Crude Oil Prices at Risk with FOMC, OPEC+ Meetings in the Spotlight

CRUDE OIL OUTLOOK:

- Crude oil prices may decline if the Fed dials up hawkish rhetoric.

- OPEC+ unlikely to yield to US-led calls for faster output increase.

- Chart positioning hints WTI momentum flagging at 7-year high.

Crude oil prices are trading water having settled in a range after hitting a 7-year high below the $86/bbl figure last week. An intraday bounce was capped yesterday as October’s US ISM manufacturing report showed sector growth slowing even as input prices surge.

That echoes a slew of recent economic data, including the past few months of payrolls data as well as last week’s back-to-back releases of soft Q3 GDP data and eye-watering inflation measures. Such outcomes feed seemingly spreading worries about ‘stagflation’, beckoning the Fed to tighten credit conditions and cool prices.

CRUDE OIL PRICES MAY FALL ON HAWKISH FOMC STANCE

This may preview how crude might react if this week’s much-anticipated FOMC policy announcement registers on the hawkish side of expectations. A rough baseline seems to be the formal unveiling of a plan to taper QE asset purchases from December through mid-2022, reducing them by about $20 billion each month.

If the central bank opts for a more ambitious timeline or offers guidance flagging a hardening stance against inflationary excess – a signal that may be read as opening the door to hawkish escalation – crude oil may fall. This makes sense: risk appetite is likely to sour in such a scenario, while the US Dollar gains.

OPEC+ MAY DISAPPOINT CALLS TO BOOST OUTPUT FASTER

A meeting of the OPEC+ group of major producers on Thursday is also in view. They may opt to retain the plan of adding 400k barrels per day (bpd) to the group’s collective supply as an output cap regime is phased out, waving off pressure to speed things up from countries including the US.

That may reflect technical difficulties – especially in Africa – at least as much as a desire to capitalize surging prices. Bloomberg data shows that OPEC itself – the cartel at the center of OPEC+, which also includes major suppliers like Russia – added just 140k bpd in output last month. That’s barely half of what it owed.

In the meantime, API inventory data is eyed. The private-sector estimate of weekly US storage flows will be weighed against expectations of a 1.56-million-barrel increase to be reported in official EIA government statistics Wednesday. Headlines from the COP26 climate change summit are also lurking in the background.

CRUDE OIL TECHNICAL ANALYSIS

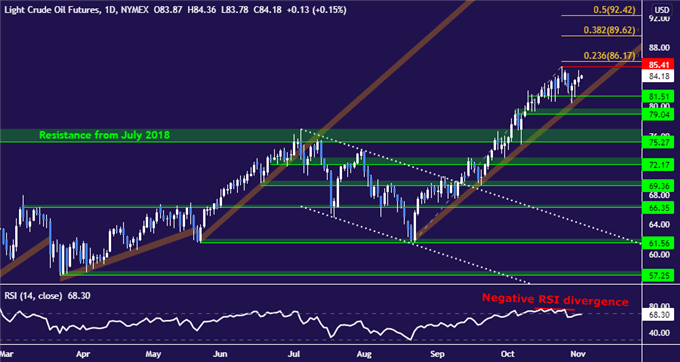

Crude oil prices are consolidating below the $86/bbl figure, with negative RSI divergence warning that upside momentum is fading and a turn lower may be in the cards. Overturning the near-term uptrend seems to call for a close below support anchored at 79.04. That may expose 75.27.

Resistance is marked by the swing high at 85.41 and reinforced by the 23.6% Fibonacci extension at 86.17. Beyond that, the 38.2% and 50% extensions approximate upside barriers at 89.62 and 92.42.

Crude oil price chart created using TradingView

CRUDE OIL TRADING RESOURCES

- What is your trading personality? Take our quiz to find out

- See our guide to build confidence in your trading strategy

- Join a free live webinar and have your questions answered

Written by Ilya Spivak, Head Strategist, APAC for DailyFX. 2nd November 2021.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now