Singapore banks Q1 2024 earnings – Earnings momentum to ease

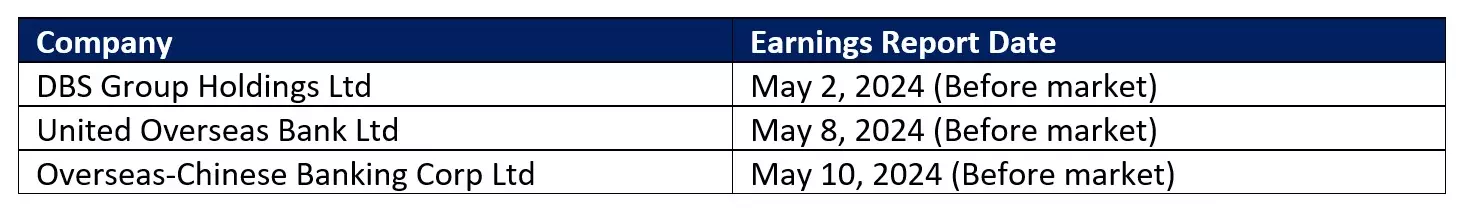

The three local banks are set to report their Q1 2024 earnings over coming weeks.

Source: Getty

Source: Getty

Source: DBS, OCBC, UOB

Source: DBS, OCBC, UOB

The three local banks are set to report their Q1 2024 earnings over coming weeks. Year-to-date, all three banks have outperformed the Straits Times Index (STI), with DBS topping the cohort with a 13.3% gain. This is followed by OCBC (+9.8%) and UOB (+6.9%), which all towers above the STI’s year-to-date return of a mere 1.2%.

Source: Refinitiv

Source: Refinitiv

What to expect for Singapore banks’ 1Q 2024 results

Source: Refinitiv

Source: Refinitiv

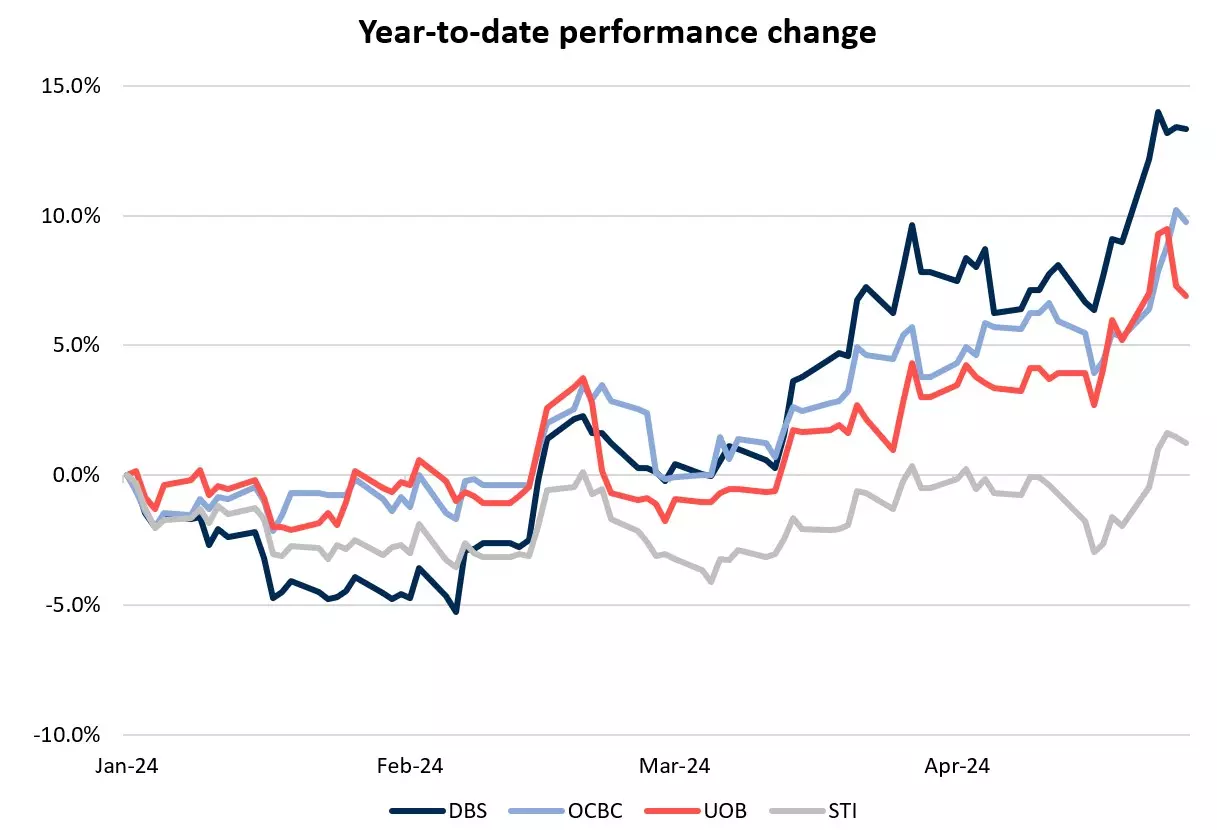

Net interest margin to see further gradual tapering

Despite the series of US economic data calling for interest rates to stay high for longer, markets remain convinced that the Federal Reserve (Fed)’s next move is still a rate cut, which pave the way for Singapore benchmark lending rates to consolidate around current levels over the past months.

Refinitiv estimates suggest that for the upcoming results, the average of the banks’ net interest margin (NIM) could edge slightly lower to 2.13%, down from the 2.15% in 4Q 2023. This is expected to be driven by a decline in NIM for both DBS and OCBC, which could be slightly offset by an uptick in NIM for UOB.

Overall, net interest income for the banks could largely remain flat from a year ago, which may further reinforce views that growth in the segment has peaked. But given the constant pushback against earlier rate cuts from the Fed and room for some downward revision in deposit pricing, the pace of NIM tapering could remain gradual. Market rate expectations are leaning towards having only one rate cut from the Fed this year, down from the three rate cuts priced just a month ago.

Source: Monetary Authority of Singapore (MAS), Banks’ earnings report

Source: Monetary Authority of Singapore (MAS), Banks’ earnings report

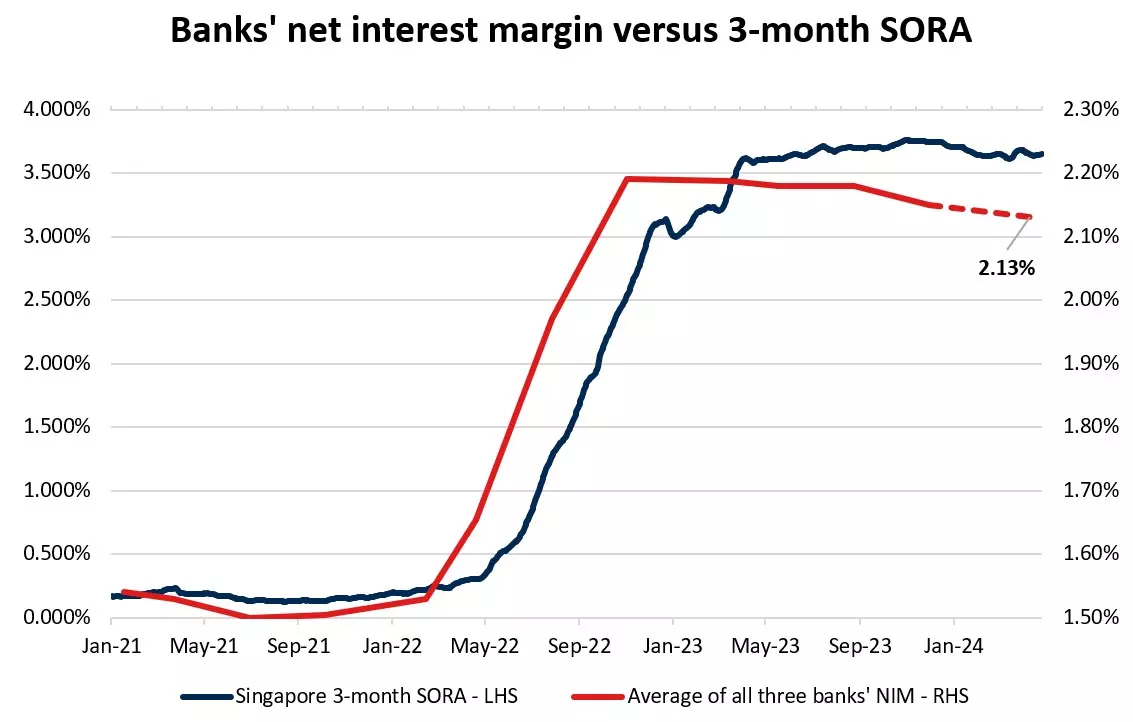

Growth in loan demand may remain subdued

Loan volume in Singapore for January and February 2024 presented a mixed picture, with business lending activities seeing an improvement in recent months, potentially on expectations for improving macroeconomic conditions in 2024.

However, the strength in businesses loan were not mirrored on the consumer loan demand. Consumer loan saw a decline in February 2024 – its first in seven months. For now, overall year-on-year (YoY) loan growth has been in contraction for the past 15 months, albeit some improvement in terms of lesser YoY decline. While further recovery may play out, the pick-up may be gradual, which could keep banks’ loan growth in the low single-digit over coming quarters.

Source: Refinitiv

Source: Refinitiv

Recovery in non-interest income to provide some earnings cushion

However, bright spots should remain in the banks’ non-interest portion, with further broad-based recovery expected in its net fees and commission income. In 1Q 2024, market conditions continue to improve significantly with a risk-on environment in place, which could aid to underpin its wealth management activities.

Expectations are for DBS and OCBC to register a near 7% year-on-year growth in fee income, while UOB may register a 3.5% growth year-on-year. Overall, the recovery momentum in the non-interest portion may help to drive the next stage of earnings growth for the banks, given that their net interest income portion could see some flat-lining ahead.

However, we may expect the banks to exercise some prudence in its loan loss provisions, given the uncertainty around geopolitical developments and economic risks. A build-up in provisions is likely to play out for 1Q 2024 across all three banks, although this is mostly a precautionary measure as credit metrics did not show too much deterioration just yet.

DBS share price: Technical analysis

A successful break above a months-long consolidation in March this year was met with a 16% extension in DBS share price over the past 1.5 month. The broader upward trend remains in place with the formation of higher highs and higher lows, but given the stellar rally so far, the odds for a near-term retracement may be raised. This comes as its daily relative strength index (RSI) trades at overbought levels, with the failure to make a new high potentially leaving a near-term bearish divergence pattern in place.

Any retracement may leave immediate support at the S$34.90 level (recent 25 April low) on watch. Any failure to defend the S$33.90 level ahead may leave the S$32.91 level on watch next for any formation of a higher low to resume the upward trend.

Source: TradingView

Source: TradingView

OCBC share price: Technical analysis

Similarly, the bullish trend in OCBC is reflected in a broad rising channel pattern in place since October 2022. Recent surge over the past week marked an upward break of the channel, with its daily RSI trading firmly above the 50 mid-line as a reflection of buyers in control. While the rally is taking a breather with a slight consolidation over the past days, the formation of higher highs and higher lows keeps an upward trend in place. Any near-term retracement may leave the S$13.92 level on watch, where the upper channel trendline stands alongside a key Fibonacci retracement level.

Source: TradingView

Source: TradingView

UOB share price: Technical analysis

UOB has also managed to break out of its months-long consolidation lately, reflecting buyers taking greater control. While recent days were marked with some breather following its 8% rally over the past two weeks, the broader trend remains upward-bias. For now, its daily RSI is eyeing for a cross back into neutral territory from current overbought levels, with any retracement to leave the S$29.60 level potentially on watch for the formation of a higher low to resume the upward trend.

Source: TradingView

Source: TradingView

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now