Is the Tencent share price at current levels a buy?

The Tencent share price is off more than 40% from February’s highs due to regulatory headwinds, but is now the time to buy?

Why is the Tencent share price under pressure in 2021

Tencent the Chinese tech giant sees its share price down more than 20% year (more than 40% down from February’s highs) to date as investors react to a regulatory crackdown furthered by media pressure.

Chinese officials clamping down on major tech companies within the region has been due to what it deem threats to national data as well as financial security. This has been followed up by the Chinese government targeting anti-competitive practices particularly within the e-commerce space. The list of Tencent services which have been affected includes private education service, WeChat, online music streaming services and mobile/online gaming.

In the short term Chinese State Media has commented that online gaming is like ‘spiritual opium’. The comments have seen a sharp selloff in gaming stocks such as Tencent, in lieu of further regulatory pressure that could follow. Tencent has been quick to react to the State Media’s comments offering further solution to the problem by limiting gaming hours for minors.

Is Tencent still a buy at current levels?

The decline in Tencent’s share price this year accompanies the uncertainty pertaining to future earnings due to regulatory actions current and possibly ongoing. Chinese authorities are removing some barriers for entry for competitors while also disrupting earnings streams through limiting usage. Compliance with regulations will also incur increased development costs for the group.

However, Tencent remains a well-diversified, capitalised and cash generative business. The companies dominance in the online internet and gaming segments as well as industry leading platform such as WeChat should ensure that the company is well placed to weather the current regulatory headwinds

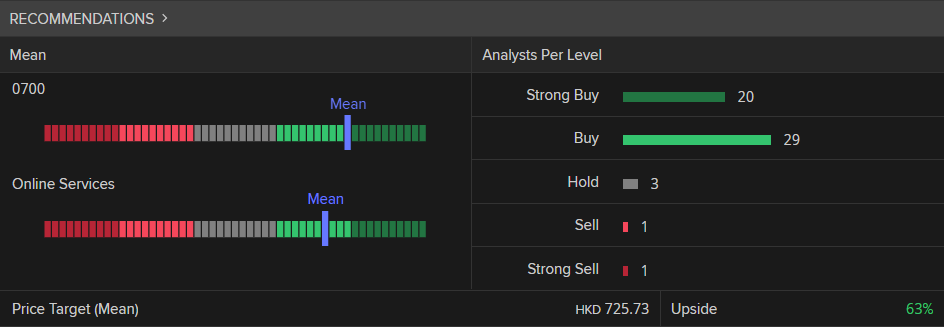

Source: Refinitiv

Source: Refinitiv

A Refinitiv poll of 54 analysts maintain a long-term investment rating of ‘buy’ for Tencent Holdings (as of 3 August 2021) with a target price (mean of estimates) of 725.73 (Hong Kong dollars). The price target suggests the current share price to be trading at a 63% discount to a perceived fair value.

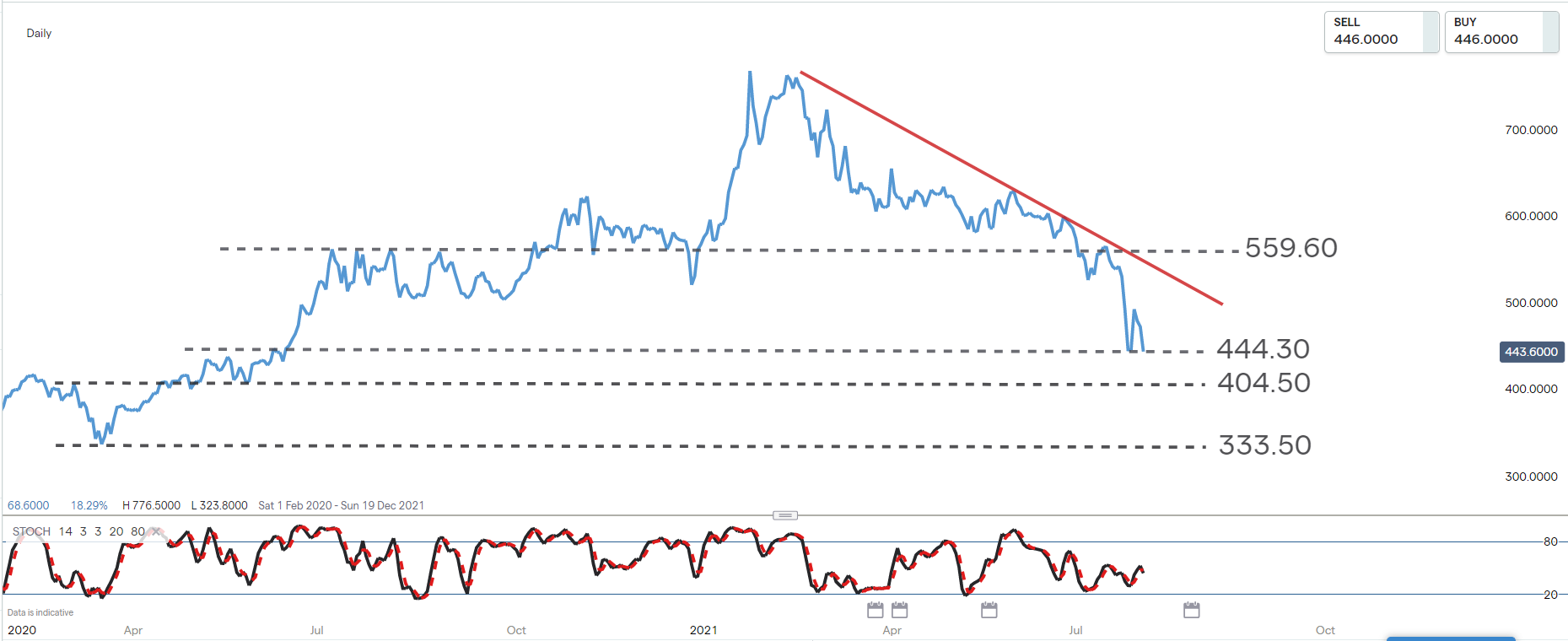

Source: IG charts

Source: IG charts

The share price of Tencent has started a new downtrend in 2021 and is currently testing support at the 444.30 level. A break of the 444.30 level would consider 404.50 as the next support target from the move.

Traders who are still looking to instead get long on Tencent, might prefer to look for entry on a price rebound and close above both trend line and horizontal resistance at the 559.60 level.

Summary

- The Tencent share price is down more than 20% year to date

- The decline follows the Chinese governments clampdown on data and financial security issues as well as anti-competitive behaviour particularly in the e-commerce space

- In the short term Chinese State Media has commented that online gaming is like ‘spiritual opium’ to further weigh on the Tencent share price

- The decline in Tencent’s share price this year accompanies the uncertainty pertaining to future earnings

- Tencent remains a well-diversified, capitalised and cash generative business

- The average broker rating for Tencent remains ‘buy’

- The share price is currently testing a key level of support

Shaun Murison | Senior Market Analyst, Johannesburg | Publication date: Wednesday 04 August 2021. IG

-

1

1

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now