What comes next for US equity indices as the anticipated pullback arrives with a vengeance

Key US indices declined after the Federal Reserve's rates announcement with the Nasdaq dropping 3.30%, the S&P closing 2.93% lower and the Dow Jones slipping 654 points.

Key US stock indices decline

Aside from the now-standard Monday rally, key US stock indices lost ground every other day last week. The decline accelerated following the Fed's hawkish hold, where it reinforced its message of "higher for longer" rates. For the week, the Nasdaq lost 3.30%. The S&P500 closed 2.93% lower, and the Dow Jones slipped 654 points (-1.89%).

To recap the key points from last week's Federal Open Market Committee (FOMC) meeting:

- The 2024 median dot moved up 50bp to 5.1% (from 4.6% in June), indicating just two cuts next year are expected vs. four previously.

- 12 of 19 Fed officials favour another rate hike this year.

We remain of the view the interest rate market is too complacent about the possibility of one final rate hike before the year's end.

However, with core personal condumption expenditure (PCE) inflation this week and expected to be well-behaved (previewed below), the most likely catalyst for a hawkish repricing ahead of the November FOMC is the September non-farm payroll jobs report, due for release the week after next (6 October).

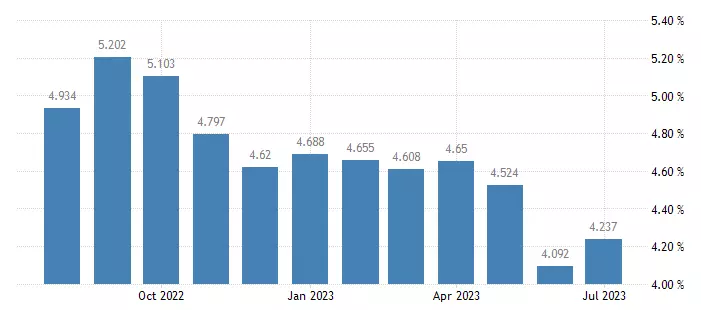

What is expected from Core PCE inflation (Thursday, 29 September at 10.30pm AEST)

Last month, the PCE Price Index increased by 3.3% YoY in July, from 3% the previous month. The Feds preferred measure of inflation, the Core PCE Price Index, which excludes food and energy, increased by 4.2% YoY in July from 4.1% the previous month.

This month, the PCE Price Index is expected to increase to 3.5% from 3.3% prior. The Core PCE Price Index is expected to ease to 3.9% YoY from 4.2% in July.

Although Core PCE at 3.9% would be the lowest reading in two years, it is still twice the Fed's inflation target of 2%, and one of the key reasons the message from last week's FOMC was rates need to stay higher for longer.

Core PCE price index

Source: Trading Economics

S&P 500 technical analysis

Since early September, we have opined that the S&P 500 was missing another leg lower towards 4250/20 as part of the correction that started in July, including here and here.

Last week's sell-off, which included a break of the August low, confirmed the missing leg lower was underway (Wave c of a possible Elliott Wave "abc" correction), and we continue to expect the S&P500 to move lower to test support 4250/20 area in the sessions ahead.

Should signs of basing emerge in the 4250/4200 area, we will likely move to a positive bias, looking for the uptrend to resume towards the July high before a possible test of the bull market 2022, 4818 high.

S&P 500 daily chart

Source: TradingView

Nasdaq technical analysis

Much like the S&P 500, we have opined that the Nasdaq was missing another leg lower towards 4250/20 as part of the correction that started in July, including here and here.

Last week's sell-off confirmed the missing leg lower was underway (Wave c of a possible Elliott Wave "abc" correction), and we continue to expect the Nasdaq to move lower towards wave equality support 14,200/14,000 area to complete a Wave IV (Elliott Wave) corrective pullback.

Should the pullback play out as expected, we then expect to see a recovery, which would see the Nasdaq test and break the highs of July and possibly set up a test of the bull market 2021, 16764 high.

Nasdaq weekly chart

Source: TradingView

TradingView: the figures stated are as of 25 September 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now