Dow 30: futures slightly lower ahead of impacting items this week

Technical overview remains bullish ahead of the fundamental events, sentiment showing CoT speculators in heavy buy while retail traders are extreme sell.

Source: Bloomberg

Source: Bloomberg

Goldilocks economy narrative aided by data

It was mostly about US pricing data last Friday, with the PCE (Personal Consumption Expenditures) price index showing a year-on-year (y/y) growth of 2.6% for December and a month-on-month (m/m) increase of 0.2%, both as anticipated. When removing food and energy, the growth showed 2.9% and 0.2%, respectively. Personal income for the same month was up 0.3%, but spending was up a stronger 0.7%, with the difference taken from savings and/or added debt. This followed last Thursday’s advance GDP for the fourth quarter of last year, showing a healthier 3.3% with the price index a welcoming miss at 1.5% (Atlanta Fed’s GDPNow estimate for this quarter is at 3%), and durable goods orders in December were unchanged.

It was another week of gains for the stock market, but tech didn’t outperform this time around. As for Treasury yields, they finished the week little changed, while higher in real terms on the further end of the curve, and market pricing (CME's FedWatch) is near a coin toss on cut vs hold this March.

Week ahead: FOMC, labor data, QRA, and more earnings from big tech

As for the week ahead, it’s a light start in terms of data but picks up with housing price data tomorrow (from FHFA and S&P/CS), where it’s been a story of ongoing month-on-month (m/m) and year-on-year (y/y) growth, even if not matching forecasts at times. This comes after the jump in both new and pending home sales readings late last week for the month of December. We'll also see the Conference Board's (CB) consumer confidence, which improved sizably last time, and job openings from JOLTS, which missed for November but are still well above pre-pandemic levels.

The labor market will remain in focus thereafter, with ADP’s non-farm estimate on Wednesday and the employment cost index for the fourth quarter. Both claims and Challenger’s job cuts will be released on Thursday, leading up to the market-moving Non-Farm Payrolls on Friday. Expectations are for growth of over 170K for the month of January, and the unemployment rate to rise a notch to 3.8%, with a focus on whether the divergence worsens between the establishment and household surveys.

Manufacturing PMIs (Purchasing Managers’ Index) will be released on Thursday from both S&P Global and ISM (Institute for Supply Management). Though preliminary figures for the former showed a surprise expansion, the narrative is expected to remain one of contraction only for the latter.

In terms of central bank action, don’t expect any from the Federal Open Market Committee (FOMC) this Wednesday, as they are expected to hold. However, both investors and traders will likely be searching for any clues of a further change in tone after December’s ‘pivot party’.

The earnings front gets serious with tech giants releasing their figures: Microsoft and Alphabet on Tuesday, and Apple, Amazon, and Meta on Thursday. While Nvidia’s figures are still weeks away, we'll have to make do with AMD tomorrow and Qualcomm the day after.

For the bond market, there are the Treasury’s quarterly refunding announcements (with funding details today and the maturity breakdown on Wednesday).

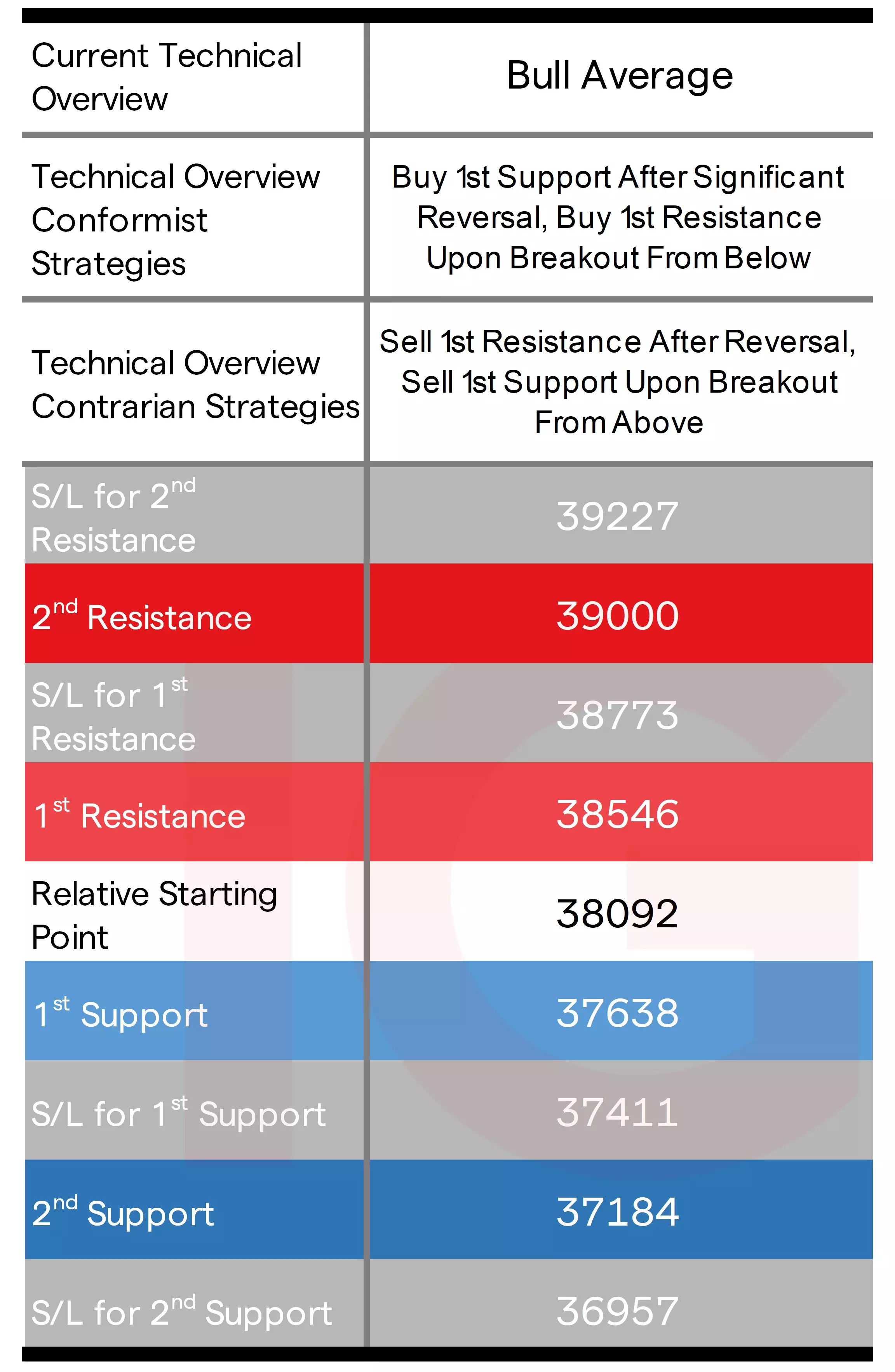

Dow technical analysis, overview, strategies, and levels

The intraweek highs were beneath its previous weekly 1st resistance level and meant a lack of a play on the weekly time frame for conformist and contrarian strategies, but where key technical indicators are still bullish and its overview unchanged as ‘bull average’. As for the daily time frame late last week, Friday's close above Thursday's 1st Resistance level with the intraday highs offering enough for conformist buy-breakout strategies even if it didn't reach its daily 2nd Resistance level, the overview there matching the weekly.

Source: IG

Source: IG

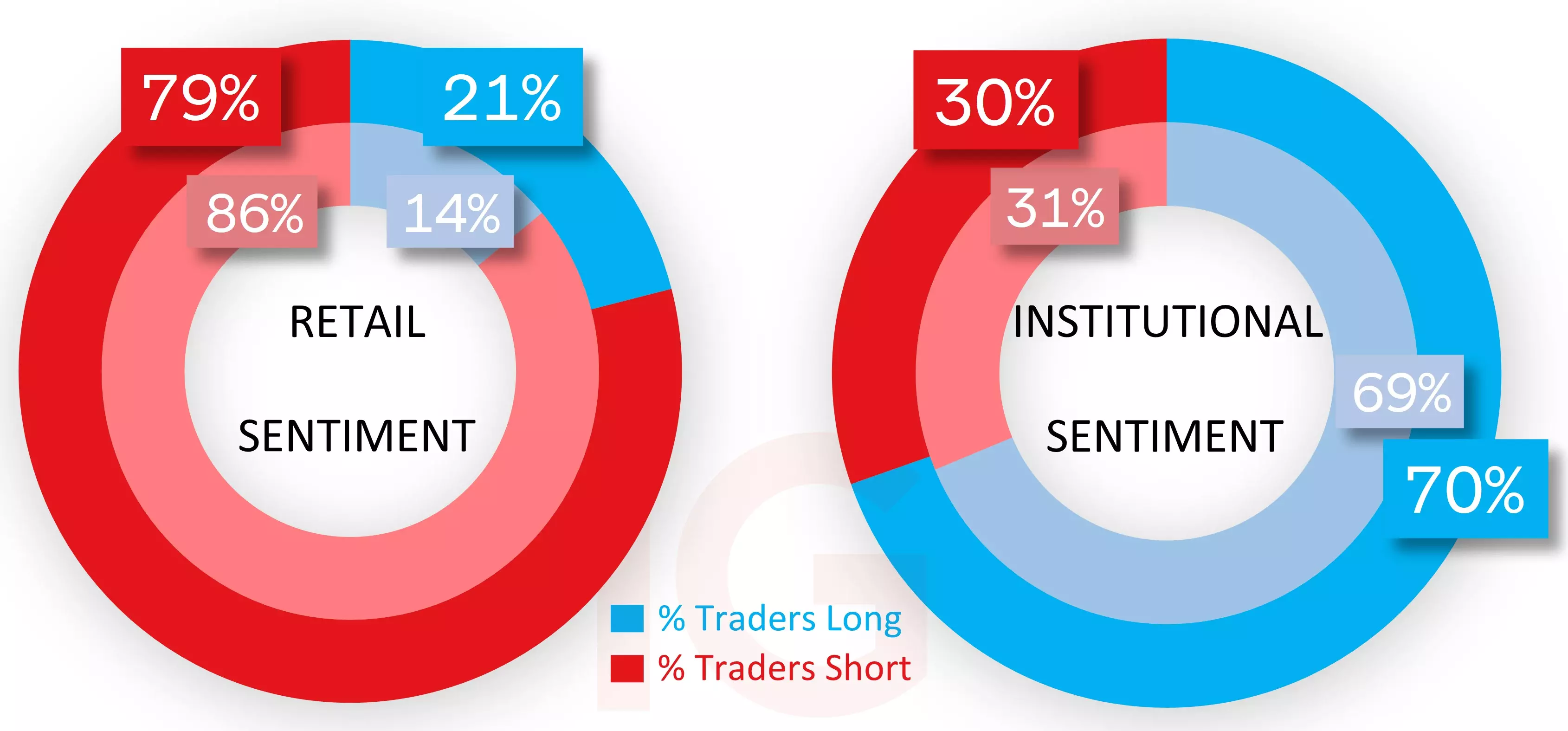

IG client* and CoT** sentiment for the Dow

As for sentiment, CoT speculators are still in heavy buy territory raising it a notch to 70% (longs +262, shorts -516), but still below the majority long sentiment levels witnessed a few weeks ago. IG clients have generally opting not to short into price gains at these levels, and falling back from extreme sell 86% at the start of last week to 79%.

Source: IG

Source: IG

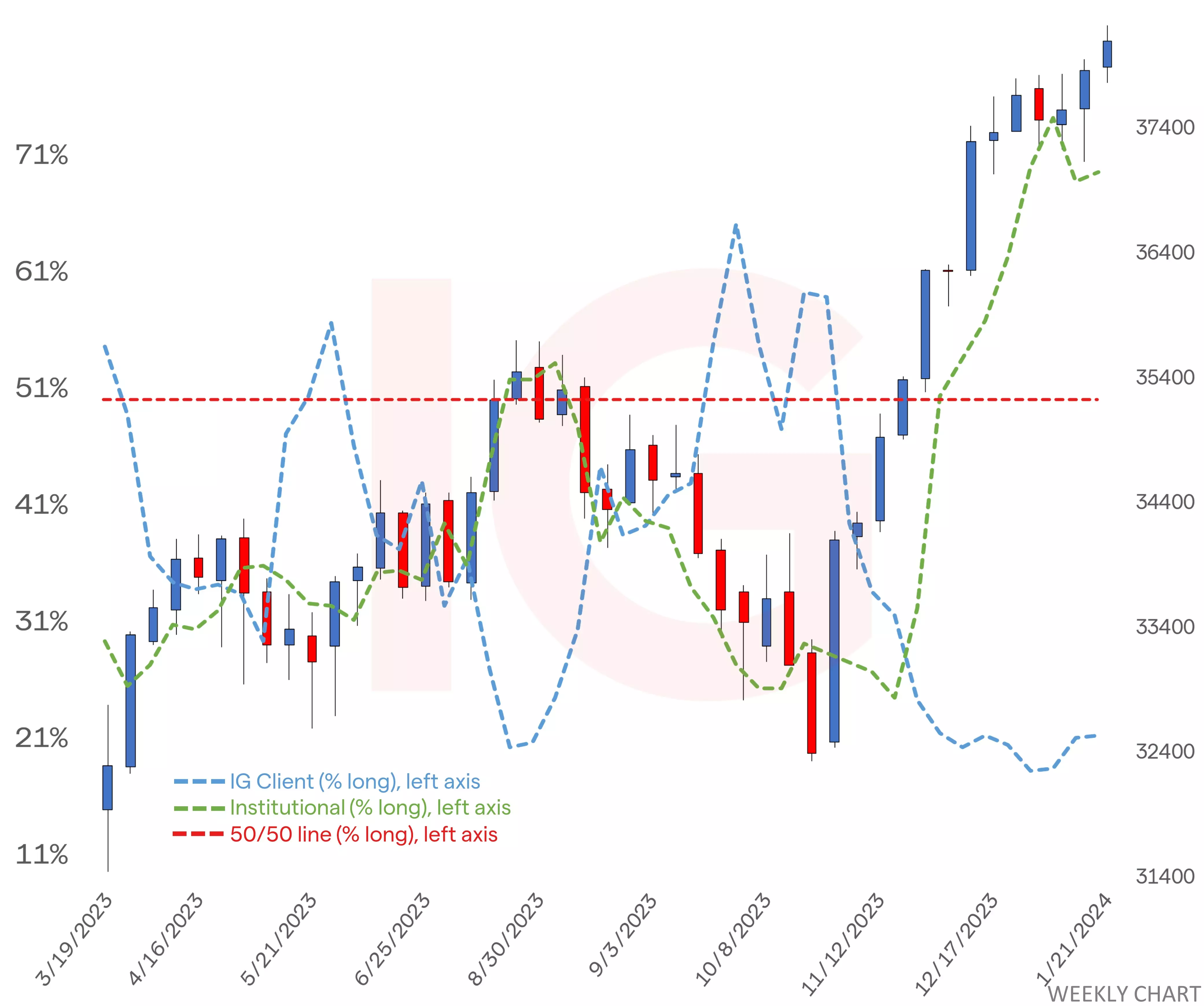

Dow chart with retail and institutional sentiment

Source: IG

Source: IG

- *The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1%, as of the start of this week for the outer circle. Inner circle is from the start of last week.

- **CoT sentiment taken from the CFTC’s Commitment of Traders report, outer circle is latest report released on Friday with the positions as of last Tuesday, inner circle from the report prior.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now