IG Community Top Contributors Competition

Hello IG Community,

We are excited to announce that the community will be running a Top Contributors Competition which will be starting on the 1st June 2022 and ends 30th June 2022. We are giving away great prizes to be won for our top 3 contributors which will be awarded at the end of the month and we’ll be announcing the winners.

How does the competition work?

The rules are we will be selecting our top 3 contributors on the IG community based on both the quantity and quality of their posts. This means the winner won’t necessarily be the person who posts the most messages, but someone who has really helped to bring the community to life by responding to other community members and bringing up relevant trading markets topics of discussion.

Ways to increase your chances of being Contributor of the Month

- Posting quality content across a broad range of topics on the forums.

- Helping others, as well as giving and receiving ‘Accepted Solutions’ and ‘Likes’.

- Asking questions to IG Community, submitting feedback to IG, and generally getting involved!

This giveaway is open to every community member!

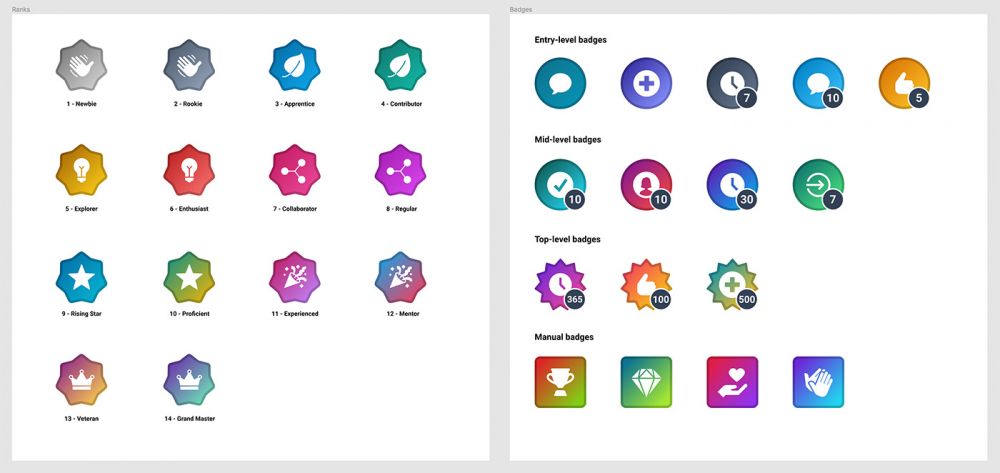

For a start you can simply post something on this blog on the comment section and reply to this post with your story on your experience with trading and stand a chance to win as the community top contributor. Post on the community forums as well on trading related discussions following the competition and community guidelines. The winner will also have the 'Contributor of the Month' badge added to their profile and a special icon next to your name for the proceeding month so all Community members are aware of your contributors.

Our top 3 contributors will receive ProRealTime for free for a full year!

If you're new to IG Community, or trading in general, it may be daunting to post trade ideas and market discussion. It is not too late to join the competition to stand a chance to win. Here are some great tips on how to get started and be ready for the competition:

- Introduce yourself to the IG Community and tell us your experience so far as a new trader.

- Submit feedback on IG's offering (e.g. feedback on our platform, apps, deal execution etc.)

- Ask any number of questions you like (e.g. how to trade, how to use certain features etc.)

Want to be featured in the next Community newsletter? How it works:

To be featured: Your forum posts can include the financial markets and marco-economic news announcements, trading strategies, technical analysis and charting, and our platform’s features on the community forums.

Read our Community guides and submit your posts. https://community.ig.com/community-guidelines/

If you have any questions, feedback or suggestions, submit your comment we would love to hear from you. Thank you very much for sharing your valuable & useful feedback. There is also a dedicated forum to share, visit and click this link: Want to be featured in the next Community newsletter. Here at IG we want to make sure your suggestions or feedback help shape the future of the Community and future newsletters.

Like, share, comment and WIN!

Whether you’re new to trading, or you’ve been doing it for a long time now, there must be something you love about trading to discuss about on the community and also to help and assist your fellow community members who are seeking for answers to their questions! So go ahead and share your posts with us and the community. Follow the leaderboard to track your progress daily and weekly https://community.ig.com/leaderboard/ example below:

We are also interested to hear from you on what other prizes would you like to stand a chance on winning for future Community competitions, comment and give us feedback on this blog below in the comment section.

If you have any questions please ask. We are looking forward to the forum posts and good luck!

All the best - MongiIG

The competition is subject to our Terms and Conditions which apply.

-

2

2

1 Comment

Recommended Comments

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now