Gold price outlook: why precious metal is still the safe-haven for investors in 2024?

By the end of November, the price of the yellow metal had increased by more than 10% year-to-date, as market participants anticipate that the current tightening cycle might be approaching its conclusion.

Source: Bloomberg

Source: Bloomberg

Why invest in gold?

Gold has long held a unique status as a powerful tool for preserving value, gradually ingraining its perceived worth in society over thousands of years. In ancient times, precious metals served as a universally recognized unit of exchange, forming the basis for the world's initial currencies for centuries.

Up until 1971, the US dollar was tied to the value of gold, and with most currencies hitched to the dollar, essentially gold played a pivotal role as the cornerstone of the global forex market.

Today, gold is still the go-to 'safe haven' for investors, preserving its value when other assets hit roadblocks. Beyond that, central banks are hoarding gold reserves, recognizing its global value to be wielded in times of crucial need.

Who is the main gold producer and buyer in the world?

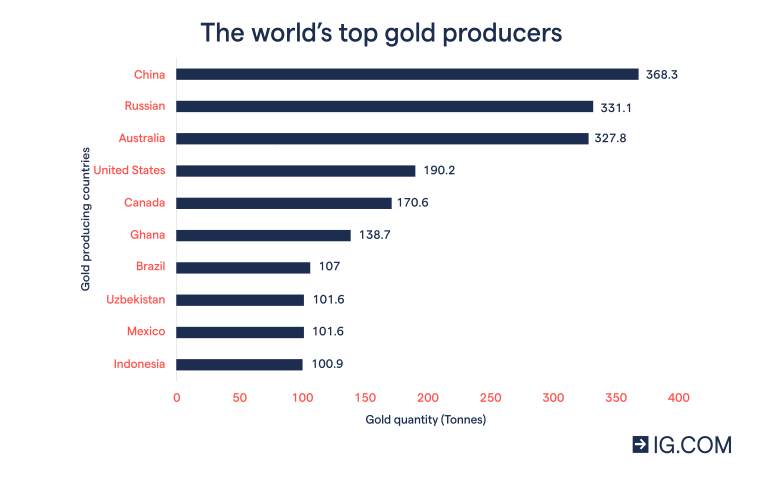

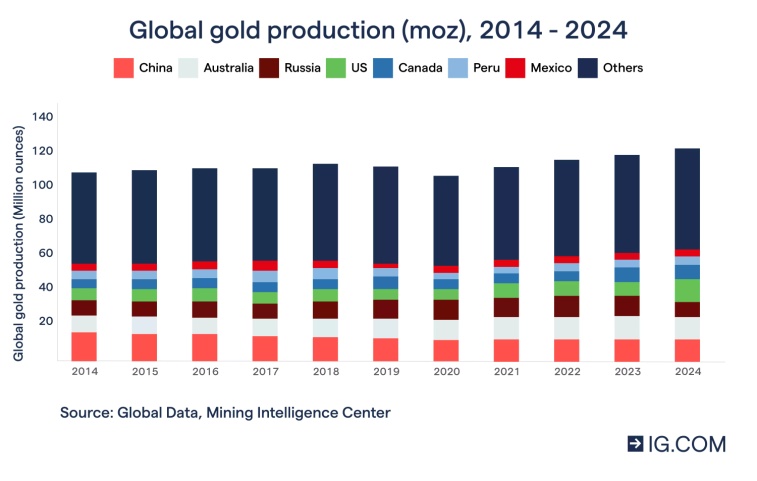

In the past, countries such as South Africa were renowned for hosting some of the world's largest gold reserves. However, over the years, nations like China, Russia, Australia, and the United States have surpassed them in this regard.

China, the leading global gold producer, contributes to 11% of the world's total production. Meanwhile, China is also the largest purchaser of gold. Gold reserves in China have averaged 1161.79 Tonnes from 2000 until 2023, reaching a record high of 2191.53 Tonnes in the third quarter of 2023.

Source: World Gold Council

Source: World Gold Council

The different ways to invest in gold markets

There are various options to invest in gold markets, including spot gold, gold futures, gold options and gold stocks.

•Spot gold: Spot gold involves the immediate purchase or sale of the precious metal, with the exchange occurring at the precise moment the trade is settled, or ‘on the spot’ price. When engaging in spot gold trading, investors transact buying and selling at the current market rate, commonly referred to as the spot price.

•Gold futures: Futures contracts allow investors to trade gold at a predetermined price on a future date. These contracts are standardized in terms of quantity and quality, with only their price influenced by market forces.

•Gold options: Options contracts operate similarly to futures, but there is no obligation to execute the trade upon purchase. Options grant investors the right to exchange gold at a predetermined price on a specified date.

•Gold ETFs: Exchange-traded funds (ETFs) can help investors track the performance of shares in a collection of publicly traded gold mining, refining, and production companies. Engaging in ETF trading extends investors' exposure and hence helps to diversify their portfolios.

•Gold stocks: Trading gold stocks is another way to invest in gold. This will enable investors to diversify their portfolio within the gold industry, going long or short on companies involved in mining and production of gold.

How will the precious metal perform in 2024?

Gold prices stayed resilient for most of 2023, reaching a two-year high above $2050 in May. By the end of November, the price of the yellow metal had increased by more than 10% year-to-date, as market participants anticipate that the current tightening cycle might be approaching its conclusion. The escalating demand for a safe-haven refuge was further fuelled by ongoing geopolitical tensions in both the Middle East and Ukraine.

By the end of November, Gold prices have posted an impressive 10% gain in the fourth quarter, surpassing the key $2000 per ounce level. The precious metal has been trading within an ascending wedge since June 2022. This pattern could propel the price towards the May high above $2075should the momentum continues. On the other hand, the level at $1998 would act as a crucial support level if the price of the shining metal pulls back.

Looking forward, the outlook for gold in 2024 is expected to remain positive, as the factors driving the growing appetite for the precious metal seem to stay intact. Furthermore, as gold is often seen as a reliable means of safeguarding wealth during challenging economic periods, the widely projected economic slowdown in 2024 should serveas an additional catalyst for gold to preserve its prime.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now