American Airlines: what to expect from Q4 results

Find out what to expect from American Airlines earnings results, how they will affect American Airlines share price, and how to trade American Airlines earnings.

Source: Bloomberg

Source: Bloomberg

When is the American Airlines results date?

American Airlines Group is set to release its fourth quarter figures on the 26th of January.

American Airlines share price: forecasts from Q4 results

And it’s been two consecutive quarters of positive earnings per share (EPS) readings after what were negative prints prior dating back to the start of the pandemic.

Initial hopes were that they’d be able to stay in the green, and the release late last week that the airline boosted revenue and profit estimates for the fourth quarter thanks to both higher fares and strong demand was no doubt a welcoming sight that boosted its share price sizably.

The sector is cyclical in nature and hence suffered outflows alongside plenty of other cyclicals when recessionary fears increased, but reopening and the increased demand for travel as consumption focus shifts have both been seen as positive. Energy prices have averaged lower in the past quarter an added boon in terms of costs, though are much higher in annual terms and the airline avoiding fuel hedging is positive when prices drop relative to others utilising the expensive practice.

There’s also the matter of managing its massive debt load – the largest amongst all US airlines – in what is a capital-intensive sector already leveraged due to the pandemic, and in a time of rate rises and a more difficult refinancing environment. Any excess liquidity is unlikely to be used to repurchase shares and instead of repaying debt early where possible as they did last month given focus will be on the airline’s debt this year, its former CFO Derek Kerr said that debt reduction “continues to be a top priority”.

Managing costs be it energy, personnel, and also capital will be noted, as how demand has fared and what factor weather has impacted their figures, and so too their expectations of travel demand, as they anticipate a 10% increase in their unit costs excluding fuel and at the higher end of their previous 8-10% forecast.

Rival Delta Air Lines released its earnings last Friday, and it managed to best both revenue and earnings estimates but suffered a drop in its share price on a weaker outlook for this quarter.

Expectations for American Airlines – according to their filing – is that we’ll get an adjusted EPS figure between $1.12 and $1.17, far higher than what we saw in its third quarter 2022 release and opposite losses suffered for the same period a year prior. It’s also double the expected $0.58 before the revisions (source: Refinitiv).

Revenue is expected to be closer to $13 billion, with American forecasting it could be higher having raised their expectations for revenue per seat mile.

As for analysts’ recommendations (source: Refinitiv), a clear majority have opted for a hold (15) with one each in buy and strong buy territory, and a similar story on the other end with two at sell and one and strong sell. In all, it marks a significant change from what we saw a couple of years ago when it was a majority sell. In terms of their price targets, the average is below its current share price after the gains last Thursday.

American Airlines weekly chart with key technical indicators

Source: IG

Source: IG

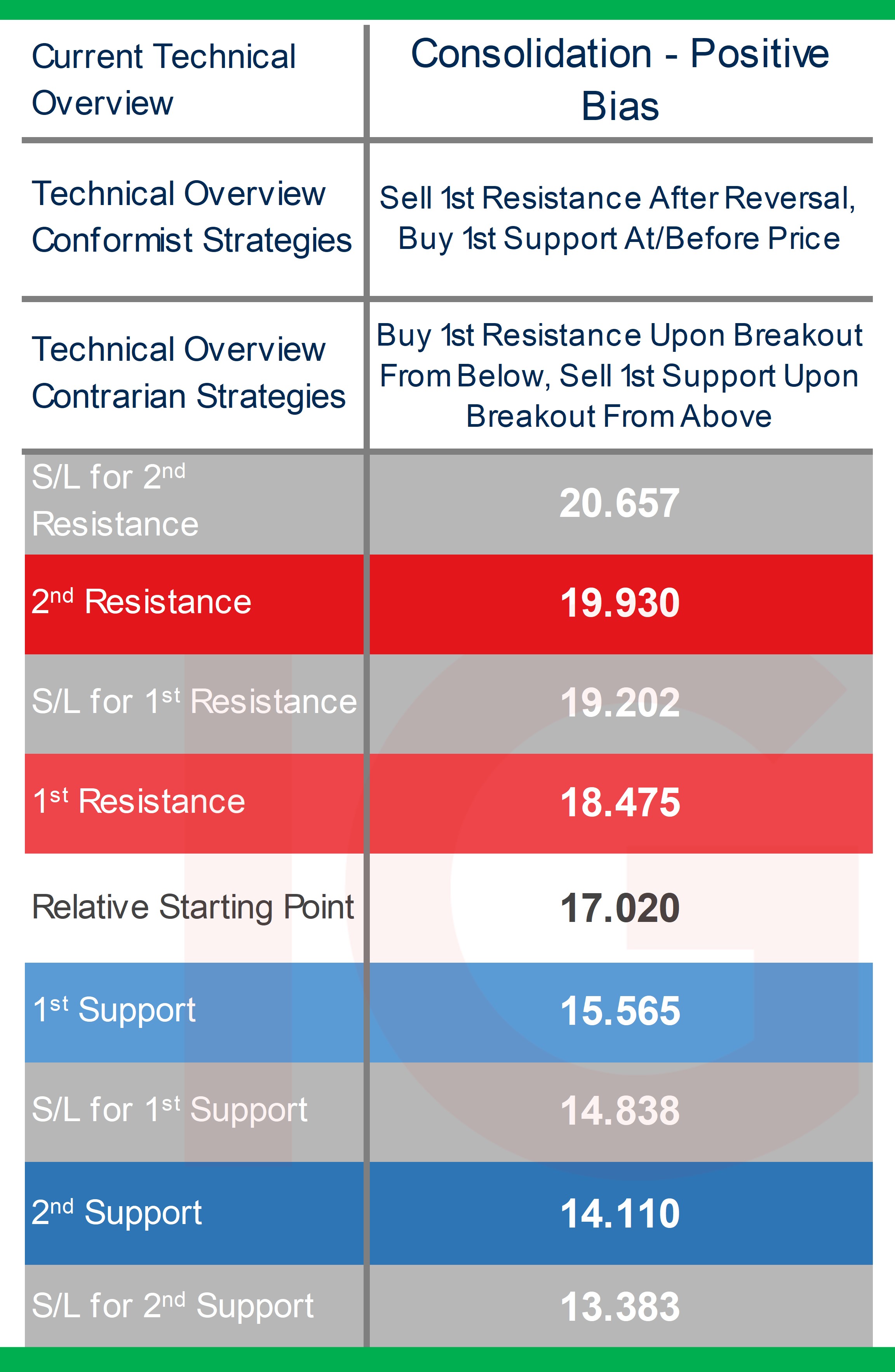

Trading American Airlines Q4 results: technical overview and trading strategies

The technicals on the weekly time frame have painted a much more positive picture after the strong gains last week, with relatively rangebound movement in its share price over the past seven months narrowing some of its key technical indicators.

Prices are above all its main short-term weekly moving averages (MA) and recently crossed its 50-week while still below both 100-week and 200-week MA’s. They’ve also breached the upper end of the Bollinger Band that narrowed on oscillations leading up to the start of last week.

When it comes to its DMI (Directional Movement Index), its +DI is above its -DI with a positive cross back in December.

Oscillations to the downside since March of last year have meant negative DMI crosses have on average enjoyed more follow-through, but if it’s consolidatory moves with or without positive technical bias from here on out and that might change the narrative for those using this indicator. Its weekly ADX (Average Directional Movement Index) reading isn’t in trending territory and hasn’t been for over a year.

Putting it all together and from a technical standpoint the overview is classified as consolidatory on the weekly time frame but with positive bias building due to last week’s fundamental release and the lift off last December’s lows and oscillations prior to narrowing key indicators.

The daily time frame is showing more positive bias with its ADX in trending territory but an RSI (Relative Strength Index) in overbought territory, an overview that’s more stalling bull.

Going back to the weekly time frame, and as with any consolidatory technical overview that enjoys positive bias conformist strategies usually involve reversals be it selling the weekly 1st Resistance level after it has been breached by a margin and shorting only if prices go back to that level and buying via fade strategies off the 1st Support. Those opting to go contrarian can consider breakout strategies with buys off the 1st Resistance if prices move north or sell-breakouts off the 1st Support if prices make a move back down to the lower end of the band.

As always and with any fundamental event, technicals usually hold less relevance and more so if the results veer far from expectations, making levels holding a far more difficult task and more so given how they’ve narrowed due to mostly range-bound movement prior to last week.

Source: IG

Source: IG

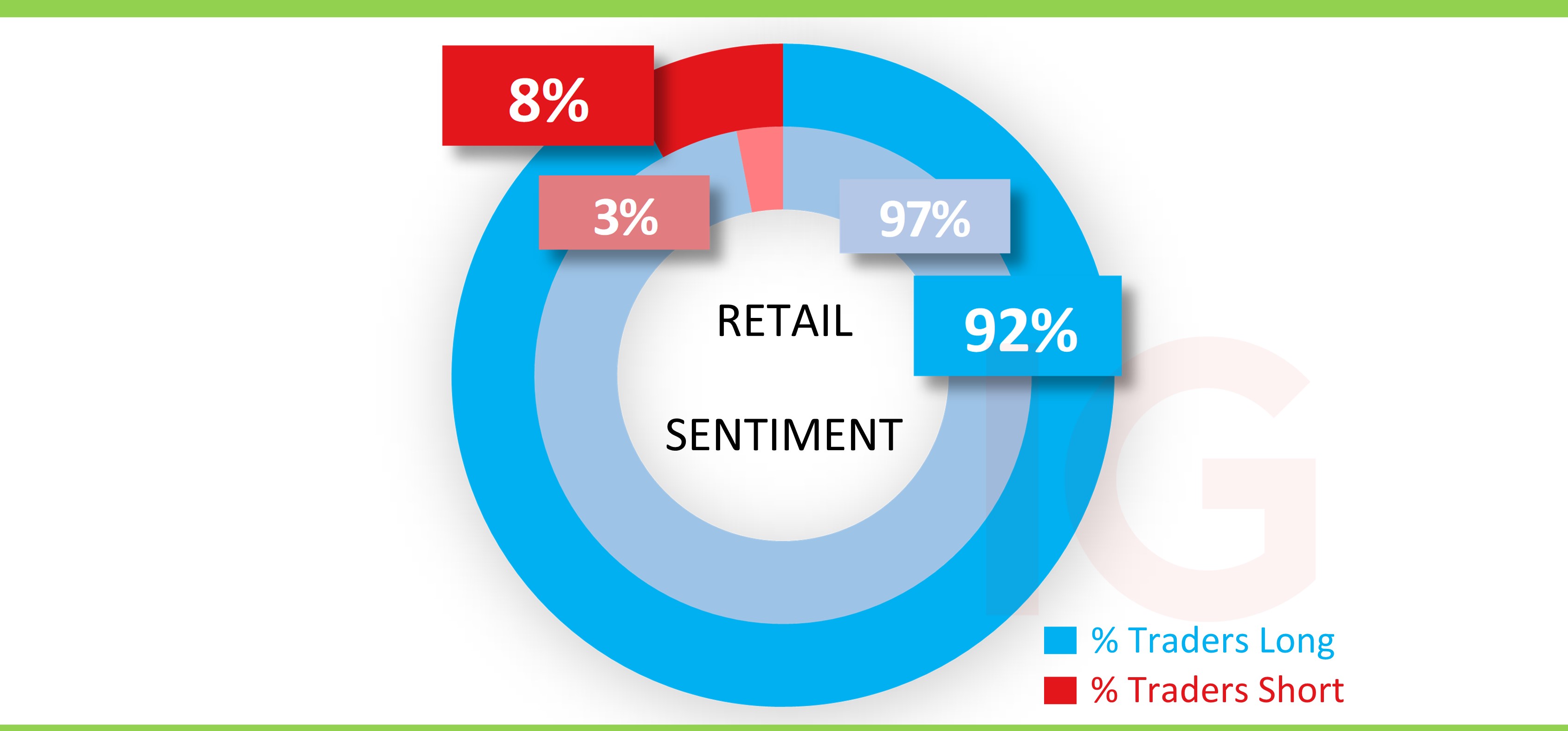

IG Client sentiment* and short interest for American Airlines shares

Retail trader bias has remained in extreme buy territory but has dropped from 97% to 92% after the big gains last Thursday, no doubt beneficiaries of the latest moves (see image below).

As for short interest, it’s been oscillating around the 80-90m mark for some time now with the latest at 89.8m, and far below the 2020 pandemic ranges that at times reached nearly double that amount (source: Refinitiv). It represents nearly 14% of shares floated and is much higher in comparison to the remaining “Big 4” major US national airlines.

Source: IG

Source: IG

*The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1%, as of today morning 8am for the outer circle. Inner circle is from the 5th of January 2023.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now