Ahead of the game: August 14, 2023

Your weekly financial calendar for market insights and key economic indicators.

Source: Bloomberg

This week brought its usual mix of high-profile successes and disappointments, while the backdrop of increasing energy prices also played a notable role in shaping market sentiment.

The decline on Wall Street intensified this week, triggered by weak Chinese economic data and Moody’s downgrading of several mid-tier US banks. In contrast, the Japanese stock market, represented by the Nikkei index, continued to climb due to robust corporate earnings and the favorable valuation of the Japanese yen.

For the ASX 200, the focus of this week was firmly on the resurgence of energy stocks and the ongoing earnings season.

- US headline CPI rose 0.2% in July, pushing the annual rate to 3.2%

- Core CPI also rose 0.2%, with the annual rate at 4.7%

- Deflation arrived in China as July inflation fell -0.3% YoY from June's 0.0%

- European gas prices surged 30%, and crude oil climbed above $84.00 a barrel

- Moody’s lowered credit rating on several small to midsized US banks

- US dollar gained for a fourth consecutive week against most G10 currencies

- Gold fell to $1910 as US yields and dollar gained

- Volatility (VIX) index on Wall Street fell -7.31% to 15.84.

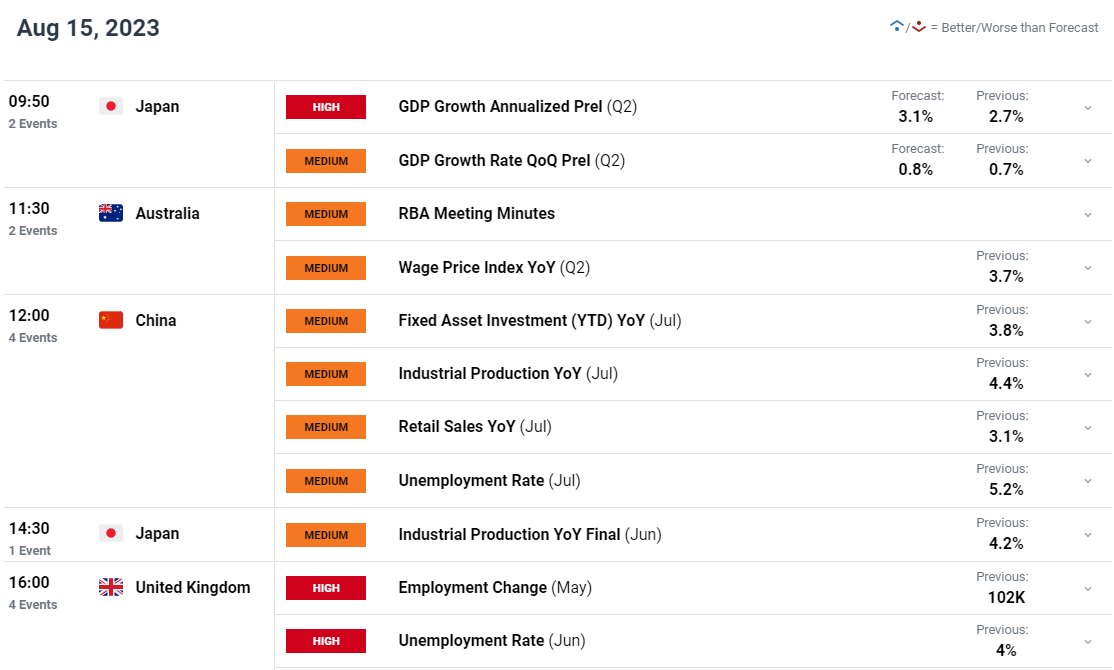

- AU: RBA Meeting minutes (Tuesday, August 15 at 11:30 am AEST)

- NZ: RBNZ interest rate decision (Wednesday, August 16 at 12:00 pm AEST)

- AU: Employment Report (Thursday, August 17 at 11:30 am AEST)

- JP: Q2 GDP (Tuesday, August 15 at 9:50 am AEST)

- CN: IP (Tuesday, August 15 at 12:00 pm AEST)

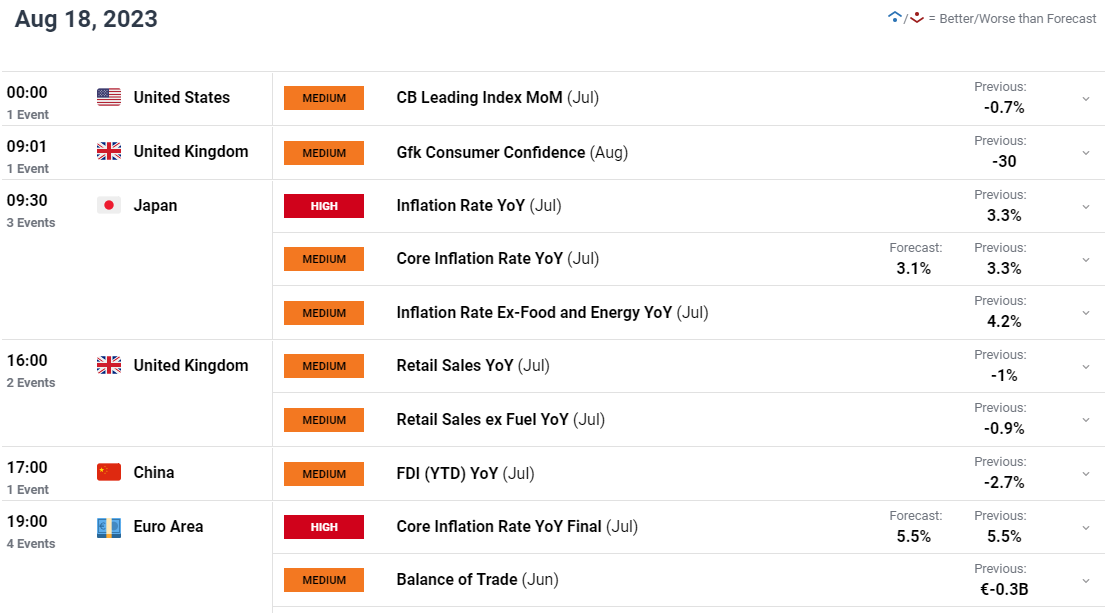

- JP: Inflation (Friday, August 18 at 9:30 am AEST)

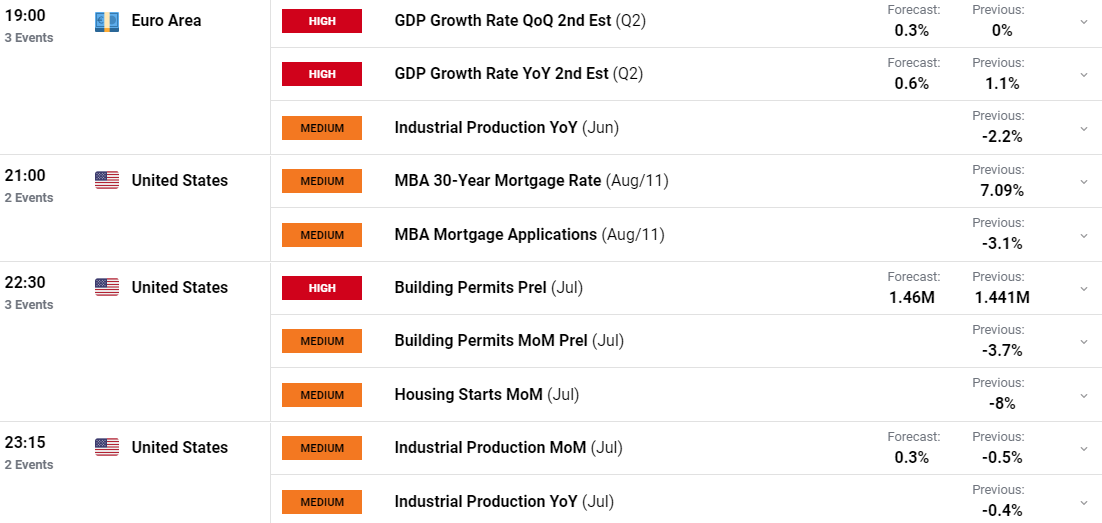

- US: Retail Sales (Tuesday, August 15 at 10:30 pm AEST)

- US: Housing Starts and Building Permits (Wednesday, August 16 at 10:30 pm AEST)

- US: IP (Wednesday, August 16 at 11:15 pm AEST)

- US: FOMC minutes (Thursday, August 17 at 4:00 am AEST)

- UK: Employment (Tuesday, August 15 at 4:00 pm AEST)

- UK: Inflation (Wednesday, August 16 at 4:00 pm AEST)

- EA: Industrial Production (Wednesday, August 16 at 7:00 pm AEST)

- UK: Retail Sales (Friday, August 18 at 4:00 pm AEST)

Source: Bloomberg

-

AU

RBA Meeting Minutes

Tuesday, August 15 at 11:30 am AEST

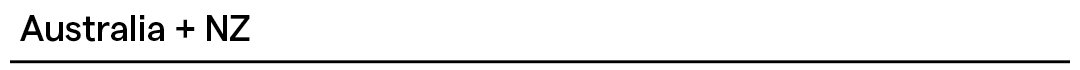

The Minutes from the Reserve Bank's meeting in August are scheduled to be released on Tuesday, August 15th at 11:30 am. At its meeting in August, the RBA kept its cash rate on hold at 4.10% for a second consecutive month.

The RBA's decision to keep rates on hold was based on similar reasons as in July - to assess the impact of a cumulative 400bp rate hikes and evidence that a sustainable rebalancing between supply and demand is underway.

In the accompanying statement, the RBA displayed more comfort around the inflation outlook, noting that while inflation remains "still too high at 6 per cent", recent data is "consistent with inflation returning to the 2-3 per cent target range over the forecast horizon" based on the proviso that productivity growth "picks up".

Putting a dent in hopes that the RBA may have ended its rate hiking cycle, the RBA retained its tightening bias: "Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe", which fits with our view of one more 25bp rate hike to 4.35% before year-end.

The Board meeting minutes would be expected to reiterate the sentiments outlined above. They will be closely scrutinised around what factors would prompt the RBA to act on its tightening bias and what factors might see the RBA extend its pause for a third consecutive month.

RBA cash rate chart

Source: RBA

-

AU

Employment report

Thursday, August 17 at 11:30 am AEST

June's employment demonstrated robust growth of 32.6k, once again surpassing market expectations for a rise of 15k, while the unemployment rate held steady at 3.5%. The participation rate experienced a slight decline of 0.1%, coming in at 66.8% compared to the previous month's record high of 66.9%.

The uptick in employment during June maintained the employment-to-population ratio at a historic high of 64.5%, indicating a tight labour market where employment has been aligning with population growth.

For July, the market anticipates a growth of +15k in employment, alongside a slight increase in the unemployment rate to 3.6%. The participation rate is expected to remain unchanged at 66.8%.

AU unemployment rate

Source: TradingEconomics

-

UK

Inflation report

Wednesday, August 16 at 4.00 pm AEST

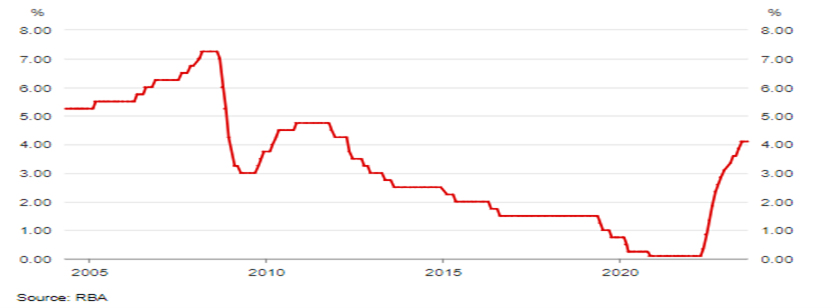

In June, the headline inflation in the UK experienced a decline to 7.9% YoY, marking the lowest level since March 2022 and significantly below the peak of 11.1% in October of the previous year. Concurrently, core inflation eased to 6.9% from a 31-year high of 7.1% YoY seen in May.

For July, the market's anticipation is for headline inflation to further reduce to 6.7%, and similarly, core inflation is predicted to follow this trend. The UK rates market has currently priced in approximately 40 basis points of rate hikes from the Bank of England (BoE) before the year concludes. Notably, the BoE's terminal rate is now perceived at 5.65%, displaying a significant decrease from 6.1% recorded at this same time last month.

UK inflation rate chart

Source: TradingEconomics

-

JP

GDP Q2 GDP

Tuesday, August 15 at 9.50 am AEST

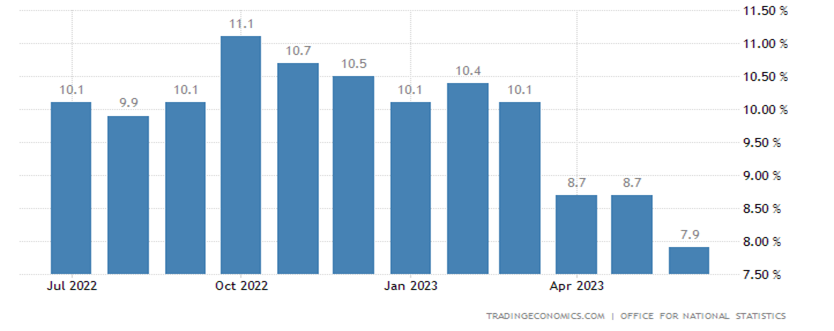

Japan's economic data in the second quarter has revealed pockets of resilience, with the services sector demonstrating ongoing strength and trade activities showing improvement. Based on these trends, current expectations are that Japan's annualized 2Q GDP will increase to 3.1%, a rise from the 2.7% recorded in 1Q. On a quarter-on-quarter basis, there is a consensus for a 0.8% growth rate, slightly higher than the 0.7% seen in 1Q.

However, it's important to note that while the upcoming GDP data is anticipated to highlight economic resilience, it reflects a retrospective view, potentially directing more attention towards recent data for insights into the country's economic prospects. The forthcoming week will bring fresh updates on Japan's inflation, serving as a focal point to determine the Bank of Japan's (BoJ) pace of normalization and its direct impact on growth conditions.

JP GDP chart

Source: Investing.com

-

JP

Inflation report

Friday, August 18 at 9.30 am AEST

Japan's policymakers have been proceeding cautiously toward policy normalisation, recently guiding for flexibility around their yield curve control policy while also ensuring to keep hawkish bets in check with unscheduled bond-purchase operations. Given that a sustained and stable 2% inflation rate is one of the considerations for policymakers, any persistent increase in inflation numbers next week may likely contribute to calls for a quicker pace of normalisation.

Currently, expectations are for Japan's July core inflation to moderate to 3.1% year-on-year, down from the previous 3.3%. The focus will be on the core-core inflation (inflation excluding food and energy prices), which remains more than two-fold above the central bank's target (4.2% in July). Any lack of progress on that front may challenge the 'transitory inflation' argument from the BoJ and trigger some hawkish bets.

JP inflation rate chart

Source: Refinitiv

-

US

FOMC Meeting Minutes

Thursday, August 17 at 4.00 am AEST

Following the 25 basis-point (bp) rate hike from the Fed at its last meeting, the upcoming meeting minutes will provide insights into the level of unity among policymakers regarding that decision, as well as their future rate hike appetite. The minutes are also expected to reflect an improved level of confidence in growth conditions, with Fed Chair Jerome Powell’s previous comments that the central bank's staff no longer forecasts a US recession.

However, given the Fed’s clear emphasis on its data-dependent policy stance, more attention may instead focus on fresh updates regarding US job and inflation data after the Fed meeting, as the minutes are backward-looking. Thus far, Fed funds futures pricing has been firm for an extended rate pause from the Fed throughout the rest of the year, supported by softer-than-expected inflation data this week.

-

US

US Q2 2023 earnings

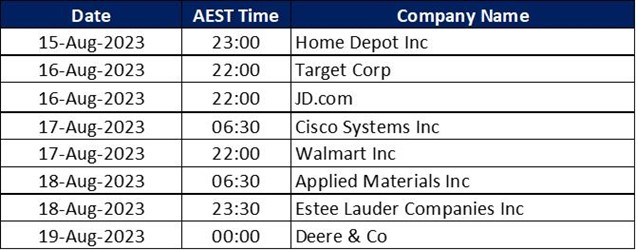

Q2 2023 earnings season is in the final straight with reports next week due from companies including the giant retailers Home Depot, Target, Walmart.

Source: Refinitiv

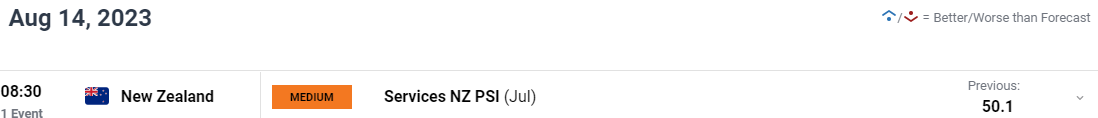

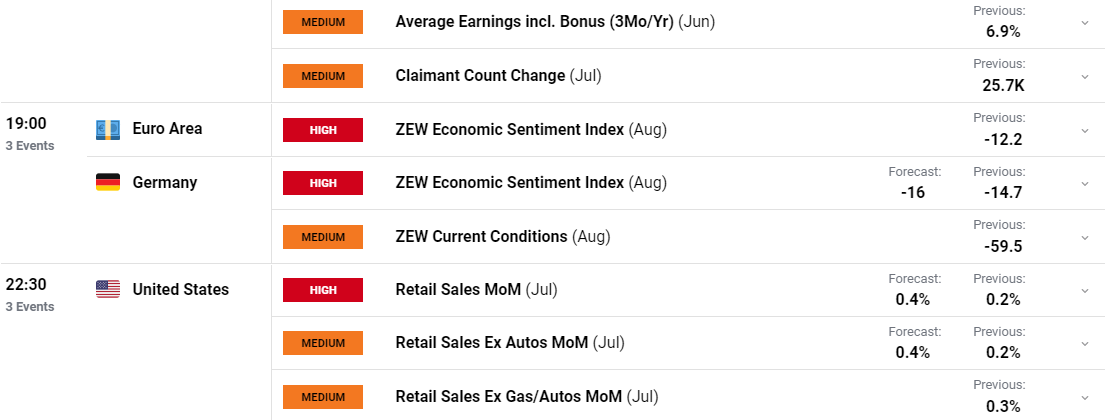

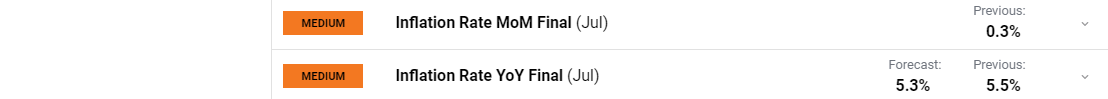

Economics calendar

All times shown in AEST (UTC+10) unless otherwise stated

Source: DailyFX

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now