Australian Dollar Forecast: Wages Key to AUD/USD and RBA Outlook

AUDUSD, AUDNZD Price Analysis and News:

- Australian Wage Data Key for RBA Monetary Policy Considerations.

- AUD/NZD Elevated Relative to Bond Spreads.

AUSTRALIAN WAGE DATA KEY FOR RBA MONETARY POLICY CONSIDERATIONS

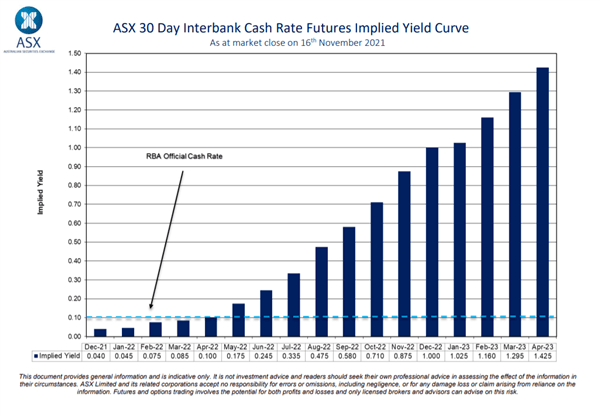

A plethora of RBA commentary overnight amid the release of the November meeting minutes as well as Governor Lowe’s speech. Within the RBA’s minutes, members noted that the risks to the inflation forecast had changed, as the distribution of possible outcomes shifted upwards. In which the main uncertainties were related to the persistence of current disruptions to global supply chains and the behaviour of wages at the lowest unemployment rate in decades. Alongside this, members agreed that the central scenario for the economy continued to be consistent with the cash rate remaining at its current level until 2024. This is in stark contrast to money market pricing, where the cash rate is seen at 1% by the end of next year. That being said, the central scenario for rates unchanged until 2024 is also predicated on sluggish wage growth, therefore tonight’s Q3 wage data release will be closely watched for Aussie traders, where a strong beat is likely to provide a bid for AUD.

Expectations are for wage growth y/y to rise to 2.2% from 1.7%. A reminder that the RBA expects H2 21 wage growth at 2.25% and given the importance that the RBA has placed on wages, strong data is likely to raise expectations that the RBA will soon give up on its central scenario.

RBA RATE EXPECTATIONS

Source: ASX

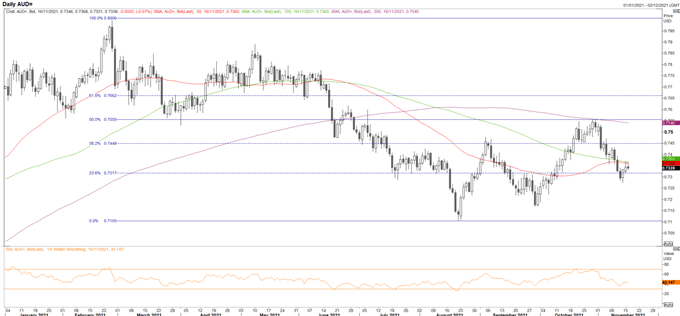

AUD/USD TECHS TO WATCH

Near-term resistance resides at 0.7360-65, which marks the 50 and 100DMAs. Therefore, a topside break would be a significant development for AUD bulls, potentially opening up a move towards the 0.7450 area. On the downside, support sits at 0.7315-20 and 0.7275.

AUD/USD CHART: DAILY TIME FRAME

Source: Refinitiv

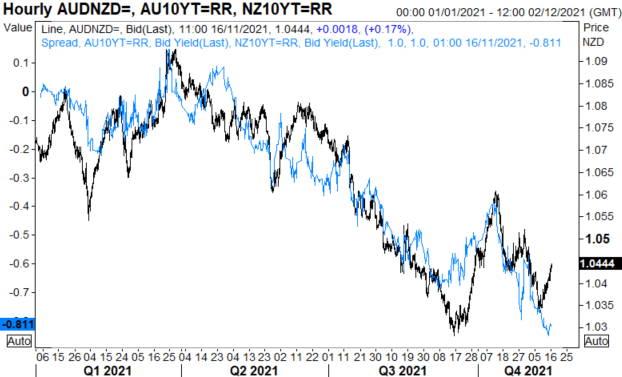

AUD/NZD ELEVATED RELATIVE TO BOND SPREADS

A modest reprieve for AUD/NZD, however, the cross is beginning to look slightly rich vs 10yr bond spreads. In turn, with the 100DMA situated at 1.0471, this may curb further upside. Although, it is important to keep in mind that the RBNZ rate decision is scheduled next week, and given current market pricing for 35bps worth of tightening next week, there is a risk of hawkish disappointment, should the Bank only raise rates by 25bps.

AUD/NZD CHART: HOURLY TIME FRAME

Source: Refinitiv

By Justin McQueen, Strategist, 16th November 2021. DailyFX

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now