JPMorgan Chase & Co share price and Q3 earnings results preview

What to expect and how to trade JPMorgan Chase & Co’s upcoming results.

Source: Bloomberg

Source: Bloomberg

When are the JPMorgan Chase & Co’s results expected?

JPMorgan Chase & Co is set to release its third quarter (Q3) 2022 results on 14 October 2022. The results are for the fiscal quarter ending September 2022.

What is ‘The Street’s’ expectation for the Q3 2022 results?

‘The Street’ expectations for the upcoming results are as follows:

Revenue of $32.091 billion : +5.42% year on year (YoY)

Earnings per share (EPS): $2.91 (-22.21% YoY)

JPMorgan Chase’s president and chief operating officer Daniel Pinto three weeks ago stated that markets revenue was headed for a 5% increase compared to last year’s, as strong activity in fixed income offset lower equities trading revenue.

At the same time, he warned that investment banking revenue is headed for a “45% to 50% decline in the third quarter” from a year ago but that the bank can adjust its cost structure not only by cutting jobs, but also by reducing the size of employee bonuses.

The bank posted $3.3 billion in third-quarter investment banking revenue last year, amid strong demand for IPOs, stock issuance and other deals.

The last few years’ bull market turned into a bear market earlier this year which has been accompanied by steep declines in capital markets activity as IPOs slow to a crawl and mergers become rarer as stocks had their worst first half since 1970.

The JPMorgan Chase & Co share price is down over 32% year-to-date (as of 6 October 2022) with the bank expected to cut compensation and jobs in the coming months but hopes to get back to 2020 variable compensation levels by next year.

Some, such as Citi’s analyst Keith Horowitz, believe that JPMorgan Chase & Co stock is currently “oversold due to credit concerns” and that third-quarter earnings will come in better than expected as the bank revises upward its outlook for net interest income, which is the profit generated from issuing loans at a higher interest rate than it pays customers for their deposits.

How to trade JPMorgan Chase & Co into the results

Source: Refinitiv

Source: Refinitiv

Refinitiv data shows a consensus analyst rating of ‘buy’ for JPMorgan Chase & Co – 5 strong buy, 11 buy, 10 hold and 1 sell - with the median of estimates suggesting a long-term price target of $135.50 for the share, roughly 23% higher than the current price (as of 6 October 2022).

Source: IG

Source: IG

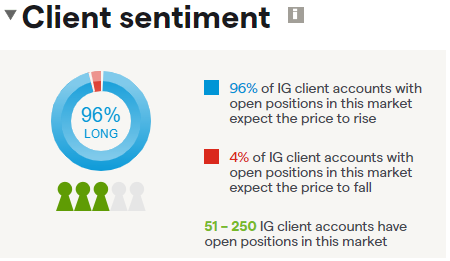

IG sentiment data shows that 96% of clients with open positions on the share (as of 6 October 2022) expect the price to rise over the near term, while 4% of these clients expect the price to fall.

JPMorgan Chase & Co – technical view

Source: ProRealTime

Source: ProRealTime

The JPMorgan Chase & Co share price has been trading in a downtrend channel for the past year, down around 36% from its October 2021 peak at $172.96, and would need to rise above the second to last reaction high on the weekly chart at the August high at $124.24 to form a lasting medium-term bullish reversal pattern. A reaction high is formed when a candle’s high is higher than that of the candle to its left and also the one to its right.

While the mid-August high, the second to last reaction high on the weekly chart, at $124.24 isn’t overcome, the downtrend remains intact.

Source: ProRealTime

Source: ProRealTime

On the daily chart this year’s downtrend channel resistance line comes in at $115.50 and, together with the 55-day simple moving average (SMA) at $113.91, may offer minor resistance ahead of the investment bank’s earnings out on Friday 14 October, especially since this area capped the share price from mid-June to early August.

A drop through the $104.40 September low would not only put the psychological $100 mark but also the December 2018, July and December 2020 lows at $91.38 to $90.78 on the cards.

From a purely technical perspective, short-term traders who are long might consider using a daily close below $104.40 as a stop loss for their trade whereas traders who are medium-term short may wish to place their stop loss above the $124.24 mid-August high.

Summary

JPMorgan Chase & Co is set to release Q3 2022 results on 14 October 2022

Q3 2022 results are expected to show a relatively small YoY increase in revenue but a 22% drop in EPS

Revenue is expected to be boosted by strong activity in fixed income markets which offset lower equities trading revenue

Long-term broker consensus suggests the share to currently be a ‘buy’, with a median price target of $135.50

96% of IG’s clients with open positions are long the share

The JPMorgan Chase & Co share price has been trading in a downtrend channel since October of last year and would need to see a daily chart close above the August high to form a bullish reversal pattern.

.jpeg.98f0cfe51803b4af23bc6b06b29ba6ff.jpeg)

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now