Nuclear resurgence and fresh fund demand could see uranium stocks power up

Uranium expected to join energy price surge, amid growing support for fresh infrastructure builds as funds bring fresh sources of investor-driven physical demand.

Source: Bloomberg

Source: Bloomberg

Uranium prices on the rise as energy crisis brings nuclear back to the table

Nuclear has fallen out of fashion over the years, with crises like Fukushima doing little to help the image of this energy source.

However, that outlook appears to be shifting as fossil fuel sources of energy surge in price and renewables fail to provide a viable alternative to fill the gap in the short-term.

China provides one example of a country struggling under the weight of rising coal prices and commitments to keep emissions down. The lack of new investment in fossil fuel-based energy sources does bring a risk that prices will remain elevated for some time yet. With that in mind, it should come as no surprise that we are starting to see a shift in the outlook for nuclear.

The new Japanese PM comes in with a pro-nuclear policy, bringing a heightened chance that we will see the country bring fresh demand to the table for uranium.

Meanwhile, Emmanuel Macron has set out plans to "re-industrialise" the French economy with a €30 billion spending plan that includes the building of small nuclear reactors over the next five years. An alternate source of demand comes from the recent Sprott Physical Uranium fund, which has been buying huge swathes of the commodity thanks to its pledge back investment in the fund by buying the material.

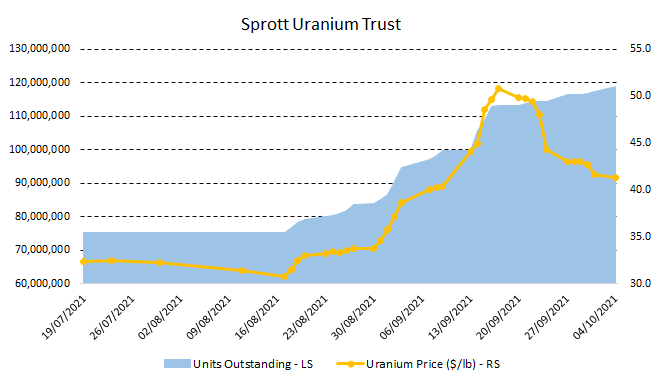

As we can see below, the Sprott Uranium fund has ramped up purchases since its inception back in August. While that rise in Sprott purchases initially helped lift uranium prices back in August, the pullback seen over recent weeks came despite an ongoing rise in Sprott holdings.

Source: SUT

Source: SUT

Interestingly, we have seen yet another source of demand emerge today, with the world's largest uranium miner forming a fund for investors to gain exposure to the space.

Kazakh firm, Kazatomprom, has formed another Physical Uranium Fund, named "ANU Energy," providing investors with a vehicle with which to partake in the expected rise in uranium prices going forward. The “fund will be operating in an environment of tightening supply, driving positive benefits for its stakeholders”.

Thus, at a time when we are seeing the world shift back towards uranium use, there are multiple funds vying for that same material simply to stockpile thanks to market speculation. On the supply-side, it is worthwhile noting that while uranium is far from scarce, a shift in the demand outlook will not necessarily result in a jump in production.

The current price of uranium is widely considered too low to incentivize new investment in the sphere. Instead, analysts are talking of a price closer to $70-90/lb needed for producers to bring new mines into production.

Without renewed investment, it seems likely that the gradual deterioration of existing mines will drive supply lower over time. Clearly higher production could be required, yet it may take prices double where we currently are to bring about that investment.

Source: TradingView

Source: TradingView

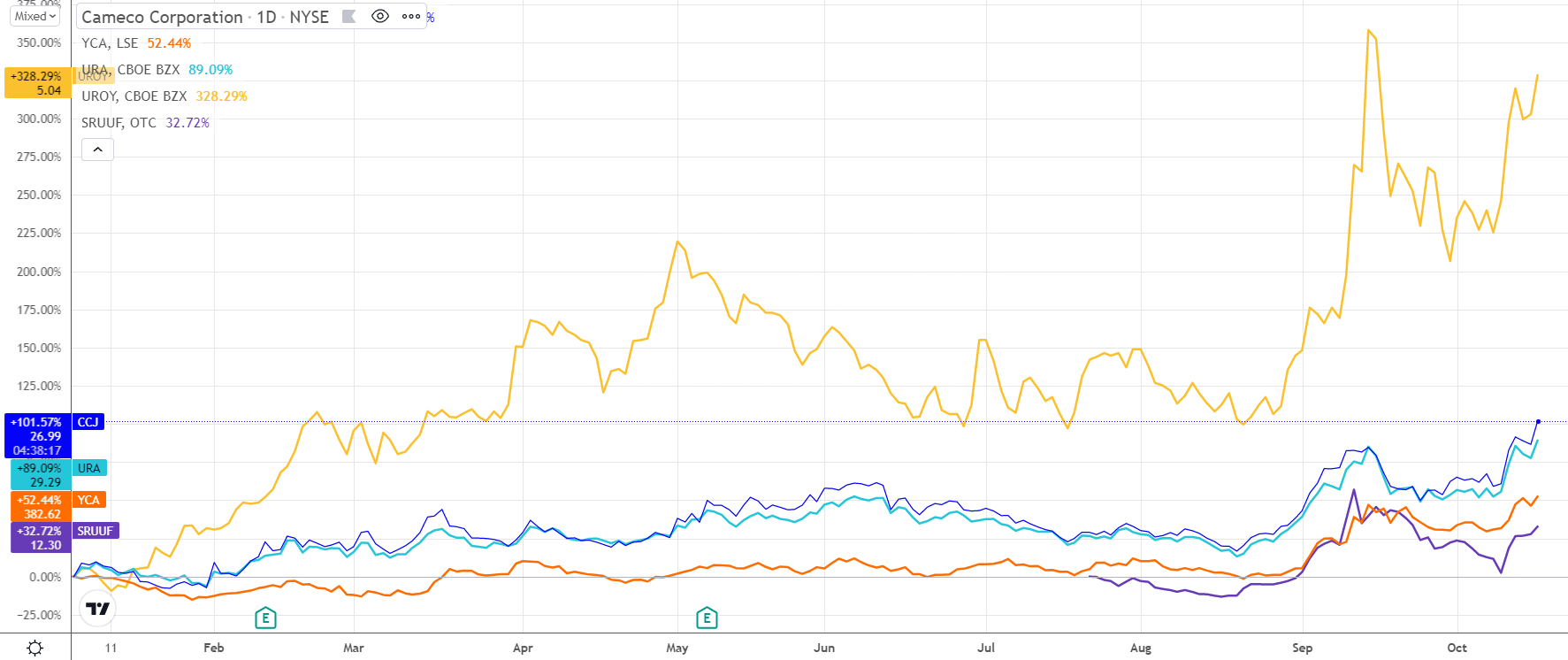

There are plenty of ways to play uranium, from miners, to ETFs.

Yellow Cake provides UK investors with exposure to uranium prices, with the firm operating a buy-and-hold strategy that offers “direct exposure to the spot uranium price without exploration, development, mining or processing risk.” That is a similar strategy to the Canadian SPROTT fund, and Kazatomprom’s ANU energy Fund.

Those looking for something with more variables to consider than simply the price of uranium, miners present an alternate avenue to enter the space. Cameco are one of the biggest in the world, with a ramp-up in prices likely to benefit the stock.

However, it is worthwhile noting the fact that many firms need substantially higher prices to bring major expansion in operations. Plus you have the risk associated with operations and exploration.

Uranium Royalty Corp makes money by financing operations and exploration for uranium companies, with royalties being paid on future production.

Global X Uranium ETF provides access to a whole broad range of companies involved in uranium mining and the production of nuclear components, including those in extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries. The chart below highlights how some of those stocks have been faring over the course of 2021 thus far.

Source: TradingView

Source: TradingView

-

1

1

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now