Boeing’s share price: what to expect from Q3 results

Find out what to expect from Boeing’s earnings results, how they will affect Boeing share price, and how to trade Boeing’s earnings.

Source: Bloomberg

Source: Bloomberg

When is Boeing’s results date?

The aerospace giant, Boeing is expected to report its third quarter (Q3) earnings on Wednesday, October 27, before the market open.

Boeing share price: forecasts from Q3 results

Last time around second quarter (Q2) results came as a big surprise, not just beating estimates sizably but posting its first quarterly profit in nearly two years thanks to gains in defense and services, its commercial airplanes division still losing money.

Previous worries cited by its chief executive officer (CEO) included Covid-19 variants and labor shortages in its supply chain, unlikely the latter has fared any better and especially given complaints across the corporate spectrum, even if the worries regarding the former have subsided a bit with average cases dropping in the US and air travel restrictions to be reduced in November.

It’s had quite a few items to contend with since, and taking a look at deliveries shows a modest increase to 85 commercial jets in the Q3 from 79 in the Q2 and 77 in the first. Digging a little deeper and that isn’t necessarily going to translate into rosier numbers, given the drop by a third in the high-value wide-body jets translating into less revenue from this aspect of the business. And while deliveries net are higher on the commercial jet front, they’ve declined on the defense, space, and security front from 43 to 37.

The return to service of the 737 MAX in China is yet to be determined and in the hands of the country’s regulators, even if executives at Boeing are hoping it’ll be later this year, an item that’ll factor into future figures and guidance given the size of the world’s second largest airplane passenger market where a quarter of Boeing’s airplanes made its way to the Chinese market prior to the 737 MAX’s grounding.

There’s also last week’s reports of a fresh defect in its 787 Dreamliner that’ll require undelivered planes to be reworked, while those already in service to be reviewed in what will be another cost to an already costly and tested model. Its space vehicle Starliner, will be delayed.

But putting it all together for this quarter, and when it comes to the numbers, expectations are for a more subdued reading of -$0.16 per share, and for revenue close to last quarter’s expectations of about $16.5bn. Expect investors to tune in on how inflationary pressures and shortages have affected this sector, and whether it’s cash flow and debt situation hasn’t worsened, this as financial tightening is expected to occur at a faster pace globally to reign in prices, and test already tested companies heavily burdened with debt.

Analyst recommendations aren’t as bullish as they were a few months back when there was a clearer majority buy bias on average amongst them, since then far more with a ‘hold’, far less with a ‘buy’ endorsement, and the net result a slight buy view (source: finance.yahoo.com), and an average price target still above current levels.

Trading Boeing’s Q3 results: weekly technical overview and trading strategies

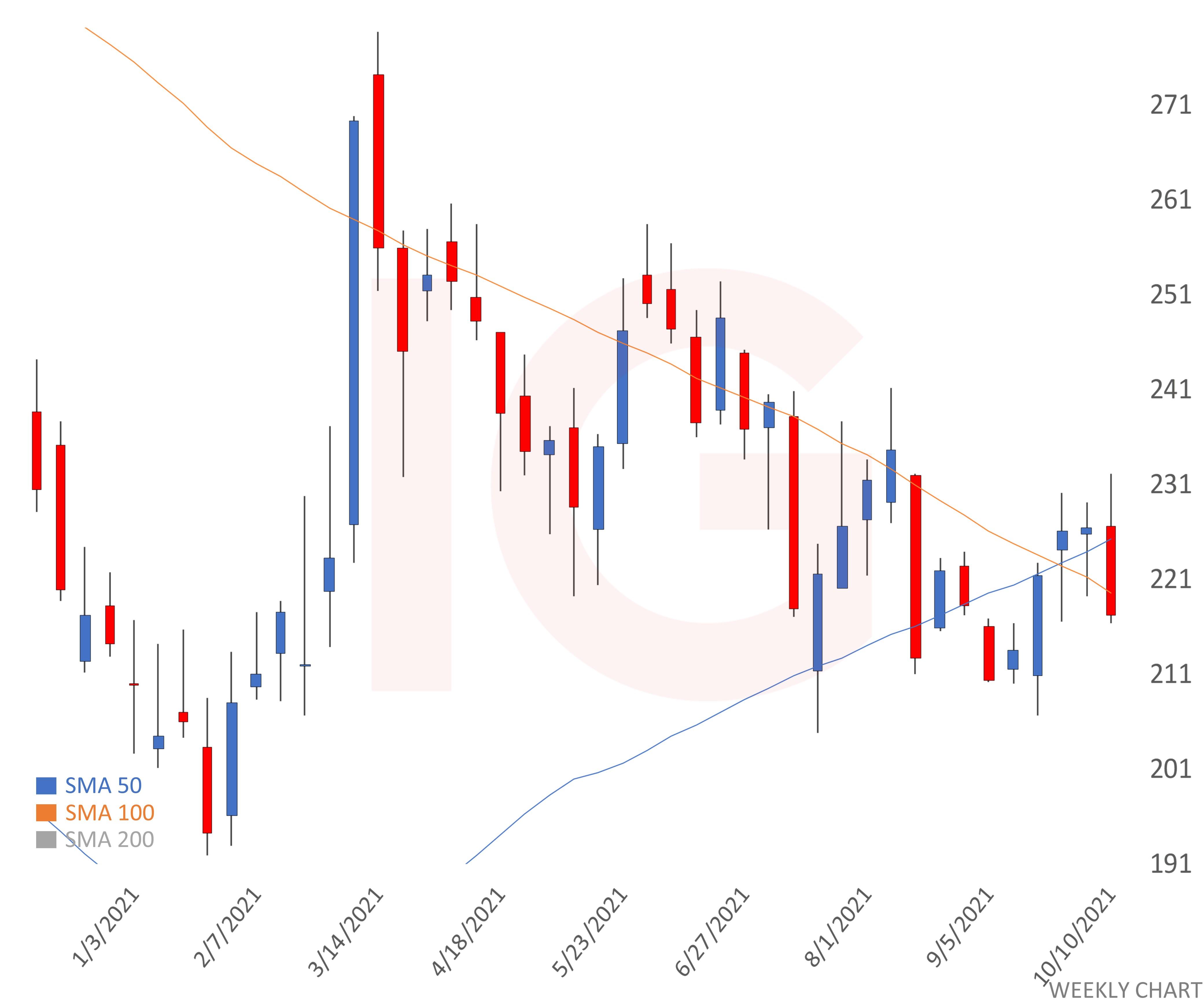

From a technical standpoint, it’s been months of moves that have consolidated back towards the mean, keeping most of its technical indicators neutral and within close proximity with each other, the prices beneath its main short and long-term moving averages in both daily and weekly time frames, and in the bottom half of the Bollinger bands that in turn have been narrowed on what has been a lack of a proper breakout move, its long-term bear trend line visible on the weekly chart briefly breached but overall holding for the time being.

That all translates into a technical overview that’s consolidatory but showing negative technical bias, with a move towards the mid-term support level that roughly coincides with the weekly second support level giving contrarian breakouts the advantage should the first support level fail to hold.

Last time around the upside surprise in earnings lead to a big move, and if traders are less likely to be shocked this time around, then a push towards or past key levels to the upside might not be done with as much ease, else putting contrarian buy-breakout strategies into play.

|

Current technical overview |

Consolidation - negative bias |

|

Technical overview conformist strategies |

Sell 1st resistance at/before price, buy 1st support after reversal |

|

Technical overview contrarian strategies |

Buy 1st resistance upon breakout from below, sell 1st support upon breakout from above |

|

S/L for 2nd resistance |

241.77 |

|

2nd Resistance |

237.59 |

|

S/L for 1st resistance |

233.40 |

|

1st Resistance |

229.21 |

|

Relative starting point |

220.84 |

|

1st Support |

212.46 |

|

S/L for 1st support |

208.27 |

|

2nd Support |

204.09 |

|

S/L for 2nd support |

199.90 |

Source: IG

Source: IG

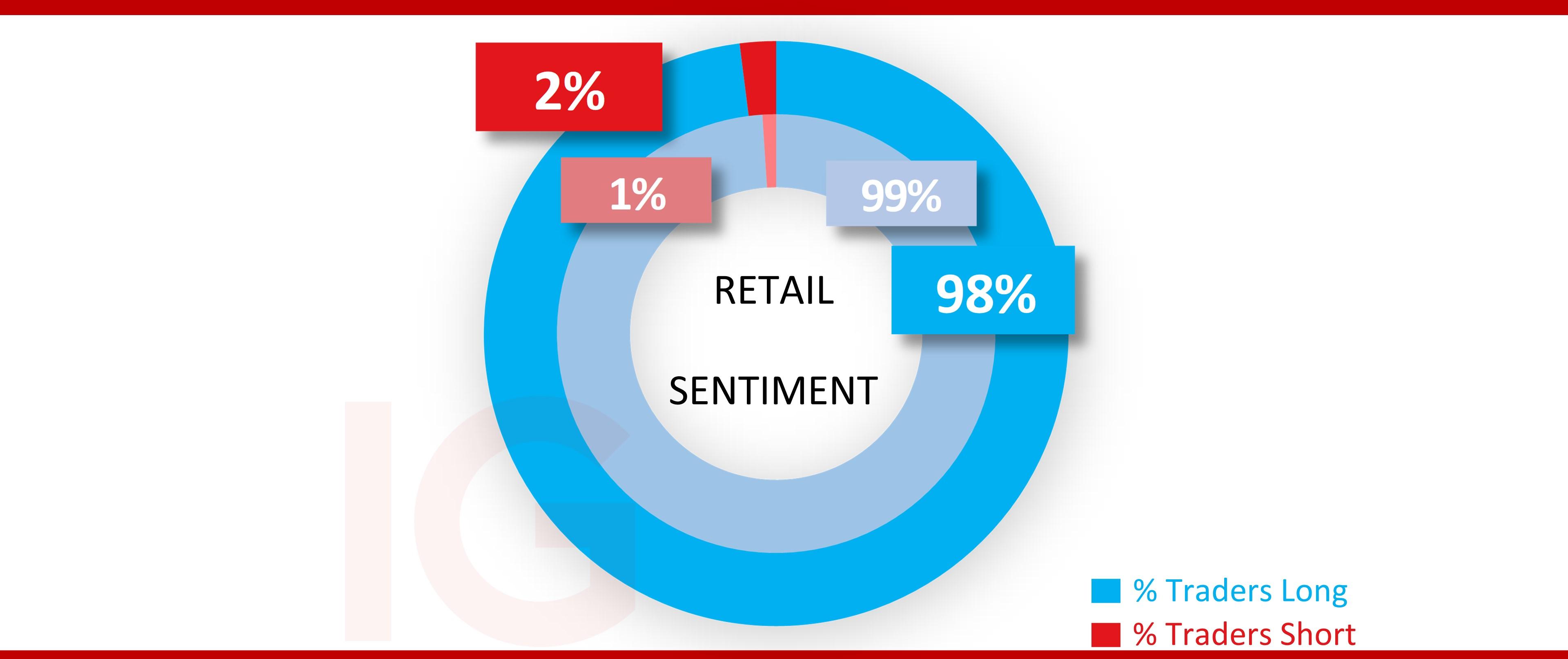

IG Client sentiment* and short interest for Boeing shares

When it comes to retail trader sentiment, it’s extreme buy and little changed since figures last quarter which were at 97%, little change from last week’s 99% long bias to 98% according to the latest reading. Its share price may have dropped since the start of last quarter, but the losses thus far have been far more contained than the Covid-19 pandemic’s plunge where its share price briefly lost more than two-thirds of its value.

As for short interest (according to shortsqueeze.com), it has dropped since the last quarter where it was 9,410,000 shares to 8,100,000, representing about 1.5% of shares floated, slightly below the 1.61% seen in the last Boeing earnings preview.

Source: IG

Source: IG

* The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1%, as of today morning 8am for the outer circle. Inner circle is from the previous trading day.

-

1

1

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now