Nasdaq 100 Outlook: Stocks Decline Despite Stellar Tech Earnings, All Eyes Shift to Fed

NASDAQ 100, APPLE, MICROSOFT, ALPHABET, TECH EARNINGS, FEDERAL RESERVE - TALKING POINTS

- Apple, Microsoft, Alphabet all post blowout earnings reports after the closing bell

- Federal Reserve meeting slated for Wednesday, eyes on liftoff and taper talk

- China crackdown on tech continues, Hang Seng Index declines by over 4%

Major US equity benchmarks declined on Tuesday as market participants prepared for a blockbuster slate of tech earnings after the closing bell. US indices posted their first declines in 5 sessions, all coming down from record highs achieved during Monday’s session. Major tech names posted blowout quarterly earnings after the bell, highlighted by Apple and Alphabet’s standout results. Risk-off sentiment in the US echoed further losses sustained during the APAC session, as Chinese tech stocks continued to stumble following a crackdown from Beijing. The Hang Seng Index declined by over 4%, taking the losses for the index to 9.56% in just the last 3 trading sessions.

TECH EARNINGS SUMMARY

Apple Q3 Results

- Revenues: $81.43 B vs. $73.30 B est.

- EPS: $1.30 vs. $1.01 est.

Microsoft Q4 Results

- Revenues: $46.20 B vs. $44.26 B est.

- EPS: $2.17 vs. $1.92 est.

Alphabet (Google) Q2 Results

- Revenues: $61.88 B vs. $56.23 B est.

- EPS: $27.26 vs. $19.35 est.

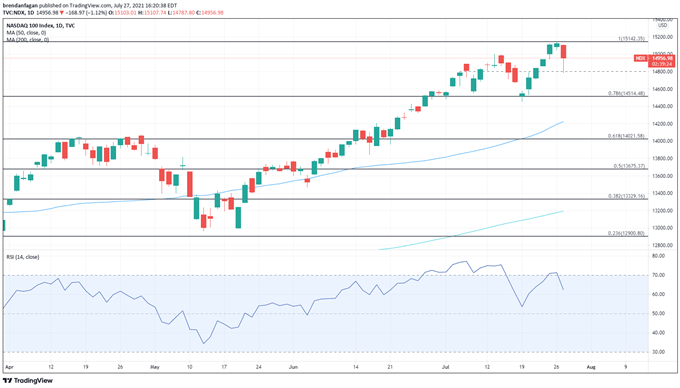

NASDAQ 100 DAILY CHART

Chart provided by TradingView

The Nasdaq 100 Index has retreated from recent all-time highs despite the expectation for a strong earnings period for the index’s largest constituents. Prior to Tuesday’s decline, the relative strength index (RSI) for the index was at 71.26, indicating that overbought conditions were present. Despite falling to 14,800 during Tuesday’s session, the Nasdaq 100 Index rebounded into the close ahead of the highly anticipated earnings reports. With the largest tech firms all posting strong results, a retest of 15,000 and all-time highs may be in store. However market participants should proceed with caution given the magnitude of Wednesday’s FOMC meeting. Near-term direction may be determined by comments from Fed Chair Jerome Powell, not the fundamentals of underlying companies in the index.

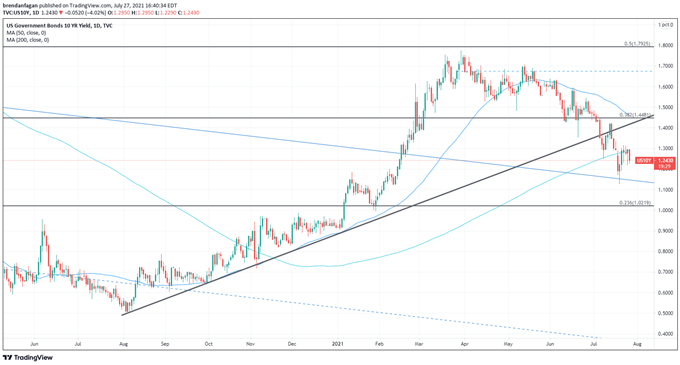

US 10 YEAR TREASURY YIELD DAILY CHART

Chart provided by TradingView

Brendan Fagan, Intern, Daily FX

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now