Market alert: Crude oil price lifted by supply constraints in several key markets

Crude oil prices have pushed higher with supply issues swirling; many oil producing nations face challenges or support cuts in output and a stronger US dollar couldn’t hold oil down but will WTI reclaim the high ground?

Source: Bloomberg

Crude oil has recovered at the start of this week as supply issues continue to cause concern for energy reserves going into the Northern hemisphere autumn.

This is despite a broadly stronger US Dollar in the aftermath of the Federal Reserve meeting last week that pointed toward higher rates for longer than the market had previously anticipated.

Last week, Saudi Arabia and OPEC+ appeared to place floor on the price of oil. Saudi Energy Minister Prince Abdulaziz bin Salman said that production could be cut if it was deemed necessary.

Then, Organization of Petroleum Exporting Countries (OPEC+) Secretary General Haitham Al-Ghais cited spare capacity as an ongoing issue for the oil market.

On Monday, unconfirmed reports emerged that the United Arab Emirates, Oman and Congo support the views expressed by Saud Arabia last week, that being that production could be cut if prices fall.

Compounding the problem, political unrest in Libya has flared up again and has the market guessing that their production may come under threat. Then there are reports of issues with Kazakhstan port facilities impacting exports of their oil.

Additionally, hopes have been dashed of a prompt resolution in resurrecting the 2015 US-Iran nuclear accord.

Exasperating oil price tension is the soaring costs of alternative energy, particularly for Europe, where Russia is pulling the strings on supply through the Nord Stream 1 pipeline.

The lack of oil coming from Russia has seen natural gas prices rocket higher. The European benchmark Dutch Title Transfer Facility (TTF) natural gas futures contract has pulled back below 300 Euro per Mega Watt hour (MWh) after peaking just under 350 Euro per MWh. A welcome reprieve but still well above the June low of 80 Euro per MWh.

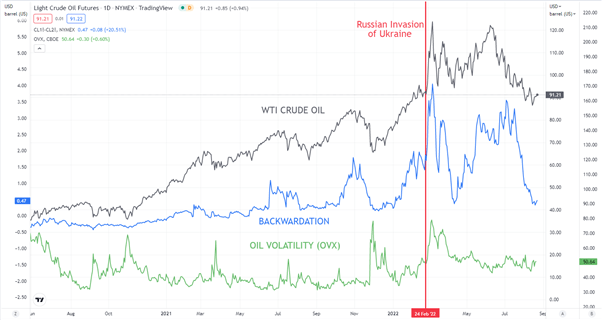

This was due to the European Union getting close to meeting its gas storage filling target of 80% goal two months ahead of schedule, with reserves now at 79.4%. The structure of the oil market might support further gains with backwardation ticking up again while volatility remains subdued.

WTI crude oil, backwardation and volatility (OVX)

Source: TradingView

30 August 2022

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now