Post-Fed rally brings new higher high for S&P 500: S&P 500, Singapore Blue Chip, US Dollar Index

The conclusion of the Federal Open Market Committee (FOMC) meeting overnight saw an expected 75 basis-point (bp) hike to a range of 2.25% to 2.5%, which was in line with market expectations.

Source: Bloomberg

Source: Bloomberg

Market Recap

The conclusion of the Federal Open Market Committee (FOMC) meeting overnight saw an expected 75 basis-point (bp) hike to a range of 2.25% to 2.5%, which was in line with market expectations and hence, there was a general muted reaction when the hike was confirmed. That said, markets were able to find relief on Fed Powell’s comments on the moderation of interest rate hikes at some point and while that should be expected as well from the pricing in the Fed funds futures, bringing it up at its latest meeting seem to suggest that some consideration is in place it may come sooner rather than later. With that, market pricing for rate hikes saw a leaner shift towards a 50 bp hike in the September meeting with a 68% probability, and the August’s Jackson Hole Symposium will be an event to watch for policymakers’ update on its tightening path. Policy guidance on a meeting-by-meeting basis also reinforces the importance of upcoming economic data, where an underperformance in inflation readings and resilient economic conditions are needed to reassure markets that another massive 75 bp hike is unwarranted.

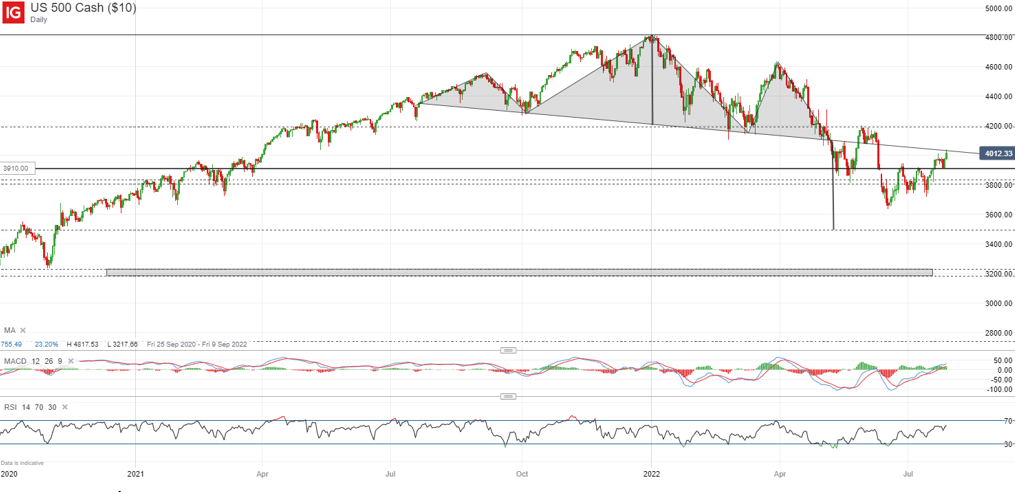

Fed Powell also pushed back against the risk of recession in US, fuelling market hopes of a potential soft landing, although the ongoing inversion of the US 10-year/2-year Treasury spreads seem to suggest that such risks remain prominent. Nevertheless, these catalysts provided much for markets to tap on for a continuation of its recent rally overnight, with the S&P 500 finding a new near-term higher high and back to retest a previous neckline resistance of a head-and-shoulder pattern. The day ahead will put the recession narrative to the test, with the release of the advance estimate for US second-quarter gross domestic product (GDP). Expectations are for a 0.5% expansion, with any significant downside surprise on close watch.

Source: IG Charts

Source: IG Charts

After-market, the corporate earnings front saw another top and bottom-line misses from Meta Platforms, which marks its first ever quarterly drop in revenue. Its guidance suggests that it could be a longer-lasting trend, with forecast pointing to a potential second year-on-year (YoY) revenue contraction in quarter three. Instagram Reels offering, which competes with TikTok, also risk having its growth displacing other higher-monetising content and that was flagged as a headwind for profits through 2022. Apple and Amazon's earnings will be on watch tomorrow. Jointly, they account for around 11.2% of weightage in the S&P 500.

Asia Open

Asian stocks look set for a positive open, with Nikkei +0.54%, ASX +0.78% and KOSPI +0.94% at the time of writing. The day ahead will leave the Asian markets to tap on the positive handover from Wall Street for some relief, while putting some focus on a talk between President Joe Biden and President Xi. Tensions over Taiwan, the Ukraine war and managing competition between the two global superpowers are key topics of discussion, but markets may have their eyes on any hints of progress on the lifting of US tariffs on Chinese goods. While a concrete decision on that front is not expected from the meeting, any indications of willingness in working towards that is an added positive for markets.

With corporate earnings in focus, Samsung Electronics rode on robust data centre demand to report a 12% rise in quarterly profit. Guidance, however, suggests that macroeconomic uncertainties persist into second half (H2). This is seemingly in line with Qualcomm's quarter four forecast overnight, which came in below estimates with slowing smartphone demand as the key risk. Closer to home,UOB earnings will be released tomorrow before market opens. A catch-up in net interest margin could aid to cushion a potential moderation in wealth management income. Loan demand in quarter two could remain resilient from recent bank lending data but overall outlook will be in focus as well.

Having broken out of a descending wedge pattern over the past two weeks, the Singapore Blue Chip Index is heading to retest its two-month high. The formation of a higher low provided an upward bias for now, as the index attempts to push above a bearish pin bar formed on Monday. The 300.00 level will be on close watch next.

Source: IG Charts

Source: IG Charts

On the watchlist: US dollar index back to retest lower base of consolidation zone post-Fed meeting

An expected 75 bp hike from the Fed and comments about the moderation of interest rate hikes at some point are in line with market expectations and should not be overly alarming, but the absence of any hawkish surprise may be driving some sell-the-news in the US dollar index overnight. On the four-hour chart, the index continues to trade within a consolidation zone over the past week, with yesterday’s sell-off bringing another retest of the lower base of the range at the 106.00 level. For now, the overall upward trend for the US dollar still remains intact, with any breakdown of the 106.00 level potentially leaving the 105.10 level on watch next. That will be a key support in focus, considering that it marks a confluence of a longer-term upward trendline and a key 50% Fibonacci level.

Source: IG Charts

Source: IG Charts

Wednesday: DJIA +1.37%; S&P 500 +2.62%; Nasdaq +4.06%, DAX +0.53%, FTSE +0.57%

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now