Bank of Japan (BoJ) preview: USD/JPY remains in a rising channel pattern

The BoJ is set to hold their monetary meeting across 15 – 16 June 2023, while speculations for a quicker policy shift from the BoJ have not been receiving much validation by policymakers.

Source: Bloomberg

Source: Bloomberg

What to expect at the upcoming Bank of Japan (BoJ) meeting?

Speculations for a quicker policy shift from the BoJ have not been receiving much validation by policymakers thus far, as a continued dovish rhetoric from BoJ Governor Kazuo Ueda has led initial hawkish bets positioned for the new leadership change to fizzle out quickly. Patience is still the takeaway from the Governor’s recent comments to end last week, where he emphasised the need to continue with monetary easing as more work is still needed in attaining its 2% price target in ‘a stable and sustainable manner’.

With that, current rate expectations have remained anchored for a no-change in policy rate for at least the next three policy meetings, with an almost-certain 98% probability being priced for its negative interest rate policy (NIRP) to continue this week. The showdown between bond traders and the BoJ has also fizzled off lately, with bond traders throwing in the towel on challenging Japan’s 10-year bond yield cap at 0.50% since May this year.

Source: Refinitiv

Source: Refinitiv

Pressures for a policy pivot still present, but not yet

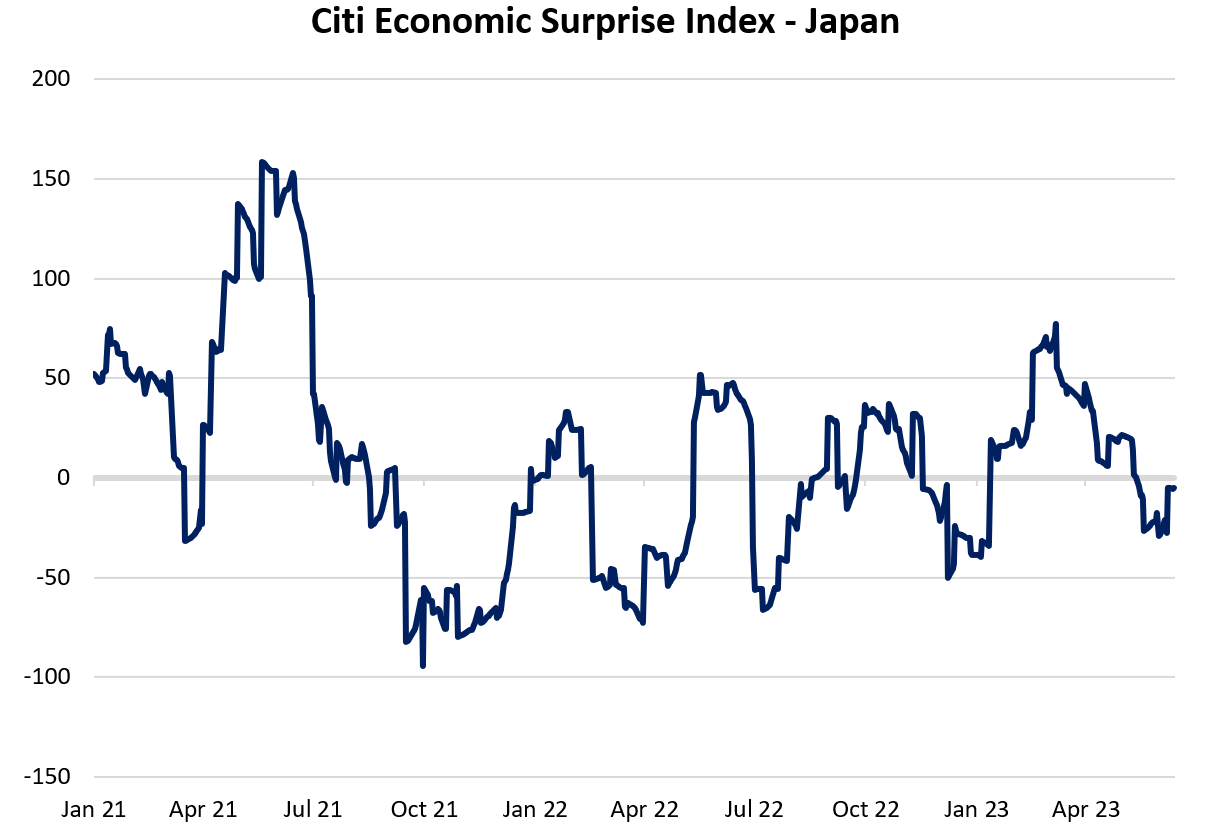

The next set of economic projections will only come during the July meeting, therefore clues on Japan’s growth and inflation outlook will have to be inferred from the Governor’s comments. Thus far, the reopening of borders has been a positive for corporate and household spending, but the strength will have to be pitted against a declining export growth outlook. The 2.6% read for April exports has translated to the weakest gain since February 2021. Overall, the economic surprise index for Japan remains in negative territory, providing some validation for accommodative policies to remain before a more sustained recovery picture is presented.

Source: Refinitiv

Source: Refinitiv

On the other hand, a continued pull-ahead in Japan’s “core core” inflation to more than two-fold its 2% target (4.1% in April 2023) has been constantly looked upon as an argument for a quicker policy shift by the hawks. But with the BoJ setting its sight on wage growth as a factor in its policy decision, a sustained move above the 2% level may be required on that front. Currently, it still sits at a subdued 1% growth, which could be tapped on by the central bank to justify its ‘transitory inflation’ view. Japan's wage dynamics could be due for a change over the coming months, however, with the shunto wage negotiations concluding with a 3.8% pay rise – the highest since 1993. Any uptick in the wage numbers will be one to watch moving forward.

Source: Refinitiv

Source: Refinitiv

USD/JPY: Rising channel pattern in place since the start of the year

The USD/JPY has been trading within a rising channel pattern over the past months, with a reclaim of its 200-day moving average (MA) and Ichimoku cloud resistance suggesting that the bulls are in control. Since May this year, a renewed rise in US Treasury yields has been supporting a widening yield differential with the Japanese 10-year Government Bond (JGB), which aided to uplift the pair to a new six-month high. With the US 10-year yield hovering at its three-month high ahead of the upcoming Federal Open Market Committee (FOMC) meeting, any break to a new higher high may translate to an in-tandem rise in the USD/JPY.

Near-term, recent moves for the pair seem to be in consolidation mode, largely on some wait-and-see as the Federal Reserve’s (Fed) decision looms. The formation of a bullish pennant is still presented however, leaving any break above the pennant on watch to provide further upside to the upper channel trendline resistance next (142.00 level). On the downside, any breakdown of the pennant could leave the 137.00 level on watch for any formation of a new higher low.

Source: IG charts

Source: IG charts

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now