FOMC meeting preview: 25bp hike expected as the Fed approach terminal rate

The Federal Reserve look likely to raise rates by 25-basis points as markets seek to gauge where the terminal rate is and when we can expect a dovish pivot

Source: Bloomberg

Source: Bloomberg

The FOMC come back into the fold today, with the committee proving their latest monetary policy decision on Wednesday. Coming on a week that also sees the ECB and BoE rate decisions, this promises to be a highlight within a particularly busy period. The two-day FOMC meeting concludes on Wednesday 1 February 2023. This time around, the question for Jerome Powell and co appears to be just how far they would be willing to take this tightening phase before rates halt.

Inflation continues to contract as energy weakens

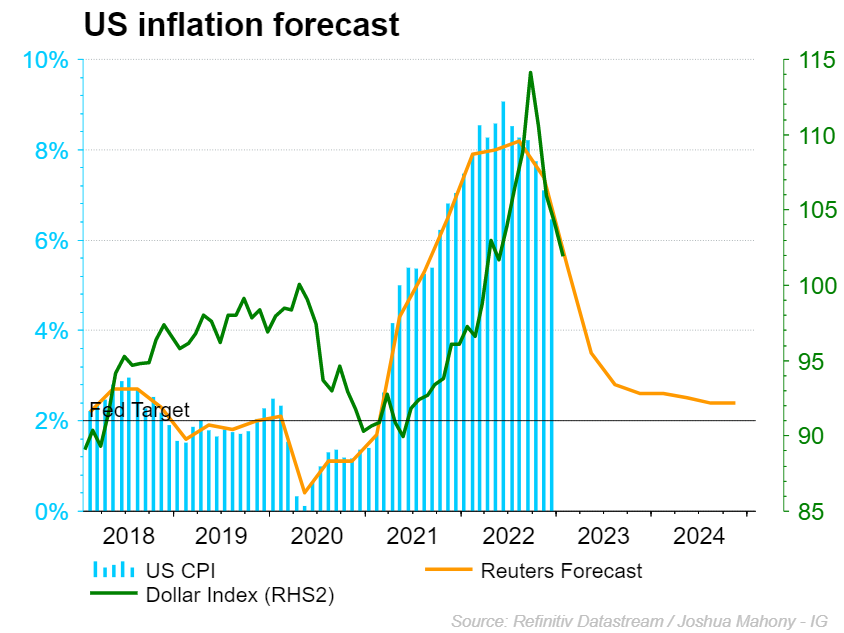

Inflation remains the key concern for the Fed, with the markets keen to understand how their outlook has adjusted as CPI heads lower. The chart below highlights how headline inflation has reversed sharply lower since reaching a 9% peak back in June 2022. The key core PCE gauge favoured by the Federal Reserve has similarly turned lower of late, falling from 5.4% to 4.4% over the past year. However, the ‘sticky CPI’ gauge does highlight ongoing concerns that some members may have, with some underlying price elements failing to reverse as more volatile aspect deteriorate.

Fortunately the recent decline in CPI inflation has been largely in line with forecasts, with Reuters projections signalling the potential for a return to 3.5% in the second quarter of 2023. Meanwhile, year-end CPI is predicted to come in around 2.6%. As we can see from the positive correlation between inflation and the US dollar, a continuation of this decline in inflation would likely result in further weakness for the greenback.

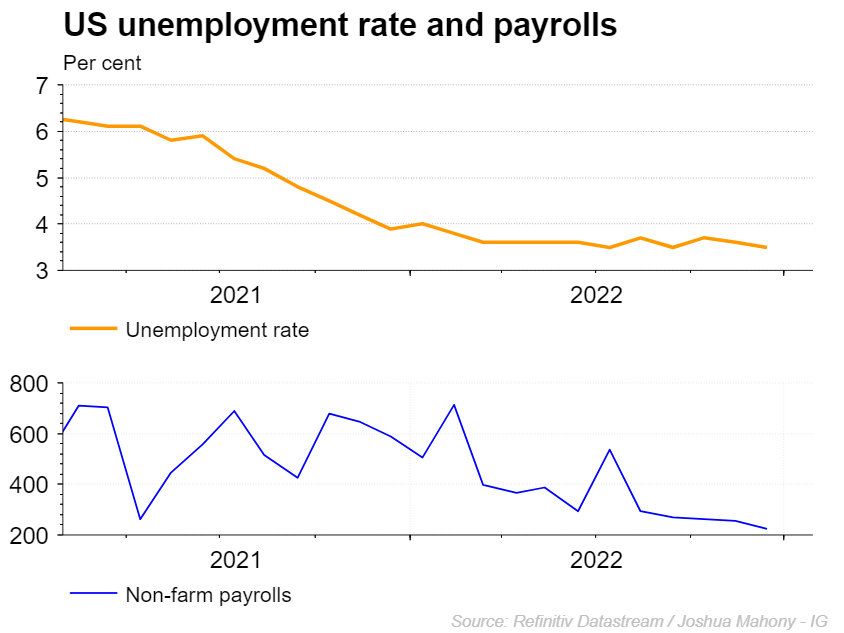

From an employment perspective, we are yet to see any particularly notable surge in unemployment despite concerns that rising rates will put pressure on businesses to cut investment. Non-farm payrolls have been under pressure of late, bringing a gradual decline over recent months. Nonetheless, the payrolls figure remains above the 200k figure despite the recent declines.

What to expect from the Fed

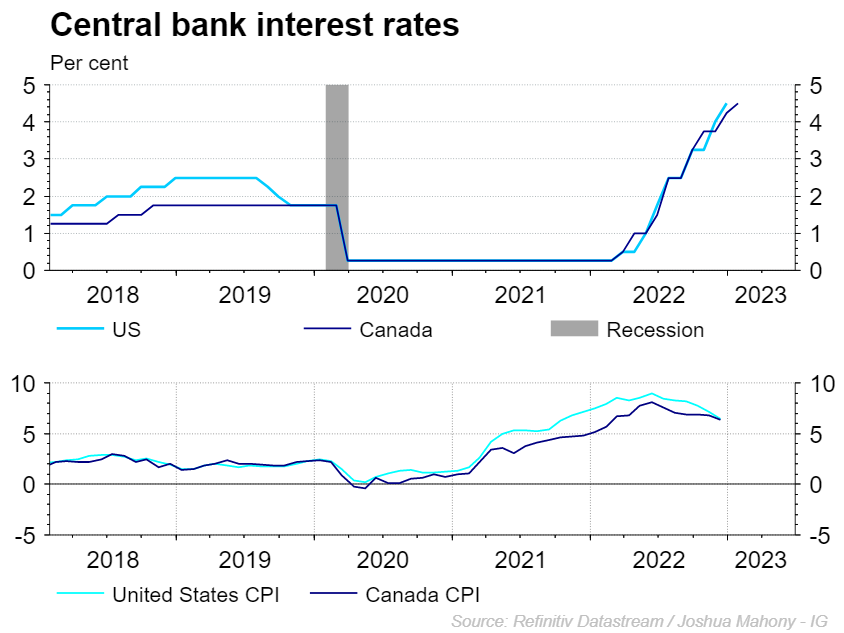

The Federal Reserve are widely expected to bring about a 25-basis point rate hike, bringing the smallest move since the inception of this phase back in early-2022. Market pricing signals a 95% chance of that small move, with a 5% chance that we see another 50-basis point rise. Interestingly, this month has seen the Bank of Canada bring an end to their hiking phase, with the close correlation between both central banks highlighting the fact that the Fed will also soon bring an end to their tightening phase. By and large markets are signalling an expectation for further 50bp upside from here, meaning that March may also see another final push higher for rates.

By and large markets are signalling an expectation for further 50bp upside from here, meaning that March may also see another final push higher for rates. However, traders will be keeping a very close eye on any commentary that better informs us over where rates will stop and enter their so-called ‘terminal rate’.

Source: Eikon

Source: Eikon

That commentary part of the meeting will prove absolutely key, with the recent run higher for stocks signalling that markets believe the downturn in inflation will ultimately provide the opportunity to swiftly pivot back onto a dovish mindset. However, it is likely that the FOMC will guard against this complacency, reiterating that they stand ready to act further if price growth picks up once again.

Dollar index technical analysis

The dollar has been under pressure for much of the past four-months, with price falling back into an eight-month low of late. However, it is worthwhile noting the fact that price has started to pick up steam towards the upside in the lead into this week’s risk events. A break through the 10252 resistance level would signal the beginning of a wider recovery for the pair. However, such a move would likely represent a retracement of the selloff from 10537 should that upside break occur. Nonetheless, it is worthwhile noting the relationship between inflation and the dollar, with further declines in CPI likely to place further pressure on the dollar as long as equities are well supported.

Source: ProRealTime

Source: ProRealTime

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now