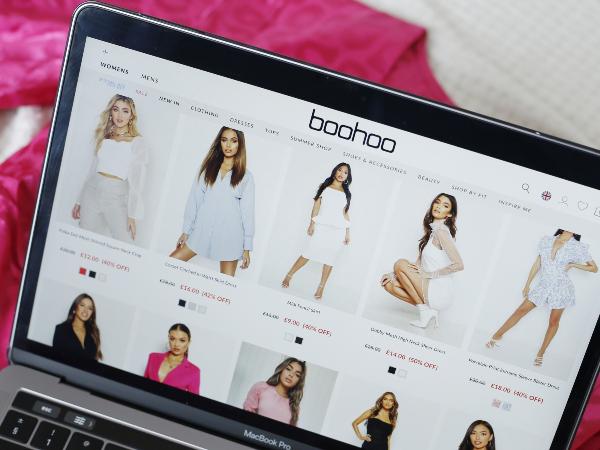

Can the Boohoo share price recover in 2022?

The Boohoo share price has fallen 64% over the past six months. With increased transport costs, extended delivery times, and rising returns, can the fast-fashion retailer recover in the new year?

Source: Bloomberg

The Boohoo (LON: BOO) share price has seen better days. It’s just fallen 15% from 136p to 116p. A week ago, its share price stood at 159p, and only six months ago, it was worth 326p.

And over the past five years, it’s been one of the most volatile stocks on the FTSE 250. It’s lost 14% of its value in this time, while the index as a whole has gained 28%.

During the pandemic-induced crash in early 2020, it fell from 327p on 21 February to 180p by 3 April. It then rocketed to 413p by 19 June, before collapsing to 230p on 17 July. In 2021, it’s continued to be extremely volatile, hitting a high of 357p on 16 April. Since then, weaker growth prospects and Omicron concerns have seen it fall to today’s low price of 116p.

Boohoo share price: trading update

At 7am today, Boohoo released a trading update covering the three months to 30 November. At first glance, results were positive for the stock. Gross sales were rose 28% and net sales were up 10% over the period. The company highlighted ‘exceptional UK demand, validating the strength of our business model where our leading proposition across price, product and service continues to resonate strongly.’ And the numbers back it up. UK gross sales were rose 58% compared to FY21, and 102% compared to FY22. Moreover, the company ended the period with £170 million liquidity and £70 million net cash.

However, Boohoo also had bad news to report, saying performance was ‘impacted by significantly longer customer delivery times as a result of the pandemic, with all of our international sales currently fulfilled from our UK distribution network.’

Moreover, ‘revenue in Europe has declined in the latter months of the Period,’ while the ‘continued impact of reduced air freight capacity on delivery times’ means that a previously anticipated recovery in the USA hasn’t happened. And the company estimates that ‘freight cost inflation’ will impact EBITDA by around £20 million in the financial year.

However, to combat these pressures, Boohoo is planning to ‘expedite’ the creation of its first US distribution centre, which will cut down on delivery times and massively reduce transport costs.

Source: Bloomberg

Weaker growth prospects

Unfortunately for investors, the Boohoo share price had factored in overly optimistic growth prospects. The company has updated its sales growth guidance for the financial year, and now expects 12% to 14% growth, compared to previous guidance of 20% to 25%. Moreover, the adjusted EBITDA margin for the year is expected to be 6% to 7%, compared to previous guidance of 9% to 9.5%. The group highlighted ‘recent developments surrounding the Omicron variant,’ and ‘significantly higher returns rates’ for the weaker guidance. But Stifel analyst Caroline Gulliver commented that ‘the factors behind Boohoo’s warning are not a surprise, but the magnitude of the slowdown and hit to margin is.’

CEO John Lyttle believes the ‘strong performance in our core UK market’ but accepts that poor results in international markets have ‘weighed on our performance.’ However, he pointed out that Boohoo has ‘gained significant market share during the pandemic,’ and furthermore that the ‘current headwinds are short-term.’ And the company remains ‘highly confident about its future growth prospects,’ and expecting ‘normalised growth rates of 25% per annum post-pandemic.’

Earlier this year, Boohoo bought the Dorothy Perkins, Wallis and Burton brands from failed retail group Arcadia for £25.2 million. It also spent £55 million on the Debenhams brand to attract an older retail cohort. While these strategic acquisitions may help with long-term growth, weakening its cash position amidst the ongoing pandemic headwinds might be a move that the company later regrets.

In the UK, Premier delivery costs £9.99 per year and comes with unlimited free returns. As deliveries become increasingly delayed, many of these returns will be clothing that has fallen out of fashion. This hits the company twice, as they are also harder to sell on. Moreover, as it markets itself as a low-cost choice, it can’t increase prices to cover increased transport costs, while simultaneously expecting customers to wait longer for parcels.

The Boohoo share price could make a comeback in 2022. But with the Omicron variant surging amidst a supply chain crisis, a turnaround could take longer.

Trade over 16,000 international shares from zero commission with us, the UK’s No.1 trading provider.* Learn more about trading shares with us, or open an account to get started today.

*Based on revenue excluding FX (published financial statements, June 2020).

Charles Archer | Financial Writer, London

17 December 2021

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now