How Do You Trade Crude Oil?

Jan 18, 2022

By:Frank Kaberna, tastytrade

To many, crude oil trading looks like the wild west: it’s a singular marketplace lacking diversification seen in other risk-on markets like equities; its traditional futures products can swing $1,000s per day; and the energy source’s options boast twice the volatility of the S&P 500.*

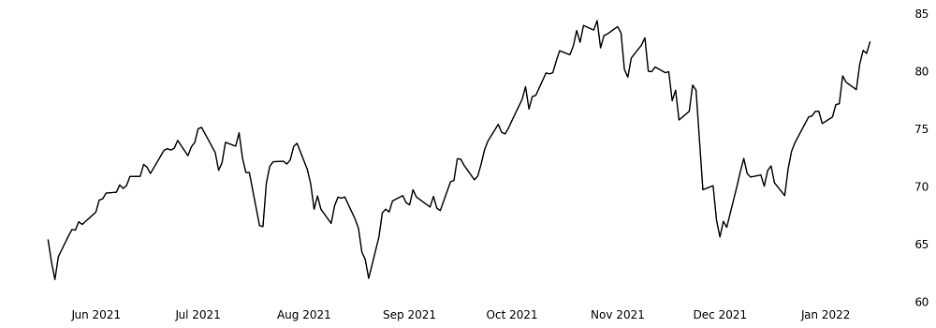

/SMO \ Small Crude Oil Futures

Source: dxFeed

With all of that being said, it’s still one of the most popular assets among active traders in derivatives markets. How do they trade it?

Mean Reversion in Crude Oil

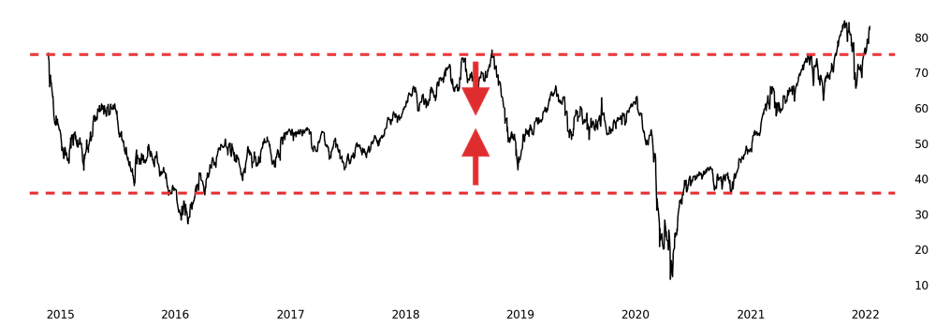

The uniformity crude oil presents makes for a great case study in mean reversion. Several years ago, the same standard barrels of crude oil were trading around between $35 and $75. When they journey outside of those bounds is when contrarians tend to jump in.

Crude Oil for Contrarians

Source: US Energy Information Administration

They sell crude oil when it reaches rarefied air, and they buy it when it’s bottoming out. Though this looks relatively simple given the historical chart, patience and small size is key to withstand the turbulence outside the average range.

Trend Following in Crude Oil

The flip side of patience for a contrarian is quickness for a trend follower. Since crude is a volatile, singular market, it does tend to run in the short term when it reaches its historical bounds.

SMO \ Small Crude Oil Futures

.png)

Source: dxFeed

They ride crude oil in whatever direction it’s headed as it moves through outlier areas. For example, buying /SMO when it hit $80 would have been a great trend-following trade, but being nimble is essential to miss large reversals like the one crude saw just a few months ago.

So who’s strategy is the right one? That’s up to you! One of the best parts of trading is that both sides can be profitable. A contrarian can sell to a trend follower as crude moves higher, the trendian can get out for profits $1 higher, and the contrarian can hold for profits after the reversal. Which side are you on?

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now