Q4 US Reporting Season: earnings expected to contract, but focus remains on guidance

US Reporting Season has begun, and will continue until the middle of February.

The market data that matters:

|

EPS Growth Expected (YoY) |

Revenue Growth Expected (YoY) |

Current Price-to-Earnings |

Est. FY1 Price-to-earnings |

Current Dividend Yield |

|

-9.2% |

-0.6% |

30.7 |

22.9 |

1.53% |

What is the market expecting out of this earnings season?

The markets are expecting another contraction in earnings growth for the quarter, as corporate profits continue to feel the effects of the Covid-19 recession. Entering into earnings season, market consensus was projecting a year-over-year in earnings of 9.4%, according to data compiled by financial data company FactSet. If another quarter of negative earnings growth were to materialize, it would mark the 5th out of the last 6 reporting periods in which earnings contracted, despite the S&P500 continued to push to fresh record highs.

What are ther key themes to watch out of earnings season?

Will guidance reaffirm lofty stock market valuations?

With expectations that earnings ought to contract for another quarter, the key issue for market participants this reporting period will be whether companies deliver guidance that reflects the positivity currently baked into prices. In a bullish sign for market fundamentals, profit estimates began an upgrade cycle in the last quarter, as market participants factored in greater optimism about the economic outlook going into 2020. Even still, valuations remain very high across the S&P500, with the trailing price-to-earnings ratio historically elevated above 30 – a level not seen since the Dot.com boom and bust.

What impact will fiscal stimulus and vaccines have on profits?

The upgrading cycle for corporate profits has come as a result of two macroeconomic factors: the roll-out of multiple Covid-19 vaccines in the US, as well as the deluge of fiscal stimulus coming from US President Joe Biden’s administration. The dynamic has sparked the so-called “reflation trade”, which has seen stocks sensitive to the business cycle outperform the market. Confirmation from company’s that they see a material pick up in profits owing to the vaccine and stimulus ought to buoy markets, who are positioned for a big uptick in economic activity this year.

Which sectors will lead and lag?

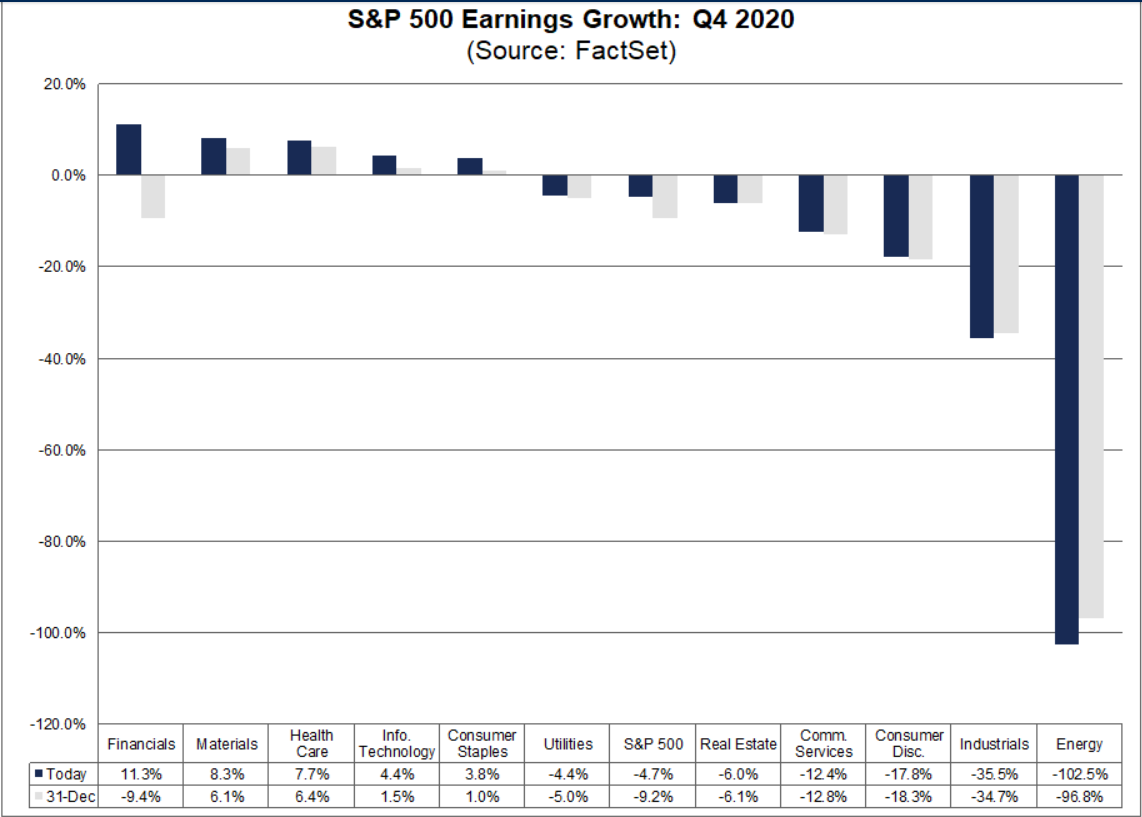

As investors position for an uptick in the global business cycle, the performance of cyclical sectors this earnings season will be closely watched. According to FactSet, the materials sector is set to deliver closer to market-leading earnings growth for the quarter, aided by the recent recovery in global commodity prices. Previous market leaders in the health care and IT sectors, which outperformed the market last year, are also expected to deliver positive earnings. On the side of the equation, some areas of the market sensitive to economic growth are expected to show considerable falls in EPS: the industrials and energy sectors ought to perform the worst this reporting period.

Source: FactSet

Source: FactSet

How could this earnings season impact the financial markets?

Earnings season is already delivering considerable upsize surprises for the market, as company profits recover and valuations experience an upgrade cycle. There is tremendous optimism in the markets right now, with market participants taking on risk to position for an economic recovery driven by vaccine developments and fuelled by a stimulus. Despite calls of complacency amongst investors, the trend for the S&P500 looks skewed clearly to the upside, albeit with the momentum that’s slowing down marginally. Continued positive surprises from S&P500 companies ought to support the index’s rise, as it continues to clock-up fresh record highs.

Kyle Rodda | Market Analyst, Australia

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now