FTSE 100 Outlook: Index Posts Worst Day in a Month Amid Commodities Sell-Off

FTSE 100, FED TAPER, ECB, DELTA VARIANT, COMMODITIES, OIL – TALKING POINTS

- FTSE extends recent decline, falling in each of the last six sessions

- Continued declines in oil and other commodities dampened sentiment

- Fears over a 2021 taper from the Federal Reserve have caused equities to wobble of late

The FTSE 100 Index slumped on Thursday, adding to what has been a tumultuous week for the index and European equities in general. Global equity indices have taken a breather of late, as slowing economic data and concerns over the Delta variant continue to dampen sentiment. Markets have also been forced to digest the possibility of a 2021 taper from the Federal Reserve, something that became apparent in Wednesday’s release of the FOMC minutes. Policy divergence between the Federal Reserve and the European Central Bank may bring about headwinds for risk-assets, a notion that has been echoed in markets over the last few weeks. Equity and commodities markets continue to wobble. Meanwhile the US Dollar hit a fresh 9-month high on Thursday.

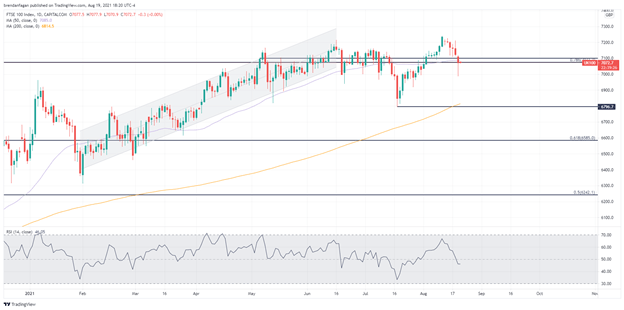

FTSE 100 INDEX DAILY CHART

Chart provided by TradingView

Mining and energy stocks dragged the flagship UK index lower on Thursday, as the rout in oil markets continues to unfold. The spread of the Delta variant is causing central banks and economists to reevaluate policy plans and outlooks. Most notably, the Reserve Bank of New Zealand delayed a forecasted 25 bps rate hike over a Covid outbreak in the country, highlighting the fluid nature of the situation. Central bankers have also gone on record saying the Delta variant poses serious threats to global economies for the rest of 2021, particularly job creation and retail spending. Significant changes in consumer behavior due to a resurgence in the virus may have the potential to derail central bank policy moves, a headwind that global markets are just beginning to appreciate.

Without any respite, the fundamental outlook for UK and European equities remains bleak. Commodities, in particular oil, may continue to struggle as the Delta variant curbs economic activity. Continued pressure in the commodities sector may also weigh on the FTSE 100, with shares of BP, Antofagasta, and BHP falling sharply on Thursday. The combination of peak growth and weakening demand could potentially be the catalyst that makes equity markets roll over, with the move in European equities not fully being mirrored by their American counterparts.

WTI CRUDE OIL DAILY CHART

Chart created with TradingView

With the Jackson Hole meeting of central bankers next week, market participants will follow closely for any guidance on the state of pandemic stimulus. While the Federal Reserve hinted at a possibility for a 2021 taper, European investors remain on edge, waiting for concrete guidance from the ECB. With headwinds abound, the FTSE may look to test the psychological 7000 level on any further weakness. Bulls should remain wary, and look for a close above the 50-day moving average for any confirmation of a reverse of the recent slide. Without any improvement to the fundamental outlook, bias in the FTSE 100 and other European indices should remain skewed to the downside.

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

Written by Brendan Fagan, Intern. 20 August 2021. DailyFX

-

1

1

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now