AMD earnings preview: expectations and outlook

Advanced Micro Devices is expected to report its earnings on November 1st after the market closes.

Source: Bloomberg

Source: Bloomberg

When will AMD report its Q3 earnings?

Advanced Micro Devices is expected to report its earnings on November 1, 2022, after the market closes. The report will be for the fiscal Quarter covering July and September.

What to expect?

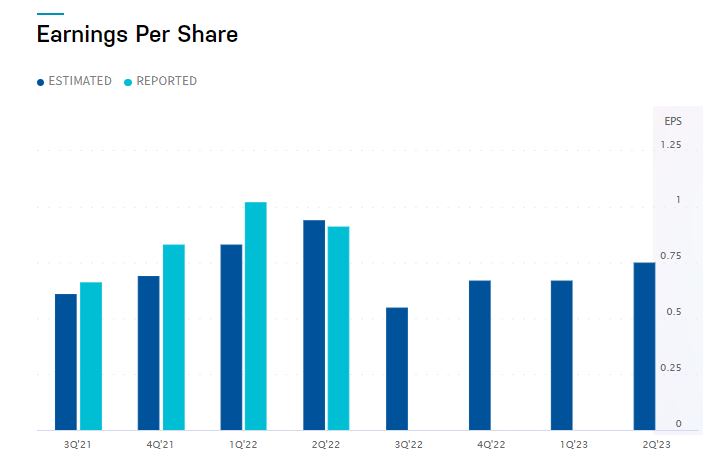

According to Zacks Investment Research, the EPS forecast for the quarter sits at $0.72, a 31% decline from the previous quarter and a 4% down from the same quarter last year. Revenue is expected to grow to $5.69 billion, 13% down from Q2 but up 32% year-over-year (y-o-y).

What to watch for

-

Preliminary third quarter 2022 financial results

On October 6th, AMD released a preview for its third-quarter earnings allowing investors to get a glimpse of how the chipmaker had performed.

On a positive note, AMD expects data centres to grow by 45% and gaming by 14%.

These two sectors contribute over 40% of AMD’s total revenue.

As stated by AMD’s CEO Lisa Su in a recent press release, "The PC market weakened significantly in the quarter."

On the other hand, heightened pressure is coming from its client segment. AMD's client products consist of consumer PC processors and GPUs currently experiencing a broad downtrend. Therefore, it’s anticipated that AMD’s client segment will post a 40% y-o-y revenue decline in the third quarter and further down in the quarters ahead.

Outlook and concerns

Going forward, the perspective that potential enormous growth will stem from the data centre segment. While competing against Amazon, the good news is that AMD has demonstrated strong momentum in this area.

The Q2 net revenue from the data centre soared by 83% from a year ago, with great potential to overtake the gaming segment as the second largest contributor.

Despite of the unprecedented headwind, the company is expecting to post an increase of 29% y-o-y.

That is to say, the chip maker remains on track for solid growth.

While the long-term picture for AMD looks solid, its near-term story is far from perfect.

AMD produces much lower profit margins than its peers. For example, AMD’s net profit margin for Q2 was 14.51%, substantially lower than NVIDIA’s net profit margin of 26.03%.

As profitability is a critical quality that investors carefully check, it will ultimately impact the company's value. Hence, we can see from the third Quarter that the PE ratio for AMD is only 17x versus Nvidia’s 34x.

-

AMD share price

AMD stock is down 60% year-to-date as investors back away from fast-growing semiconductor stocks in the face of inflation. The US government’s chip ban on Russia and China is one of the latest examples of an accelerated decline over the past two months.

From a technical viewpoint, the stock price for AMD is attempting to break through the 20-day moving average while the RSI is leaping from oversold territory. In the case that the earnings manage to satisfy its investors, we should be able to see the price surge to face the key hurdle at $71, which used to be a massive support.

On the other hand, the price may retest $59 if AMD misses the expectation. Bear in mind that the broader trend remains bearish.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now