades if not.

-

1

1

-

-

-

Last day of the early start:

UK and European clocks go back one hour when daylight saving time (DST) ends on Sunday 27 October. From this date until Sunday 3 November, the end of US DST, there are a number of changes to our opening hours:

•

US and Canadian markets will trade one hour earlier in UK time. For example, US and Canadian shares will be quoted between 1.30pm and 8pm

•

All forex markets will open at 9pm on Sunday 27 October and close at 9pm on Friday 1 November

•

24-hour dealing on indices will open at 10pm on Sunday 27 October and close at 9pm on Friday 1 November

•

US shares (all sessions) will run from 8am to midnight Monday to Thursday, and from 8am to 9pm on Friday 1 November

•

In-hours trading on Eurex futures (including the Germany 30) will be available one hour earlier at 12:10am

•

Expiring US markets will be settling an hour earlier than usual

•

New York Cocoa, Sugar and Coffee, and London Sugar all close an hour earlier than normal

•

Weekend trading on indices will open at the same time (4am Saturday), but will close one hour earlier (9.40pm Sunday)

The dealing desk will also close early at 9pm on Friday 1 November.

-

1

1

-

1

1

-

-

10 minutes ago, Guest Phil said:

DailyFX showing 82% of IG clients net long on bitcoin, 93% of clients long Ether, 97% of clients long Ripple, and 92% of clients net long Litecoin.

Assume any limits will be filled on the open price which after this mega rally would be significant?

Best

Phil

That's right - all orders would usually be triggered & filled basis the opening price. We would, of course, pass on any positive slippage on limit orders.

-

1

1

-

-

Agreed - not ideal. Unfortunately no other way around the maintenance & updates required this weekend.

Again sincere apologies- we remain on track for a 1200 open without any further delay.

Ludwik

-

1

1

-

-

Morning all - please see below info sent earlier this week:

There will be a delayed open on our cryptocurrency and weekend markets on Saturday 26 October, to allow for scheduled maintenance.

We’re planning to reopen these markets at 12pm (UK time), rather than the normal 4am, however this is subject to change. We’re sorry if this causes you any inconvenience.

If you have any questions about this or need assistance with your account, you can find answers in our help and support area or IG Community. Alternatively, our highly trained client services team is available by phone or email 24 hours a day from 8am Saturday to 10pm Friday.No changes to plan- on track for midday at this time.

Thanks,

Ludwik

-

1

1

-

Lunar New Year 2022

in Indices and Macro Events

Posted · Edited by Ludwik Chodzko-Zajko IG

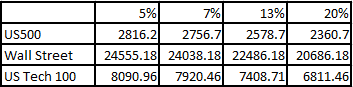

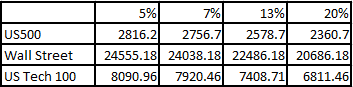

Lunar New Year begins on 1st February.

We expect affected markets to be closed on the following dates:

We will offer out-of-hours pricing on index futures throughout the period. We do not presently offer out-of-hours pricing on the Malaysia 30 or the Hong Kong Tech Index (marked with *). Any amendments to the schedule will be shown below.

Please don't hesistate to contact client services should you have any questions.

All the best.

Ludwik