Walt Disney Q3 earnings: revenues expected to rise as reopening continues

Walt Disney Q3 earnings provide an important update on their reopening transition, with rising revenues needed to justify elevated share price.

Source: Bloomberg

Source: Bloomberg

When will Walt Disney report their latest earnings?

Disney report their earnings for the third quarter of the 2021 fiscal year financial results after the close of regular trading on Thursday August 12, 2021.

Walt Disney earnings – what to expect

Disney has experienced a difficult pandemic period, with the Covid restrictions having severe implications for both their ability to create content and open theme park locations.

While the Disney+ streaming service provided a somewhat timely offering as the firm built a fresh revenue stream at a time when physical products were a tough sell, the majority of their earnings come from products that are related to practices that have been impacted by the pandemic.

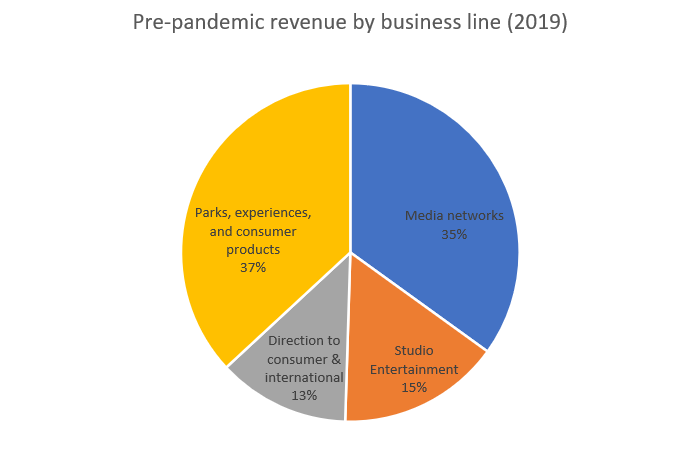

The breakdown of where those earnings lay can be seen below, with the pre-pandemic revenues coming predominantly via their media networks and Parks and Experiences segment. With that in mind, investors will want to keep an eye out for how these two segments are faring in particular.

Source: IG

Source: IG

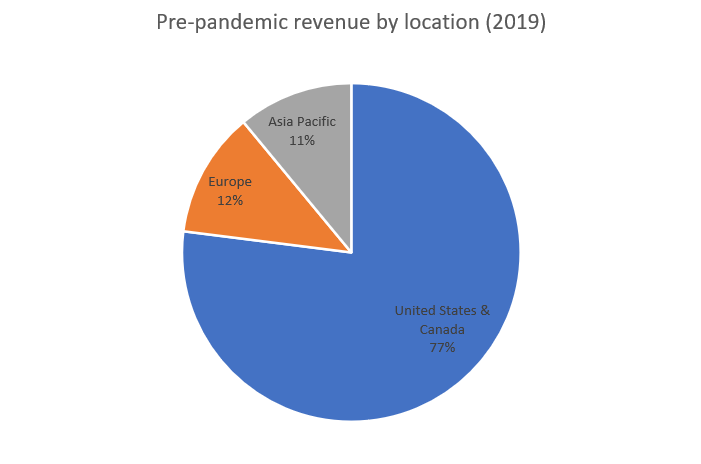

Another idea of exactly where their focus lies comes when looking at the geographic location of revenues, with North America somewhat predictably providing the mainstay of their income.

Nonetheless, with Parks in Paris, Hong Kong, and Shanghai coupled with a cruise operation, the company has been influenced by experiences elsewhere in the world.

Source: IG

Source: IG

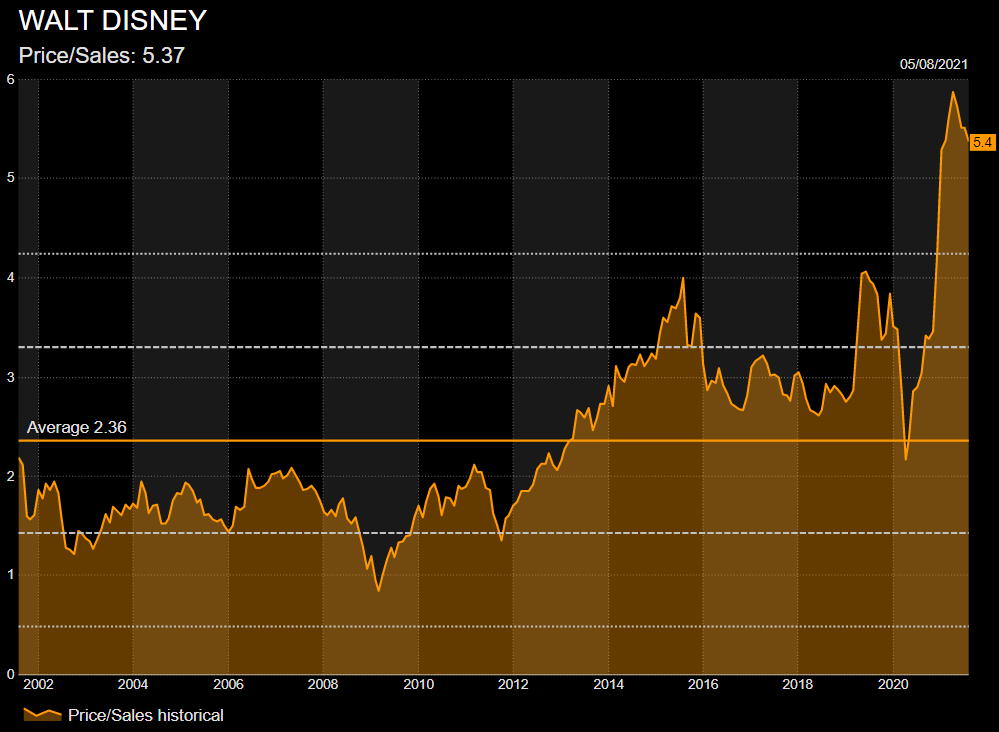

With the stock already trading some 15% above its pre-pandemic 2020 high, there will be many questions asked over how justified that valuation is in relation to earnings.

We can see how this rise in the Disney share price has impacted their ratios, with the price-to-sales figure surging to highlight how we have seen markets preempt the recovery in revenues.

Source: Refinitiv

Source: Refinitiv

What figures should we watch out for?

Disney is expected to report revenues of $16.76 billion, which would continue the improvement after a figure of $15.61 billion last quarter. From a historical perspective, that figure would be a significant improvement on the third quarter (Q3) 2020 revenue number of $11.77 billion, but down on the pre-pandemic Q3 2019 reading of $20.24 billion.

Elsewhere, earnings per share (EPS) is expected to come in around $0.55, which would be well down on the $0.79 seen in the second quarter (Q2). From a historical perspective, that figure would be well up on the Q3 2020 EPS of $0.08, but down on the Q3 2019 figure $1.35.

Disney earnings – valuation and broker ratings

Disney remains popular with brokers, with 26 ‘strong buy’ or ‘buy’ recommendations and four ‘holds’. They have no sell recommendations.

Disney shares – technical analysis

Disney shares have been drifting lower over the course of the past five months, with the stock down 15% from the record high established in March.

With higher lows continuing to play out over the course of 2021 thus far, this latest pullback looks like a good buying opportunity ahead of their latest earnings figures.

A break back below the $169.24 July low would bring about a more bearish outlook for the stock. To the upside, the bullish story gains prominence with a rise up through the $181.34 swing-high.

Source: ProRealTime

Source: ProRealTime

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now