What’s in store for the S&P 500 in September?

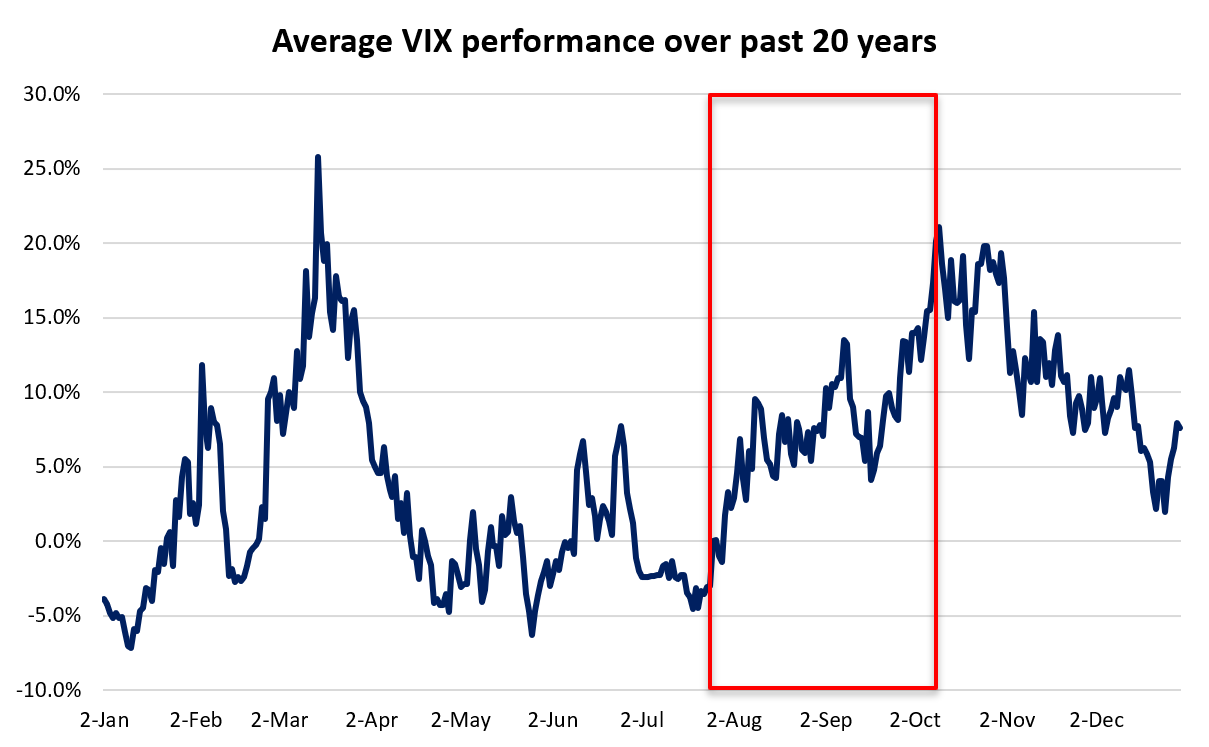

If seasonality is of any guide, we are potentially heading into a period of increased volatility. With key economic data in focus ahead, how will the S&P 500 play out this month?

Source: Bloomberg

Source: Bloomberg

What to expect this coming September?

If seasonality is of any guide, we are potentially heading into a period of increased volatility, which traditionally saw a move higher in the VIX before tapering off towards the end of the year. The average 10-year historical performance of the S&P 500 generally saw May (+0.23%) and September (-0.35%) being the weaker months compared to the rest of the year. After a period of consolidation in mid-August this year, the VIX has bounced off its closely-watched 20 level, rejecting the notion of a perceived low-risk environment (VIX < 20). This suggests ongoing market stress, in light of heightened uncertainty and fear. With the recent sell-off, current market sentiments seem to trade more on the neutral level, with a clear moderation from previous overbought technical and market breadth conditions.

Source: Refinitiv

Source: Refinitiv

Key economic data in September

With the Federal Reserve (Fed) removing its forward guidance and taking on a data-dependent stance, more focus will be placed on the upcoming economic data to drive market expectations of upcoming policy moves. Several potential high-impact economic data in September to watch may include:

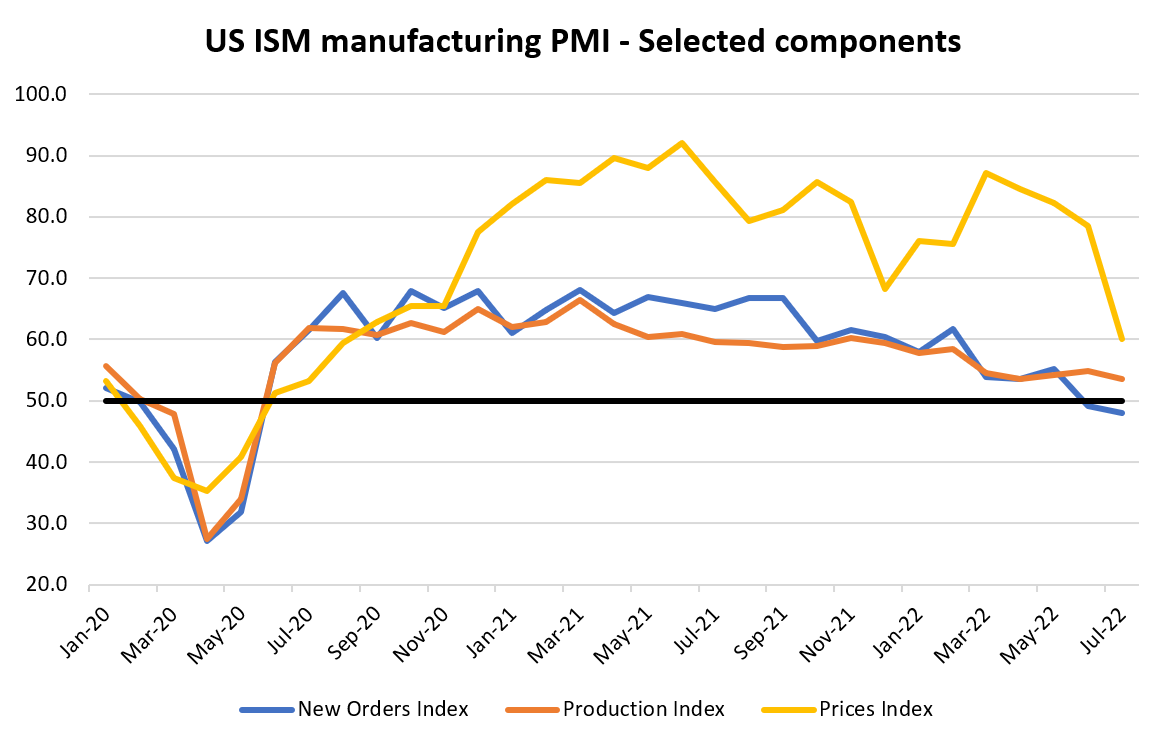

1 September 2022, Thursday: ISM manufacturing PMI

6 September 2022, Tuesday: ISM non-manufacturing PMI

Prices paid by firms are expected to display a slower increase compared to the previous month, in order to support the peak-inflation narrative. With the prices-paid sub-index trending below expectations for four consecutive months since April this year, markets could be accustomed to seeing further moderation in pricing pressures. With that, any upside surprise could point to Fed’s tightening process being higher-for-longer. Further constraints on economic conditions such as new orders and production could be reflected as well, but the primary priority for the Fed seems more concentrated on taming inflation compared to supporting growth at current point in time.

Source: Refinitiv

Source: Refinitiv

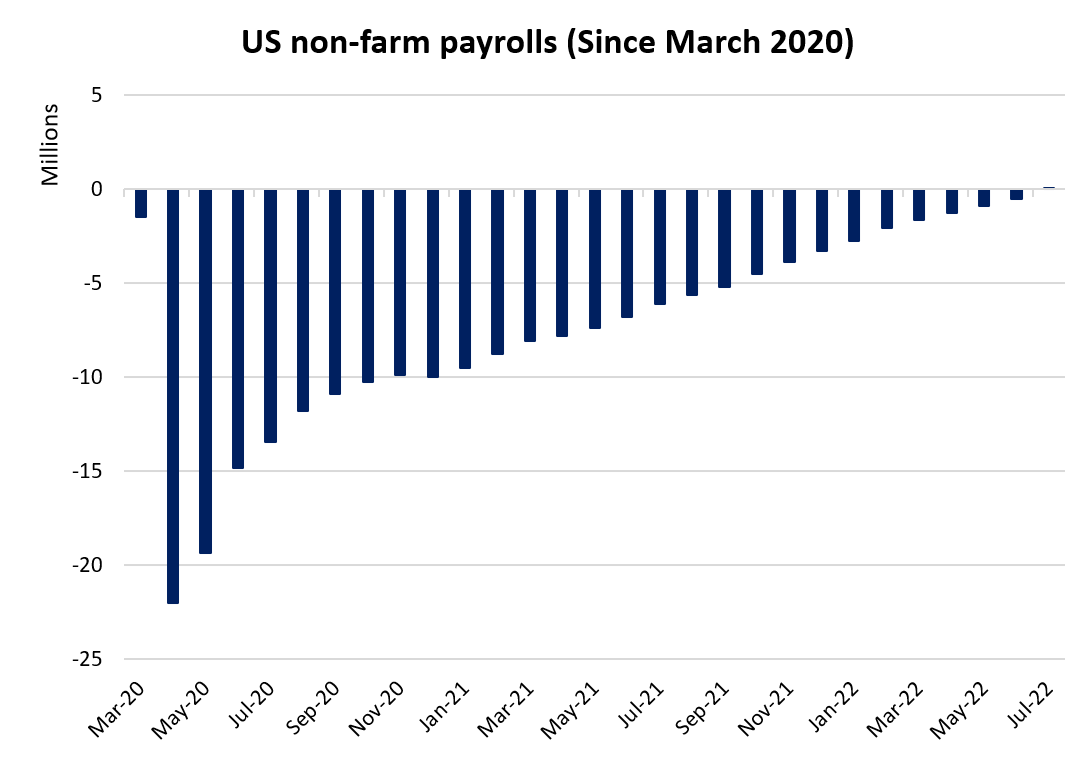

2 September 2022, Friday: US non-farm payrolls

The US labour market has fully recovered all of its jobs lost due to Covid-19, which highlights greater need for job gains to fall back to more normalised levels of the 200,000 monthly range. That has not materialised thus far, with job numbers blowing past expectations over the past four months. Another blowout reading will likely fuel louder calls for more aggressive tightening from the Fed to tame the overheated labour market, providing another headwind for equity bulls to overcome.

Source: Refinitiv

Source: Refinitiv

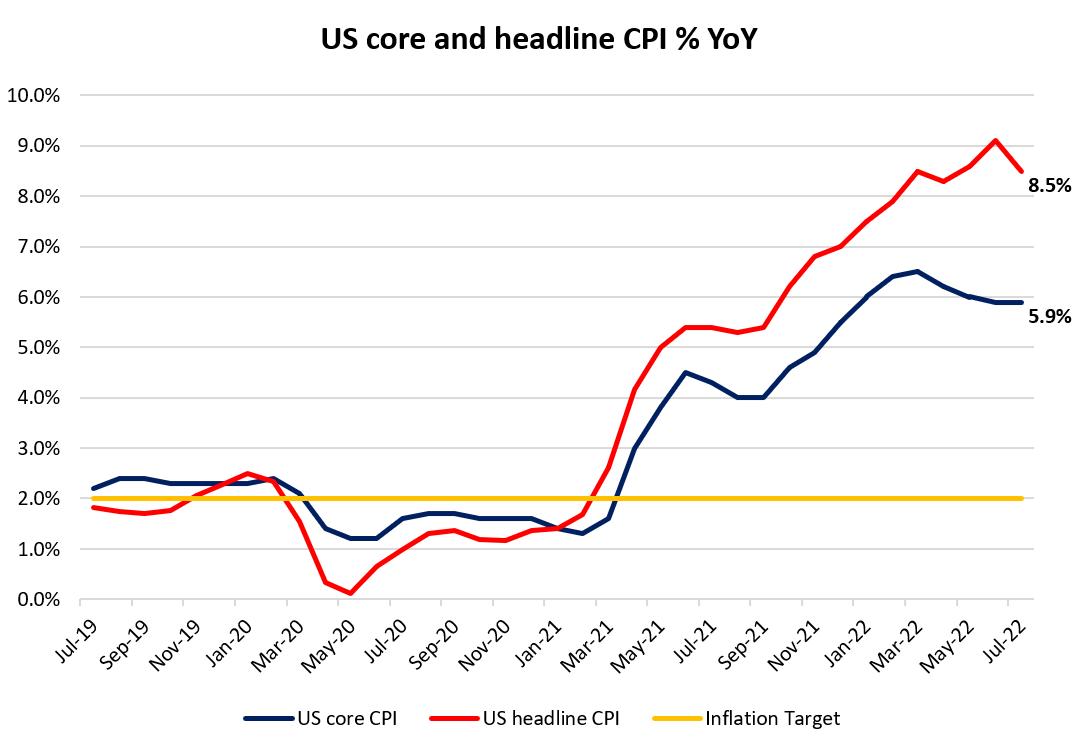

13 September 2022, Tuesday: CPI

14 September 2022, Wednesday: US PPI

The August readings for US headline inflation did provide some relief for markets after delivering its first downside surprise for the first time since March 2021, fuelling expectations that the worst is over in terms of pricing pressures. That said, a single data point does not make a trend. With markets having accustomed to the narrative that prices should continue to trend lower over the coming months, there are some pressure for inflation data to keep up with expectations. Current estimates are still pointing to an average of 7.5% for headline consumer price index (CPI) in quarter four (Q4) 2022, which could translate to the Fed maintaining its firm stance in taming inflation and we may have to see inflation readings around the low-5% range for some considerations of a dovish pivot. With the peaking-inflation narrative having been priced for now, further downside surprise in inflation data will be closely watched to push back against inflation being more persistent and hence, lesser pressure on Fed’s tightening.

Source: Refinitiv

Source: Refinitiv

Key market risk event: US FOMC meeting (20 – 21 September)

The upcoming month will bring the next long-awaited Federal Open Market Committee (FOMC) meeting, where the debate will continue to revolve around whether a 75 basis-point (bp) or a 50 bp hike is warranted. With the higher-for-longer stance for rates coming from various Fed members, the Fed Funds futures are currently placing its firm bet on a 75 bp increase with a 68.5% chance. A 75 bp hike may sound daunting, but if the Fed can provide indication of a subsequent rate slowdown, sell-off could potentially be short-lived. With talks surfacing of a higher-than-4% terminal rate, the fresh dot plot will be closely watched for any push-back as market expectations are still pricing for a 3.75% terminal range.

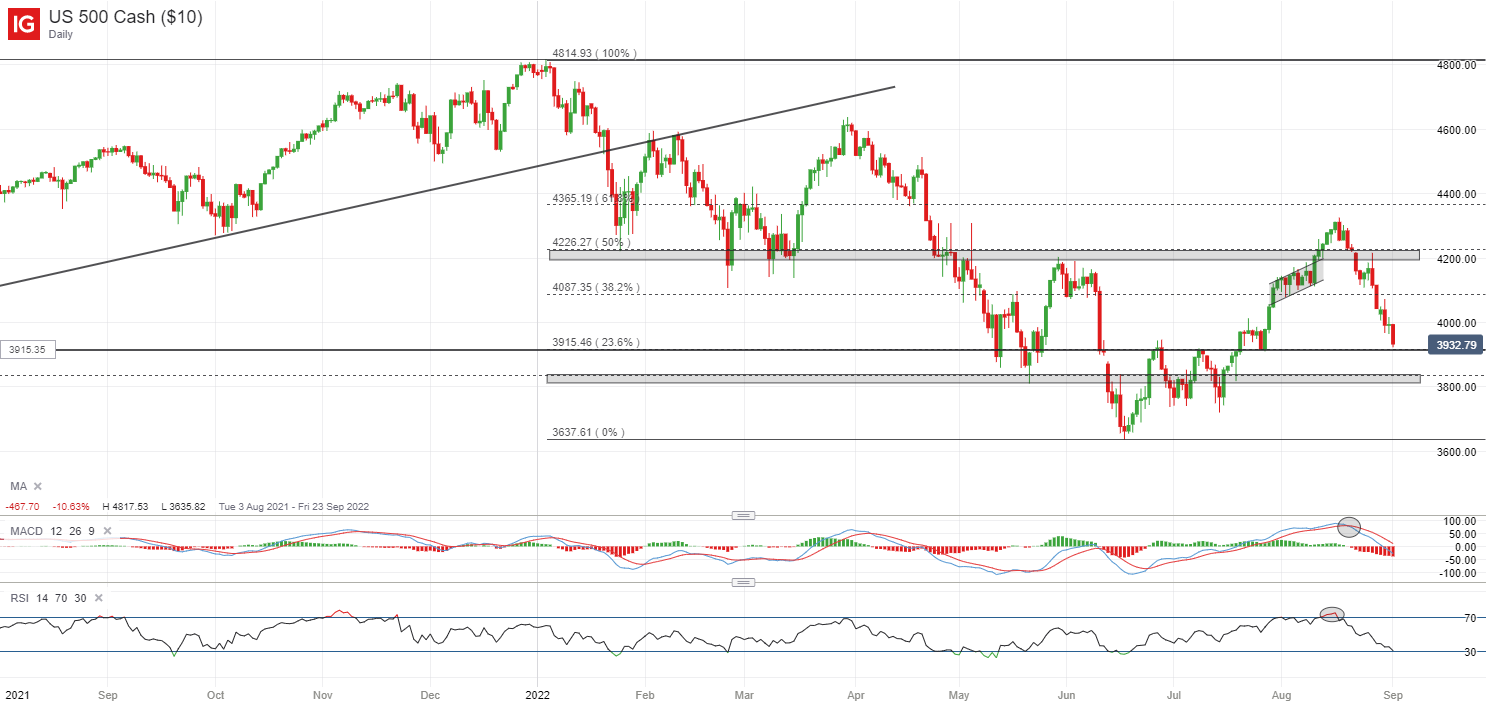

Technical analysis – S&P 500

After a failed retest of the 4,200 support level to end last week, the S&P 500 has crashed through its 100-day moving average (MA), with the series of lower highs and lower lows reinforcing an overall downward bias. The index has failed to defend its key psychological 4,000 level this week, which will now serve as resistance to overcome. Near-term support may be at the 3,915 level, but with the bears currently in control, any rebound from this level could leave the formation of a lower high on watch.

Source: IG charts

Source: IG charts

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now