-

Posts

27 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Blogs

Events

Community Tutorials

Store

Posts posted by Trading_psychology

-

-

over trading

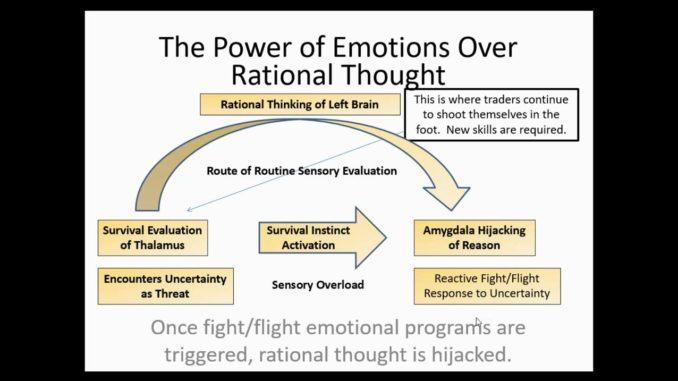

In a trained trader’s mind, the trader maintains an emotional state of disciplined impartiality. The feeling element of this emotional state produces a belief in the certainty that the trader can take advantage of what ever the market is willing to give it. This state of mind is much more conducive to effective trading and can be developed though memory enrichment and symbolic representation.

overtrading also make your wining rate lower and make you at disadvantages from the probability perspective. so from long run, over trading will make you reach a negative expectation on trading results. -

Once breathing becomes a skill, it can be used like a rheostat for your heart rate. There is a reciprocal relationship between the rate at which you breathe and the rate at which the heart pumps. When breathing with long, deep breaths you produce a mood of calmness where the heart is at rest and the heart rate is slowed down. However if you speed breathing up (or stop breathing), you also speed up the heart rate. As the heart begins to beat harder and faster, an alarm is triggered in the survival brain and it triggers to fight or flight. An emotional hijacking (and a bad trade) is in progress. This, in combination with your cutting off your air supply to the brain, leads the primitive survival brain to overwhelm the thinking brain and become a runaway freight train. This is not conducive to successful trading.

-

Breathing is like air supply to a fire. Just as a blacksmith will fan a fire with his bellows to produce a hotter fire, your type of breathing will either fan the arousal of an emotional fire or quell the fire.When the emotions of fear and anger are triggered, air supply to the brain is cut off. Consequently one’s capacity to think is shut off. Both of these emotions deal with the fight or flight motivation grounded in primitive survival impulses. Biologically you are predisposed to react rather than think. All the body’s energy is rerouted into the big muscles and is preparing you to fight or to flee. Thinking is not important at this time.

-

When you start trading, there is stress for fear to lose money. however, we can learn to manage the stress by control our breath. Breathing is a unique hybrid to the brain and body. It is simultaneously autonomic and volitional. Due to its autonomic character, you are able to breathe without thinking about it. When you go to sleep, your breathing will go on about its business without your slightest concern. Due to its volitional nature, you can manage how you breathe when in an awakened state. It is this aspect, managing how you breathe, that is vital to emotional regulation.

-

On 27/09/2023 at 18:25, Kiaramiles said:

Online casinos have undoubtedly made it incredibly convenient to access a wide variety of casino games from this link. The ability to play from the comfort of your own home or even on your mobile device while on the go is a significant advantage. However, convenience should always be balanced with responsibility.

there is no casino. it is actually a probability game for trading

-

18 hours ago, skyreach said:

BEWARE!

Lot of cliques exist for traders and investors. And, there are many many indicators and even snake-oil investment methods merchants who may try to lure you to try them out. That can make it more confusing or, give you information not worth using.

Also, no trader should rely on indicators solely as they will not work at times. And use only key indicators and methods you are adapt at using well.

Tried and tested indicators and methods are useful. But note, indicators are mostly lagging indicators. Market Maker can and will push prices as they want which actually creates the indicators patterns. So price moves lead.

However, Market Makers can and do manipulate the way chart patterns are formed. They even buy or sell for their own accounts too. A lot of factual data exists from ex-market makers so check it out on the internet. Check out the various manipulate tactics used by them, e.g. slippage for buy or sell orders and incentives given to brokers by them. Market Makers make the market and they control the 1st and last hour of trading.

WE SEE THE NET RESULT OF VARIOUS BUY / SELL PLAYS ONLY. What happens behind the scenes is something else.

100% agreed. the indictors can only be used to help make decision. nothing is 100%. No one can make money rely only on indicators.

psychology contribute 80%+

-

overtrading also make your wining rate lower and make you at disadvantages from the probability perspective. so from long run, over trading will make you reach a negative expectation on trading results.

-

Trading is just a Game. Maths game you need trade with perspective of statistics and probability the eBook is not specific for binary trading. It is on general trading psychology. When you can manage your psychology, you can profit in any market with any popular strategy you are good at. Wish you succeed.

-

usd/shekel

would advise you trade the popular one like eur/usd; usd/jpy pairs.

-

1

1

-

-

On 19/08/2023 at 19:41, SandySouth said:

Hi Community,

Are there any traders that use voice-assisted trading tools for their trading? How have you find the quality of the commands/tools itself?

I'm interested to hear your experiences.

Thank you for your help!

I think this is possible from technology perspective.

but I'm concern on its reliability. so i will skip it in live trading.

-

This is rare but is not abnormal.

the data has direct impact and also future concerns.

the overall impact is determined by the market participants. so, the same data can produce very different (up/down) views on the specific pair. now GBP/USD

another reason: the market is not always rational. just follow the trend and accept what happening on market is the objective approach. you may find the answer in the following video.

-

On 31/05/2023 at 22:52, xyz said:

I am trading almost 10 year. All the time i lose my money against anti trading. some amount make you to win but actually you losing more.

anyone booked good profit let me know.

Even index they are doing anti trading against customer.

To help many more small traders, we decided to make it Free to the public from now on and thanks to the support of all our clients. You can get a free copy as attached.

Attached File(s)

i spent time wrote this ebook for you guys to train your trading psychology. strategy is key but trading psychology is more important which contribute 80%+ to your success. if you want to trade like a sniper and pursue long term profits, then the book is for you.

wish you succeed in trading. -

To help many more small traders, we decided to make it Free to the public from now on and thanks to the support of all our clients. You can get a free copy as attached.

Attached File(s)

some of you may choose to trade by yourself. so, i spent time wrote this ebook for you guys to train your trading psychology. strategy is key but trading psychology is more important which contribute 80%+ to your success. if you want to trade like a sniper and pursue long term profits, then the book is for you.

wish you succeed in trading. -

On 25/10/2022 at 17:44, LordFlasheart said:

Hi. Is there anywhere I can see a track record of how the signals have performed,thanks

You can't make money rely on signal. the signal mainly provides you the entry point. the more important thing is when to exit and manage you emotion. would advise you place more importance on trading psychology.

-

-

When you can manage your emotion, your psychology, you can profit with whatever strategy. 🙂

-

trader’s fear of loss is not only located in the here and now of his trading, but also in his history. And that history shaped how he sees the market, opportunity, risk, and reward. He adapted to avoid loss. This is his Adapted Voice reacting unconsciously (mindlessly) to the Prosecuting Attorney in his head.

This trader can hear a voice in him saying, “Don’t you dare be foolish. Don’t risk your capital stupidly. Keep a tight lid on your losses – or you’ll be left homeless.” Out of fear of loss inherited from a previous generation, his internal dialog limits who he can be today as a trader. Tragic – the historical dialog he trades from was transparent to him. Now, it is not. He no longer mindlessly has to be held prisoner by this intergenerational conversation of possibilities.

-

To help many more small traders, we decided to make it Free to the public from now on and thanks to the support of all our clients. You can get a free copy as attached.some of you may choose to trade by yourself. so, i spent time wrote this ebook for you guys to train your trading psychology. strategy is key but trading psychology is more important which contribute 80%+ to your success. if you want to trade like a sniper and pursue long term profits, then the book is for you.

wish you succeed in trading.

.thumb.jpg.3da15369e08561033c10343be7133fae.jpg)

Free ebook: Trading like a sniper

in General Trading Strategy Discussion

Posted