ITV share price and full-year earnings results preview

Outlook on the ITV share price ahead of its upcoming full-year results.

Source: Bloomberg

Source: Bloomberg

When are ITV’s results expected?

ITV, the British media company that holds 13 of the 15 regional television licences in the UK and is the country’s oldest and largest terrestrial television network, is expected to post its full-year results on 2 March 2023. The full-year results will be for the financial year ending in December 2022.

What is ‘The Street’s’ expectation for the FY results?

‘The Street’ expectations for the upcoming results are as follows:

Revenue of £3,612 billion : +4.6% year-on-year (YoY)

Earnings per share (EPS) : 12.73 pence : -15.7% (YoY)

ITV’s share price has greatly outperformed the FTSE 250 as it managed to increase by around 14% in the past couple of months while the index came close to 5%.

This outperformance might be in large part due to the UK broadcaster launching ITVX, its replacement of the ITV Hub in December, which will take on streaming giants such as Netflix, Apple TV and Disney+.

ITV’s CEO Carolyn McCall’s vision of moving away from terrestrial television towards online streaming and the studio business at first got a cold reception from investors as it was seen to join the streaming revolution long after British rivals BBC and Channel 4.

A trading update in January showed, however, that the company’s £120 million launch of ITVX led to a 55% rise in streaming hours in the first month after its launch and a 65% rise in online users when compared to a year ago, helped by the World Cup.

With the broadcaster’s studios producing several big-budget exclusive ITVX movies and mini-series attracting hundreds of thousands of new viewers who can either watch these for free with advertising, or as a paid-for ad-free option, including BritBox (a joint venture with the BBC), advertisers are attracted to the new online streaming service and are expected to boost the broadcaster’s revenue.

Thursday’s full-year results are thus not only expected to show healthy advertising income but also double-digit growth in ITV’s streaming and studios businesses.

How to trade ITV into the results

Source: Refinitiv

Source: Refinitiv

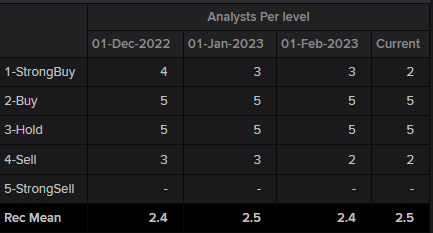

Refinitiv data shows a consensus analyst rating of between ‘buy’ and ‘hold’ for ITV – 2 strong buy, 5 buy, 5 hold and 2 sell - with the median of estimates suggesting a long-term price target of 95.00 pence for the share, roughly 7.5% higher than the current price (as of 1 March 2023).

Source: IG

Source: IG

IG sentiment data shows that 94% of clients with open positions on the share (as of 1 March 2023) expect the price to rise over the near term, while 6% of clients expect the price to fall. This month 70% of clients bought the share and this week 68% sold it.

ITV – technical view

ITV’s share price took a battering last year when it dropped by up to -55% between February and September but then recovered within a clearly defined uptrend channel by over 65% since.

From a long-term perspective, going back to 2019, the share remains in a downtrend and below its 2019-to-2023 downtrend line at 104.20p but medium-term it did form a bottom in September of last year at 53.96 which was made close to its March 2020 low at 50.06p.

ITV Weekly Chart

Source: Tradingview

Source: Tradingview

On the daily chart the ITV share price is being supported by the December-to-March uptrend line at 87p within its September-to-March uptrend channel.

Should a slip take the ITV share price through its three-month uptrend line and below the last reaction low at 85.12p, made on the 22 February, the lower uptrend channel support line and 55-day simple moving average (SMA) at 81.18p would represent the next lower technical downside target.

Failure there could lead to the 200-day simple moving average (SMA) and the December trough at 71.80p to 68.60p being revisited.

ITV Daily Chart

Source: Tradingview

Source: Tradingview

Only a rise and daily chart close above the February peak at 96.62p would put the 2019-to-2023 downtrend line at 104.20p on the map.

Summary

ITV is set to release its full-year 2022 results on 2 March 2023.

Revenue is estimated to come in at £3,612 billion (+4.6% YoY) and EPS at 12.73p (-15.7% YoY).

Revenue is expected to be boosted by healthy advertising income and show double-digit growth in ITV’s streaming and studios businesses.

Long-term broker consensus suggests the share to currently sit between a ‘buy’ and ‘hold’, with a median price target of 95.00 pence for the share, roughly 7.5% higher than the current price.

94% of IG’s clients with open positions are long the share and 6% short.

The ITV share price’s bottomed out in September 2022 and has been trading within an uptrend channel since but its December-to-March uptrend line and the last reaction low at the 22 February low at 85.12p are key for the immediate trend.

A slip through this level could not only trigger a sell-off to the lower uptrend channel support line and 55-day SMA at 81.18p but also a decline back towards the 200-day SMA and the December trough at 71.80p to 68.60p.

Only a rise above the February peak at 96.62p would reignite the uptrend and eye the 2019-to-2023 downtrend line at 104.20p.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now