Nasdaq 100: positive close but futures in retreat

It’s an ongoing bullish technical overview despite recent struggles, with retail traders opting to retain a majority sell bias while CoT speculators reduce their majority buy sentiment.

Source: Bloomberg

Source: Bloomberg

Tech outperforms, cautious Fed member speak, and mixed US data

Nearly all sectors finished yesterday's session in the green, with tech in second place, though the two in the red were consumer discretionary and communication, albeit with limited losses. The performance for the tech-heavy index ultimately surpassed both the Dow 30 and the S&P 500 for the session, yet the gains failed to offset the losses suffered on Tuesday, and futures are struggling as of this morning.

There was plenty of attention on the Federal Reserve’s (Fed) Chairman Powell, who stated that rates are "likely at their peak for this tightening cycle", though "the economic outlook is uncertain" and reaching their 2% "inflation objective is not assured". He cautioned against cutting too soon and failed to provide an exact timeline on rate cuts that will "likely be appropriate... at some point this year". After that, Daly emphasized that they are "focused and resolute on getting inflation down", and Kashkari mentioned the possibility of two or even just one rate cut this year.

As for Treasury yields, they finished the session lower on the further end of the curve, though unchanged in real terms, and market pricing (CME's FedWatch) remained unchanged as the majority anticipate a hold-hold-cut scenario for the March-May-June meetings.

Economic data out of the US was mixed, with ADP's non-farm estimate for the month of February slightly missing expectations at 140K (vs. 150K estimates), job openings for January out of JOLTS falling to 8.86 million, not far off forecasts, and wholesale inventories for the same month dropping by 0.3%. The weekly claims, Challenger's job cuts, and unit labor costs are among the data releasing later today before tomorrow's market-moving Non-Farm Payrolls.

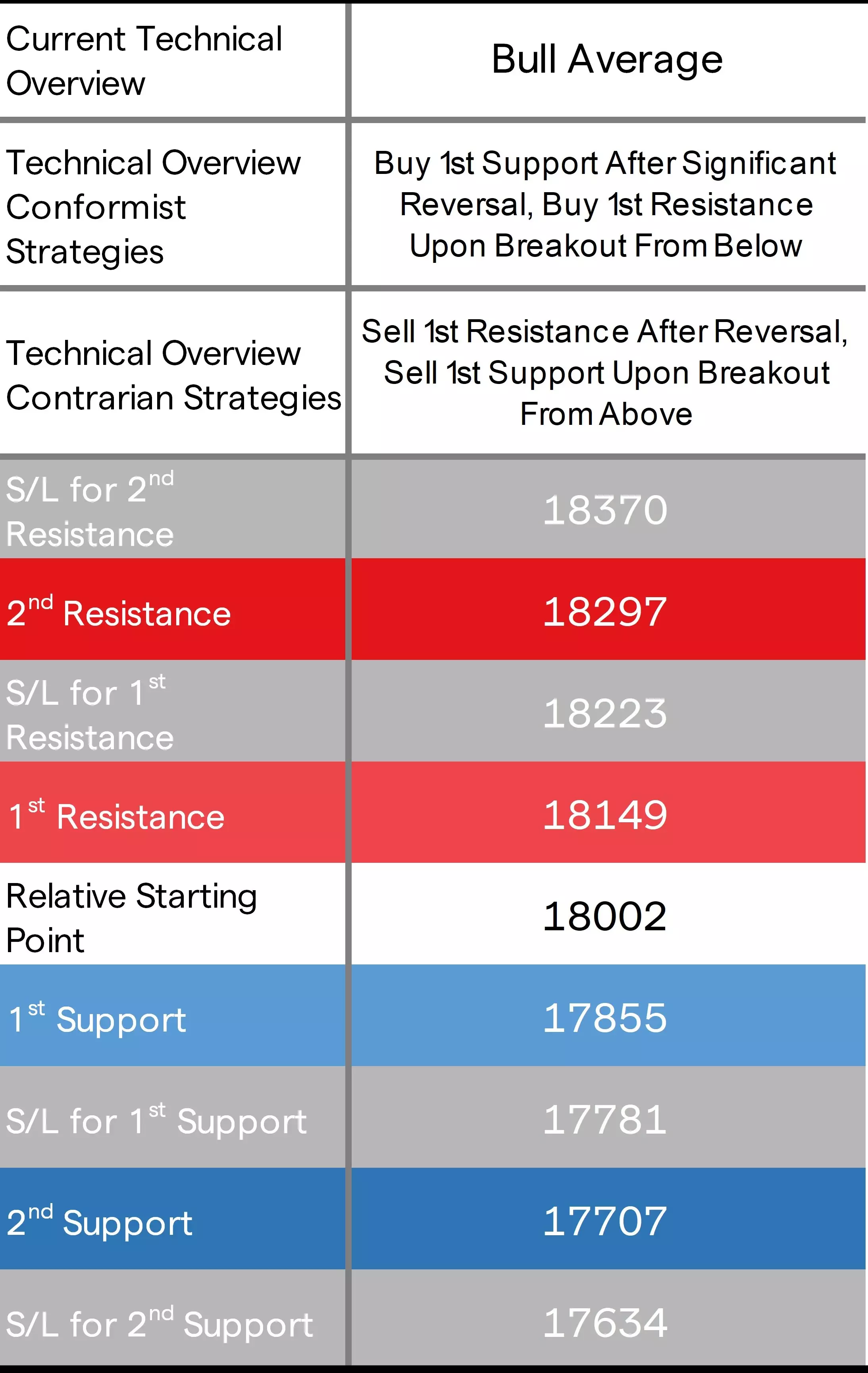

Nasdaq technical analysis, overview, strategies, and levels

Price spent most of yesterday’s session above its previous 1st Resistance, easily giving conformist buy-breakouts, the edge before the moves as of writing this morning that took it back beneath the key level. Its technical overview remains a ‘bull average’ in both weekly and daily time frames and means added caution via ‘significant reversal’ for conformists buying off dips when price reaches the 1st (or even 2nd) Support levels.

Source: IG

Source: IG

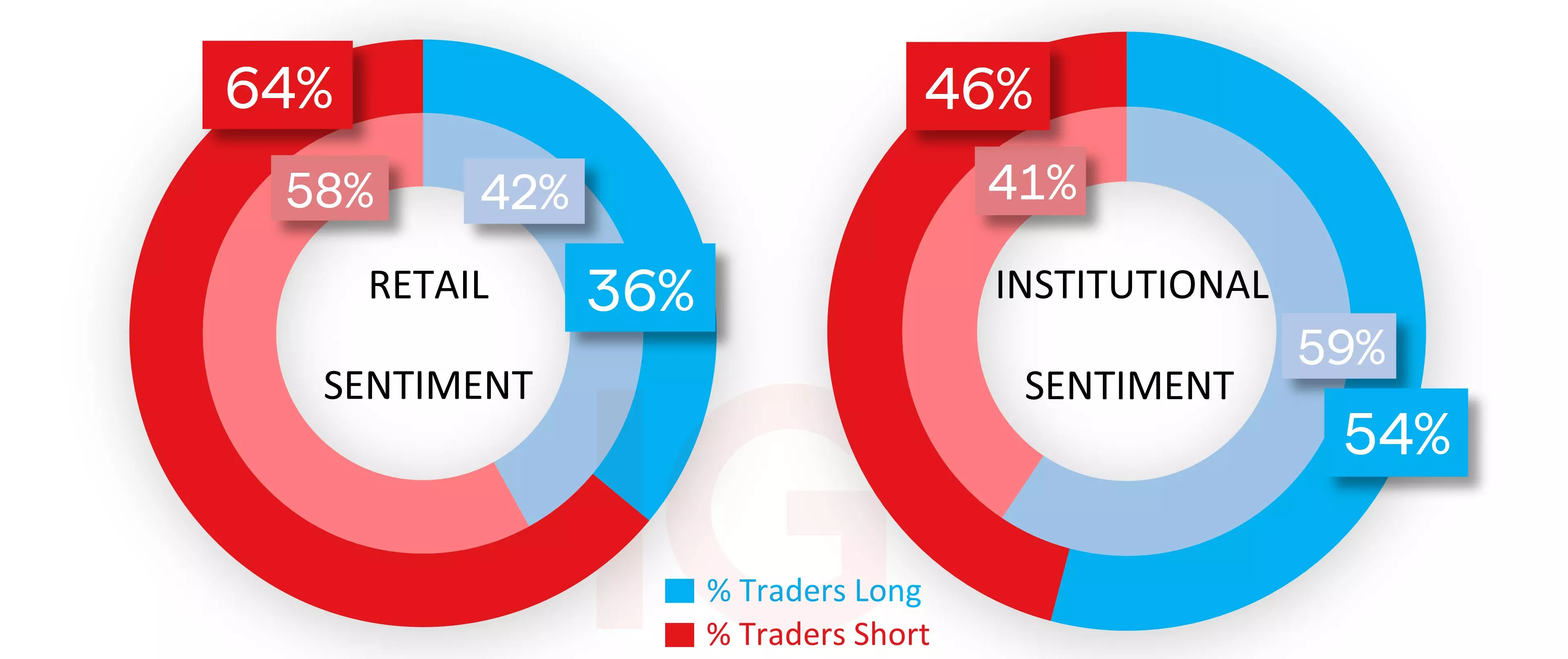

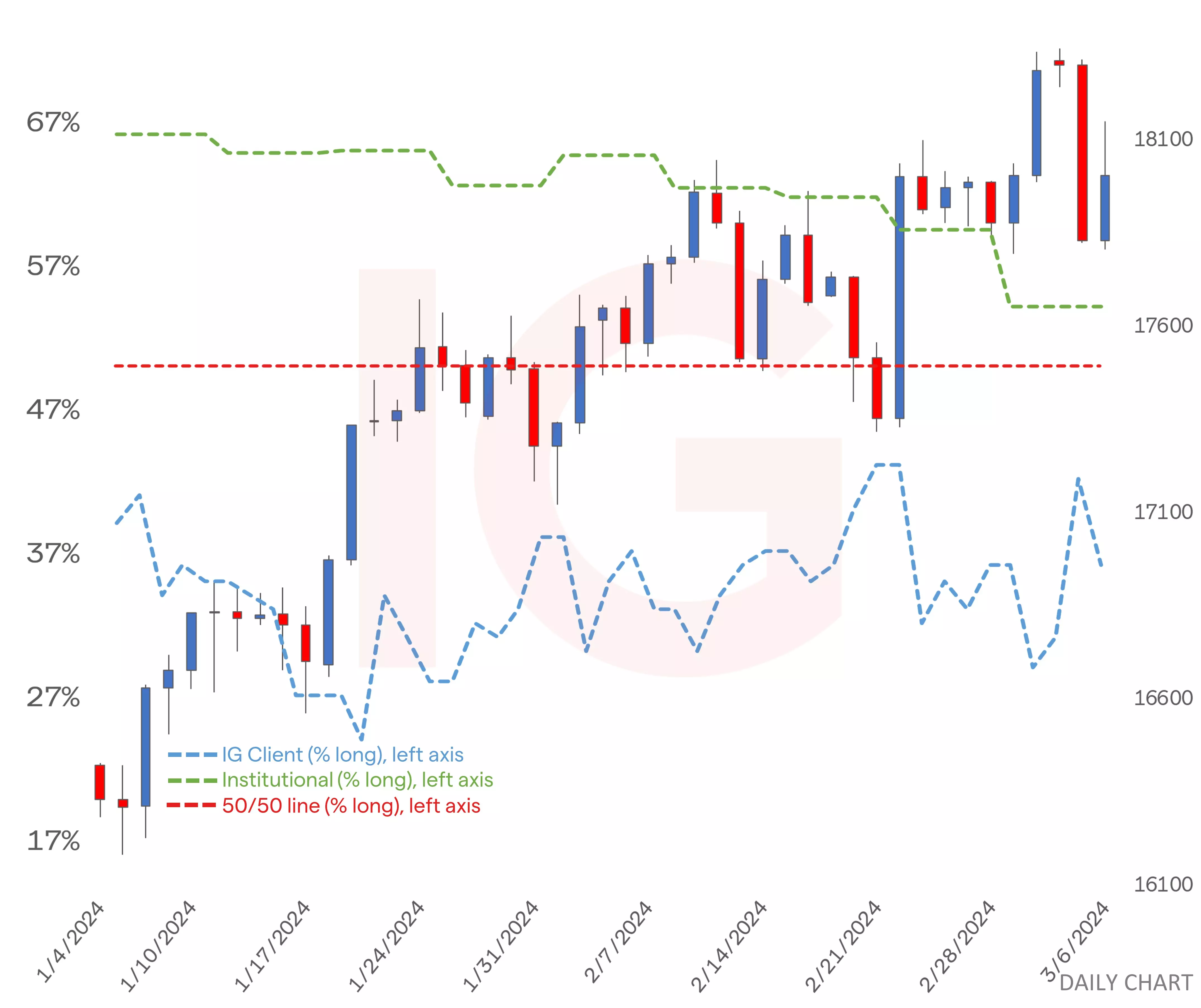

IG client* and CoT** sentiment for the Nasdaq

The higher close took sentiment amongst retail traders closer to heavy sell territory, rising from 58% yesterday to 64% as of this morning. Any pullback in price would make them beneficiaries, given they generally shorted into price gains. CoT speculators have been majority buy throughout this period, but there’s no denying the recent unwind, taking the long bias amongst them to a slight buy 54% on an increase in short positions, and a simultaneous drop in longs. Another drop in percentage terms like that and they’ll shift to slight sell.

Source: IG

Source: IG

Nasdaq chart with retail and institutional sentiment

Source: IG

Source: IG

- *The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1%, as of today morning 8am for the outer circle. Inner circle is from the previous trading day.

- **CoT sentiment taken from the CFTC’s Commitment of Traders report, outer circle is latest report released on Friday with the positions as of last Tuesday, inner circle from the report prior.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now