Q2 earnings season preview: weaker performance expected, as inflation rises and growth falters

After a two-year low in earnings growth for Q1 2022, an even lower level of growth is expected for the upcoming reporting season.

Source: Bloomberg

Source: Bloomberg

When does earnings season start?

The next reporting period for US companies, covering the calendar second quarter (Q2), begins on 14 July with JPMorgan Chase & Co (All Sessions) and other US banks reporting earnings.

Key market data

For the second quarter, earnings are expected to rise 4.1%, which would be the lowest rate of growth since the fourth quarter (Q4) of 2020. Meanwhile, revenues are expected to rise 10.1% compared to a year earlier.

What should investors watch out for this quarter?

- Rising negative earnings guidance

The number of companies in the US 500 with negative earnings guidance has steadily risen since its lowest level in the third quarter (Q3) of 2020.

A year ago, only 37 companies in the index were giving negative earnings guidance, but rising inflation and the pressure this puts on profit margins, along with weakening expectations about economic growth and consumer spending mean that the number has risen to 71 for the second quarter (Q2) 2022. This is the highest level since the final quarter of 2019.

It is true that this level is below the peak of the first quarter (Q1) of 2016, when 87 companies reported negative earnings guidance. But we have yet to see whether the US enters even a technical recession this year.

The surge in inflation in the first half of the year has yet to subside, or even cool in a sustainable fashion, suggesting more economic pain to come for both the broader American economy and US consumers.

Source: FactSet

Source: FactSet

- Earnings growth to hit fresh post-2020 low

Growth of 4.1% in earnings for Q2 2022 would be the lowest level since the end of 2020, and down sharply from the 9% of Q1 2022.

At present of course these are just estimates, but the expected weaker growth does accord with the generally gloomy economic outlook.  Crucially, earnings estimates have fallen as we head towards the quarter, reflecting the weaker expectations for the reporting period.

This makes sense, given how investors now openly fret about a recession in the US and potentially in much of the rest of the world too. While inflation remains so high globally, any slowdown in the rate of central bank policy tightening seems unlikely, so little help is expected from this quarter.

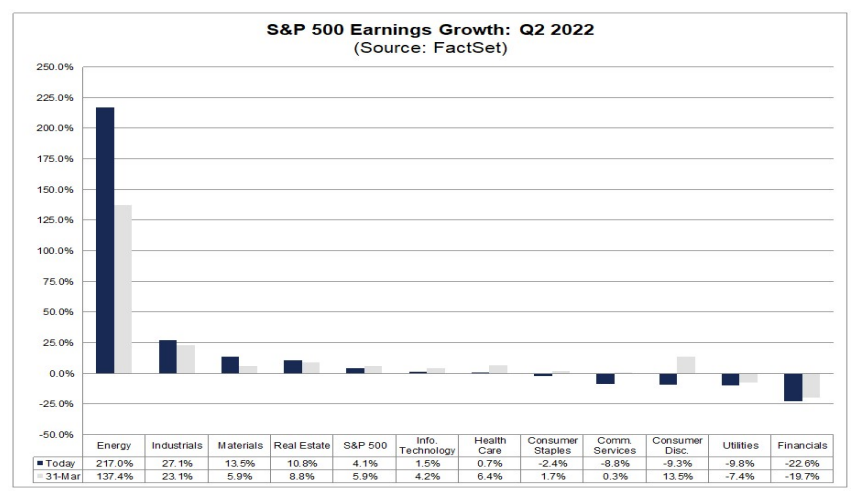

Once again, energy is expected to post the biggest rise in earnings, following its impressive performance in Q1. Financials and Utilities are expected to see earnings declines for Q2.

Source: FactSet

Source: FactSet

- More bad news on the way?

The worry for investors is that this earnings season may not mark the end of the slowdown. If the number of companies reporting negative guidance rises for Q3 compared to Q2, or earnings for Q2 turn negative, then we can expect investors to be even less keen on increasing their equity allocations.

Investors still expect a rebound in Q3 and Q4 of the year, with current expectations for earnings growth of 10.5% and 9.7% respectively, for an overall rise of 10.2% for the year.

This still seems optimistic, setting up stocks for a tough end to the year, and potentially a tough beginning to 2023.

-

1

1

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now