Will the 2022 Stock Market’s Performance Influence the US Midterm Elections?

US MIDTERM ELECTIONS OUTLOOK:

- US midterm elections will be held on November 8 this year.

- The Democrats, who currently control both houses of Congress, could lose their slim majority, paving the way for political gridlock in Washington.

- Historically, stock market performance in a midterm cycle year does not seem to influence the outcome at ballot box.

Most Read: How Does the Stock Market Affect the Economy? A Trader's Guide

The 2022 US midterms elections, where Democrats and Republicans will battle over control of Congress and shape the second half of Joe Biden’s presidential term, are quickly approaching.

American citizens will head to the polls on Tuesday, November 8, to choose the 435 members of the House of Representatives, who are up for re-election every two years. Meanwhile, 35 of the 100 Senate seats are up for grabs in the evenly divided upper chamber. Dozens of gubernatorial races and a variety of other state and local legislatures will also be contested, but this article will focus entirely on Federal offices.

Traditionally, midterm elections are bad cycles for the president’s party, indicating that a shift in the balance of power on Capitol Hill could be just around the corner.

In this article, we will analyze post-World War II midterm elections to determine whether recent equity market performance has any correlation or predictive power at the ballot box. For context, midterm elections are held around the midpoint of a president's constitutionally mandated four-year term, on the Tuesday immediately after the first Monday in November.

Continue Reading: Everything You Need to Know About Types of Stocks

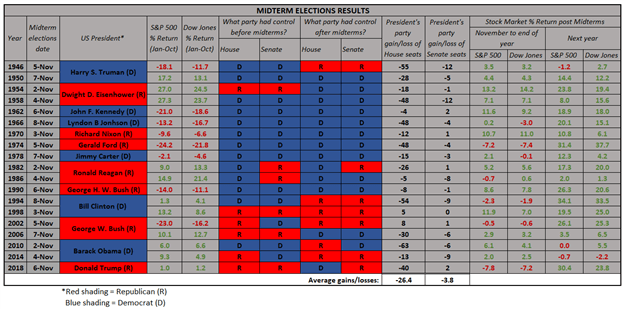

The following table displays the results of all midterm elections from 1946 through 2018. It also shows the percentage returns of the S&P 500 and Dow Jones in those cycles, from January through the end of October, to see if gains or losses in the equity space coincided with any specific voting outcome.

Source: DailyFX and Brookings Institute

The initial premise before starting this report was that a poor stock market performance in a midterm election year could translate into congressional losses for the party of the incumbent president. The other theory was that a positive stock market performance could bring gains for the president’s party. Although intuitive, these assumptions proved to be somewhat inaccurate. We explore why next.

Overall, there are no notable correlations between equity returns in the 10 months leading up to a midterm election and the final outcome of the vote, but there is one clear pattern to emphasize: the party of the incumbent at the White House tends to lose seats in Congress regardless of how Wall Street has been doing. In fact, over the past 19 midterm cycles, the party holding the presidency has lost an average of 26 seats in the House of Representatives and four in the Senate.

PRESIDENT’S PARTY PUNISHED NO MATTER WHAT

US stocks have plunged this year on high inflation, downturn fears and tightening monetary policy. Although the S&P 500 and Dow Jones have recovered some ground over the summer, both have lost more than 15% and 12%, respectively, so far this year (at the time of writing). While stock market returns appear to have no predictive power for a midterm election based on past data, the underlying drivers of equity weakness this year, such as soaring consumer prices and recession concerns, may influence how voters cast their ballots.

Often, the incumbent president's party is blamed and punished for all negative developments in the economy and the country as a whole. In a sense, midterm elections can be seen as a referendum on the party in power and a barometer of the administration’s popularity.

If Republicans can sell their message successfully and tie everything bad in the economy to Democrats, they can reap significant gains at the polls on November 8, aided by the more benign electoral environment for the opposition. Given that the Democrats enjoy only a slim majority in both Houses, even small losses could cost them control of Congress for the next two years. That said, betting markets are heavily discounting a split government after November’s vote.

BEYOND MIDTERM ELECTIONS

While no outcome is guaranteed, history has not been kind to the incumbent president's party, indicating that Republicans may be on the verge of winning back the House and perhaps the Senate, although the path to a majority in the upper chamber for the GOP looks more complicated.

In any event, a divided Congress will certainly bring gridlock, preventing the Biden’s administration from enacting his most ambitious plans that require legislation for implementation. In a split-government scenario, major spending initiatives are unlikely to materialize, with fiscal policy becoming more reactive rather than proactive, responding only to a major slowdown or crisis. Monetary policy, however, could eventually become more accommodative to compensate for reduced fiscal impulse.

SPLIT GOVERNMENT

Traders and investors are trying to assess whether risk assets will continue to sell off if the Democrats lose their majority in anticipation of further obstruction in the legislative process. Looking at the data over the past three decades, when partisanship began to become increasingly extreme and the modern political alignment took hold, there have only been three instances in which a unified government, i.e., Executive and Legislative under one party, lost its majority in Congress after a midterm election (2006, 2010, and 2018).

On average, stocks, as measured by the S&P 500 and Dow Jones, tend to be roughly flat in the last two months of the year in a midterm cycle after a change in the balance of power on Capitol Hill, but then go on rallying about 12% the following year. There are only a few observations for this specific occurrence, so causality should not be assumed.

While drawing parallels and extrapolating circumstances can be a dangerous investment strategy considering that no two periods are ever entirely the same, a fragmented government could bring volatility toward the tail end of 2022. Should this scenario play out, equity market stability and a more durable recovery may not be achieved until 2023, when the new Congress shows its cards and it is time to start compromising to pass future legislation.

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG's client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

--- Written by Diego Colman, Market Strategist for DailyFX | 5th Oct 2022

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now