NFP preview: Omicron wave cresting

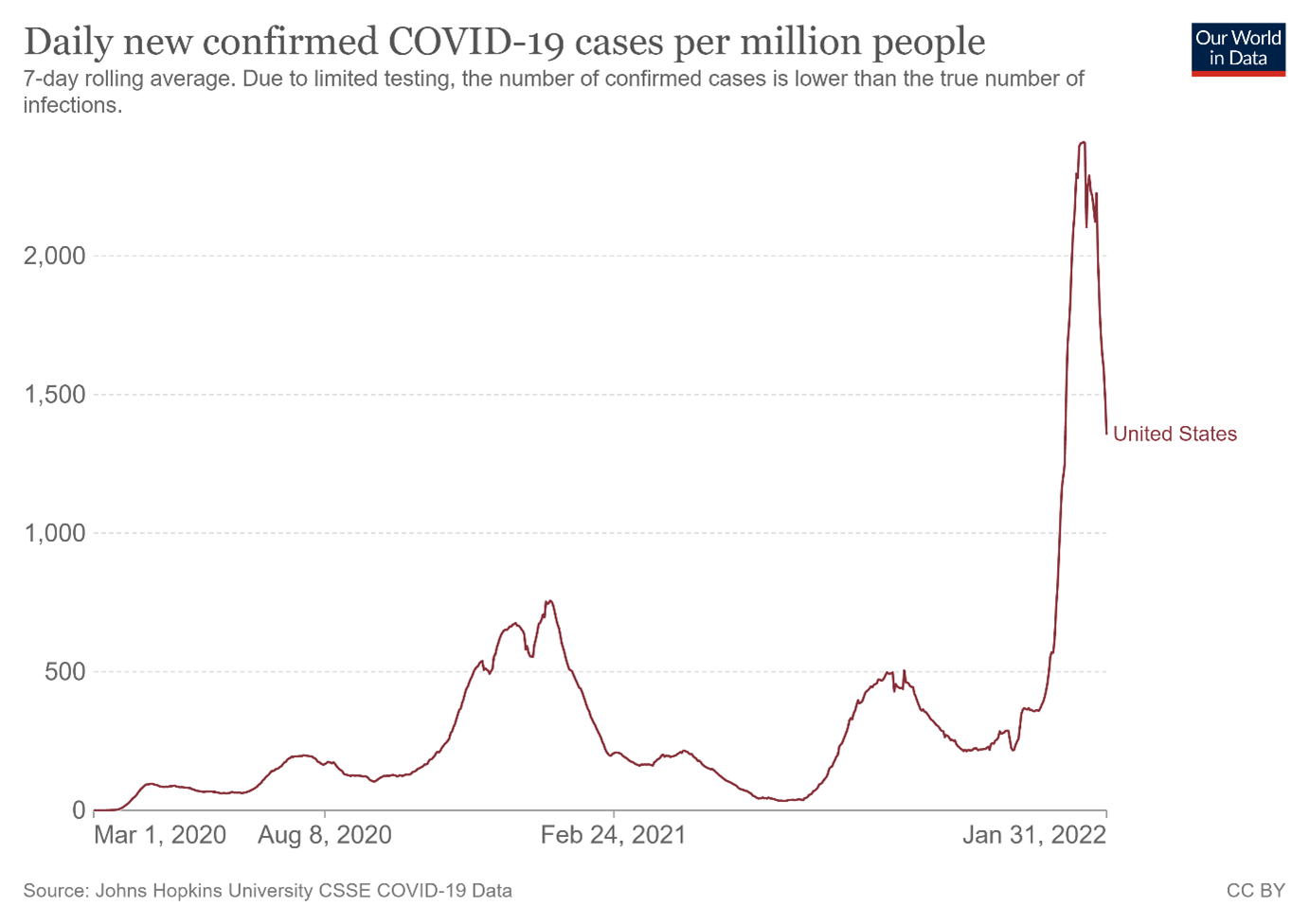

The Omicron wave in the U.S. has begun to crest. How will that affect the upcoming NFP report?

Source: Bloomberg

Source: Bloomberg

The non-farm payrolls report is scheduled to be released on Friday, 4 February.

Given the slow but steady decline of Omicron’s impact in the US, as evidenced by a decrease in the number of new cases, this is likely to lead to a more comparatively favourable non-farm payrolls (NFP) report.

The earlier NFP report captured the first two weeks of December, which caught data before the surge in Omicron cases in the latter half of December.

Source: John Hopkins University

Source: John Hopkins University

Source: Trading Economics

Source: Trading Economics

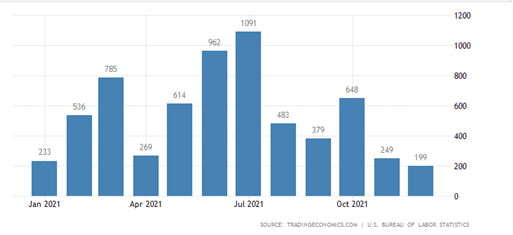

Therefore, current consensus NFP projections for January are slightly lower than projections for December, as January saw a peak in cases (which are currently dropping). January projections come in at 153 000 cases versus 199 000.

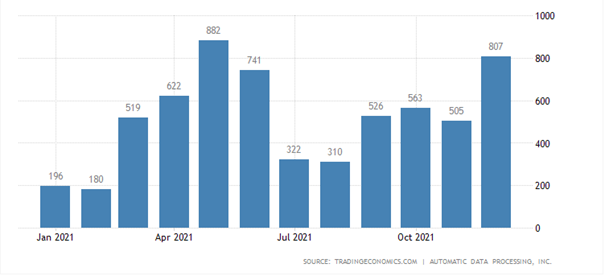

ADP-payrolls, due to be released February 2nd, closely track official NFP figures and are currently projected to come in at 207 000. A decline in consensus estimates mirrors the downward revision we saw in the consensus NFP figures.

Source: Trading Economics

Source: Trading Economics

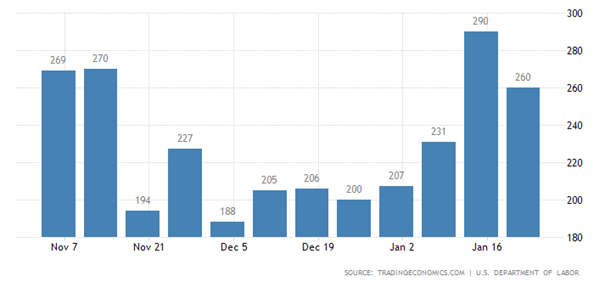

Weekly released initial jobless claims serve as an excellent gauge to infer potential monthly NFP figures. The weekly frequency provides an insightful glimpse into the final jobs report.

Source: Trading Economics

Source: Trading Economics

Analysing initial claims figures demonstrates a correlation between the declining COVID-19 cases and the drops in initial jobless claims. Consensus estimates for initial jobless claims are at 245 000, a lower number than the prior week’s 260 000 as COVID-19 cases drop.

Source: Trading Economics

Source: Trading Economics

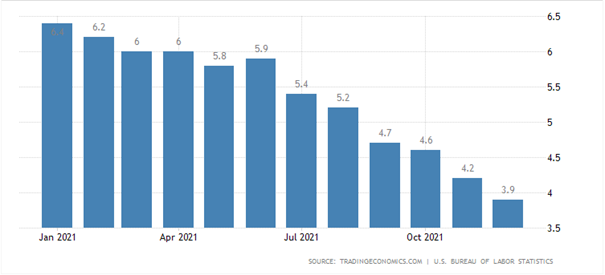

The consensus unemployment rate for January is set to be at 3.9%, which is not too far from December’s consensus figure at 3.9%.

Considering weekly unemployment claims are moving higher due to the Omicron surge, the unemployment figure could stay at 3.9%. This is still slightly short of the pre-pandemic low of 3.5%.

If actual results come out better than expected, this would cause tremendous short-term volatility in markets. It would also further strengthen hawkish interest rate expectations and lead to quick downward pressure in broader market indices.

Given that we are still in an earnings season, this could present an excellent buying opportunity for those wishing to find attractive entry points in indices. Daily support and resistance levels could be used to find good entries.

Source: ProRealTime

Source: ProRealTime

The 14 500 level could be a good entry point for the NASDAQ 100 index. Furthermore, traders could utilise the VWAP, for more short-term intraday swings in order to find entry points.

VWAP is calculated on an intraday basis so traders would have to watch where the VWAP is as the data is released.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now