Tesla's Q2 results: A turnaround story amid rising deliveries and fiscal stability

Anticipating a significant increase in revenue, Tesla is set to release its Q2 results on Wednesday, July 19. With record sales in China, can it sustain its growth and justify its valuation in an increasingly competitive market?

Source: Bloomberg

Source: Bloomberg

Anticipation for Tesla's Q2 results

When is Tesla’s results date? Wednesday, July 19, after the market closes, is when we can expect Tesla, Inc. to release its figures for the second quarter of this year.

Tesla predictions post Q2 results

Following what were clear beats on deliveries, the forecasts are for an increase in revenue. This increase is expected to best first quarter figures and what we saw for the same quarter a year earlier.

Insight into Tesla's delivery numbers

Breaking down the deliveries, the preliminary print showed 466K, an increase of over 10% quarter-on-quarter (q/q). Production was higher at 480K, up 9% over the same period. This reduced the gap between it and deliveries, though a gap still exists, raising the net tally after consecutive quarters of excess supply. As a percentage, Model X and S rose to 4% of total deliveries, a big increase for the quarter.

Consequently, the share of the lower-margin Model 3 and Y dropped, even if retaining an obvious and near-full majority. Record sales in China of over 93K for the month of June were a big plus, according to data from China’s Passenger Car Association. These sales showed gains of nearly 19% from a year earlier.

Keys to justifying Tesla's valuation

This quarter has seen big moves in partnerships in the EV charging space for Tesla. It includes automakers choosing its Supercharger network and/or adopting its charging standard. Price reductions have been less pronounced compared to the first quarter’s ‘EV price war’ cuts.

Along with eligibility for the Inflation Reduction Act’s $7,500 tax credit, this is seen as a boon. It aids in maintaining price stability and competitive price ranges. This comes after pushing for high volumes compared to the previous “lower volume and high margin” approach, as CEO Elon Musk pointed out after the Q1 earnings release.

Forecasts for Tesla's revenue and EPS

Forecasts suggest revenue is expected to rise to $24.57bn, up from Q1's $23.33bn and Q2 2022's $16.93bn. However, earnings per share (EPS) is anticipated to drop to $0.82, down from Q1's $0.85 but higher than Q2's $0.76.

This figure has been revised higher over the past two months (source: Refinitiv). While it might not have bested estimates last time around, Tesla does have a decent history of beats.

Analyst recommendations on Tesla's shares

Analyst recommendations are more spread out compared to previous months. There's been an uptick in those venturing into ‘sell’ and ‘heavy underweight territory’, rising to two and four respectively. The number of those in ‘strong buy’ territory has dropped to six, 'buy' stands at 12. A larger group of 19 are opting to 'hold'.

The average target is $213.9, which is beneath its current share price (source: Refinitiv).

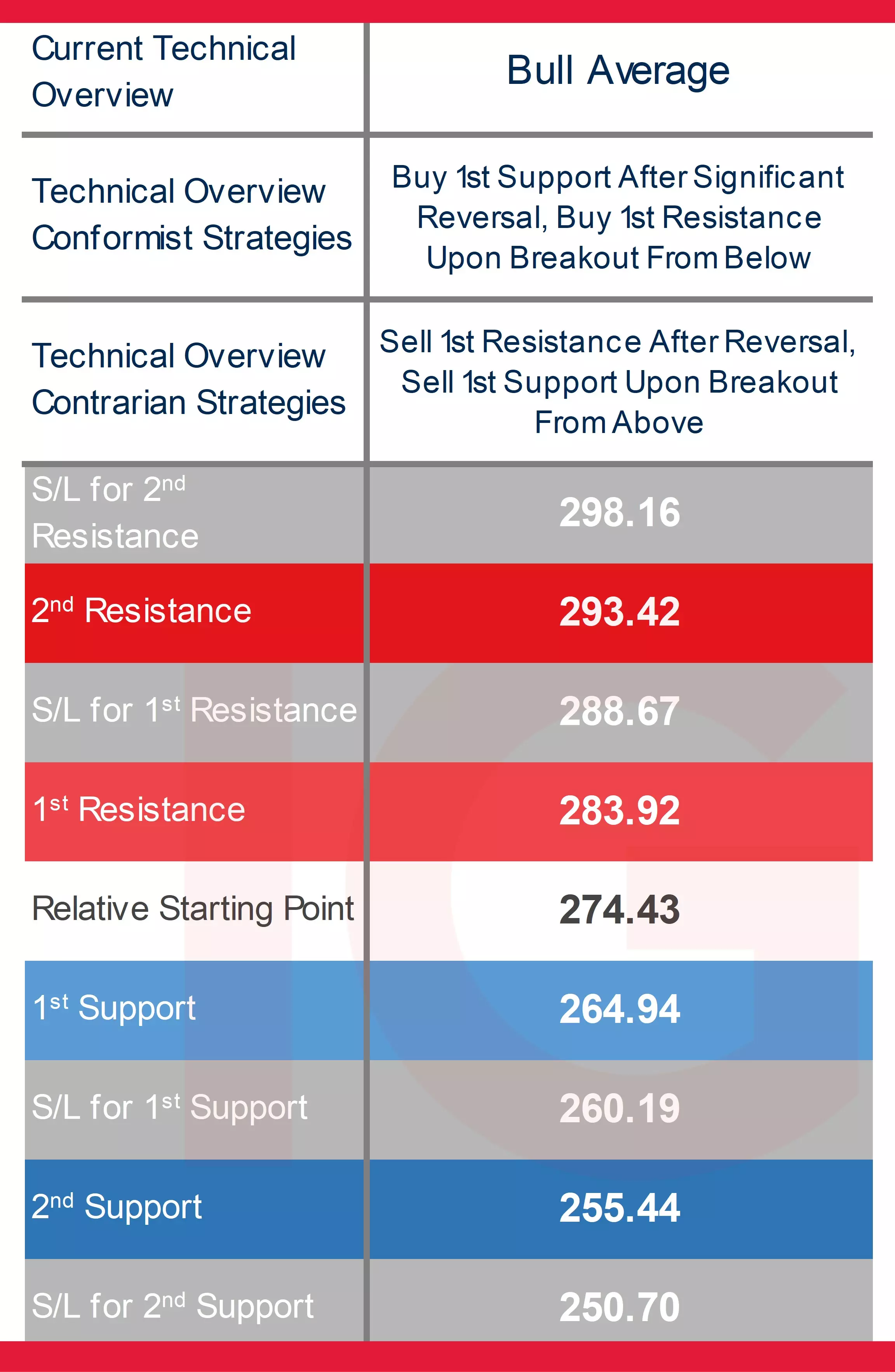

Trading Tesla’s Q2 results: Weekly technical overview

What a difference a quarter can make. With a change in the key technical indicators on the weekly time frame for Tesla’s share price, a breach is not just out of its previous bear channel covered in the first quarter earnings preview, but now in a smaller and narrower bull channel as seen in the chart below.

Strong technical indicators in the weekly time frame

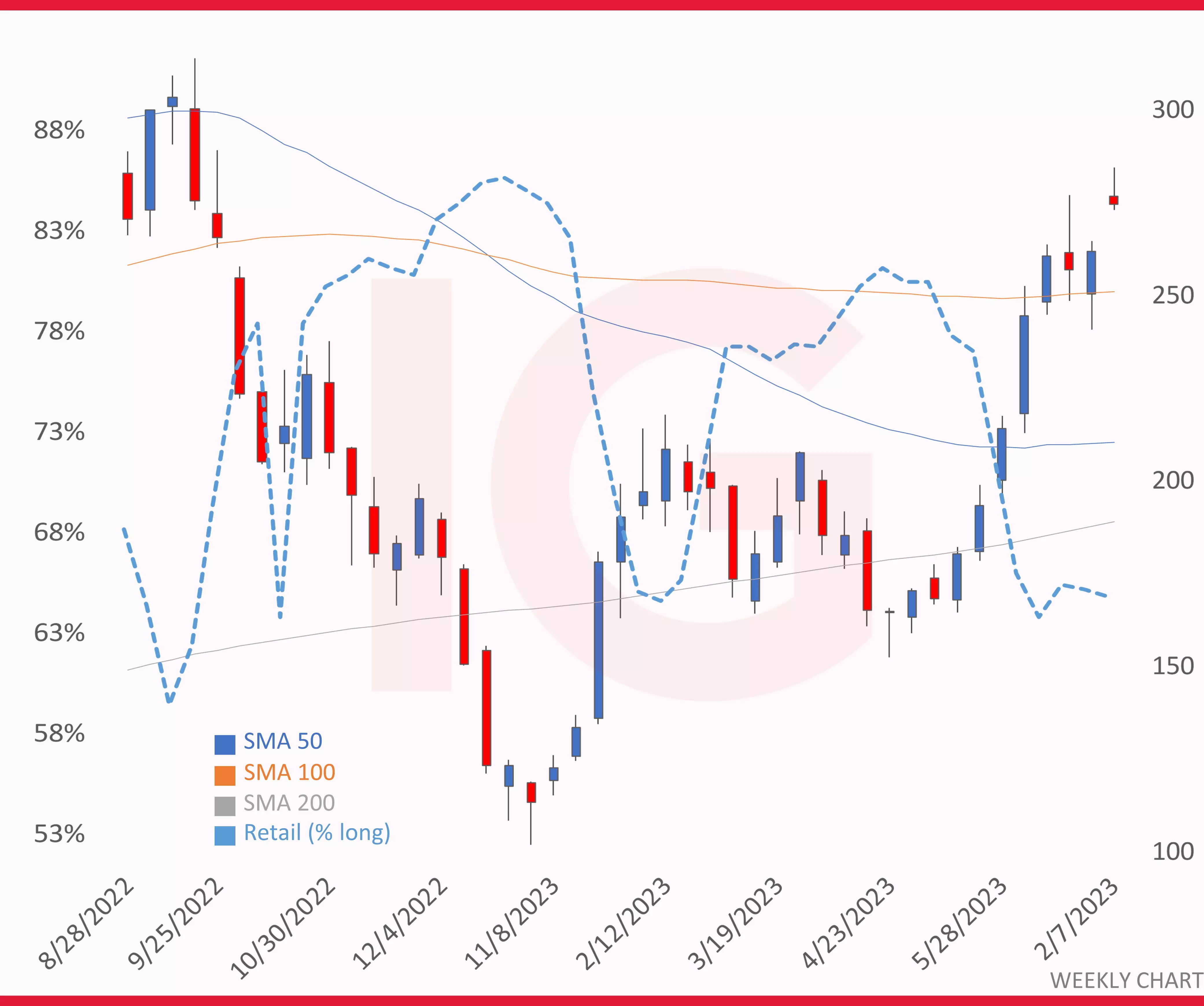

The technicals are naturally stronger on the daily time frame but here on the weekly time frame, we’re seeing the price above all its main moving averages and near the upper end of both the Bollinger Band and the bull channel. The RSI (Relative Strength Index) is just beneath what is considered to be overbought territory.

There is a sizable margin on the DMI (Directional Movement Index) front between the +DI and -DI. The ADX (Average Directional Movement Index) reading isn’t far off a decent trending figure. However, combined with a sizable channel (even if narrower than the prior weekly bear), it makes its technical overview more ‘bull average’ for now than ‘stalling bull trend’.

Strategic standpoint for buying and selling Tesla stocks

From a strategic standpoint, that puts buys into the conformist camp and allots sells for contrarians but this doesn’t mean conformists ought to initiate without caution, especially on any pullback that could take the price to the lower end of the channel.

As a result, buying off the weekly 1st Support level should ideally be done only after a significant reversal for those opting to go conformist. It's crucial to understand what’s on offer in terms of upside follow-through for breakouts above its 1st Resistance.

Contrarian approach and impact of earnings release

Those who don’t expect the recent bullish moves to last and favour going contrarian should consider shorting the 1st Resistance level only after a reversal. Sell-breakouts for more follow-through should be considered if eying a price near or beneath key weekly moving averages (such as the 50-week and 200-week).

It's important to remember that the earnings release is a fundamental event. Depending on how far results veer from expectations, it can easily test even longer-term weekly technical levels. This could result in a more breakout vs. reversal strategic scenario when the figures hit the wires.

Source: IG

Source: IG

Tesla weekly chart with key technical indicators (from IG’s trading platform)

Source: IG

Source: IG

Tesla weekly chart with IG client sentiment

Source: IG

Source: IG

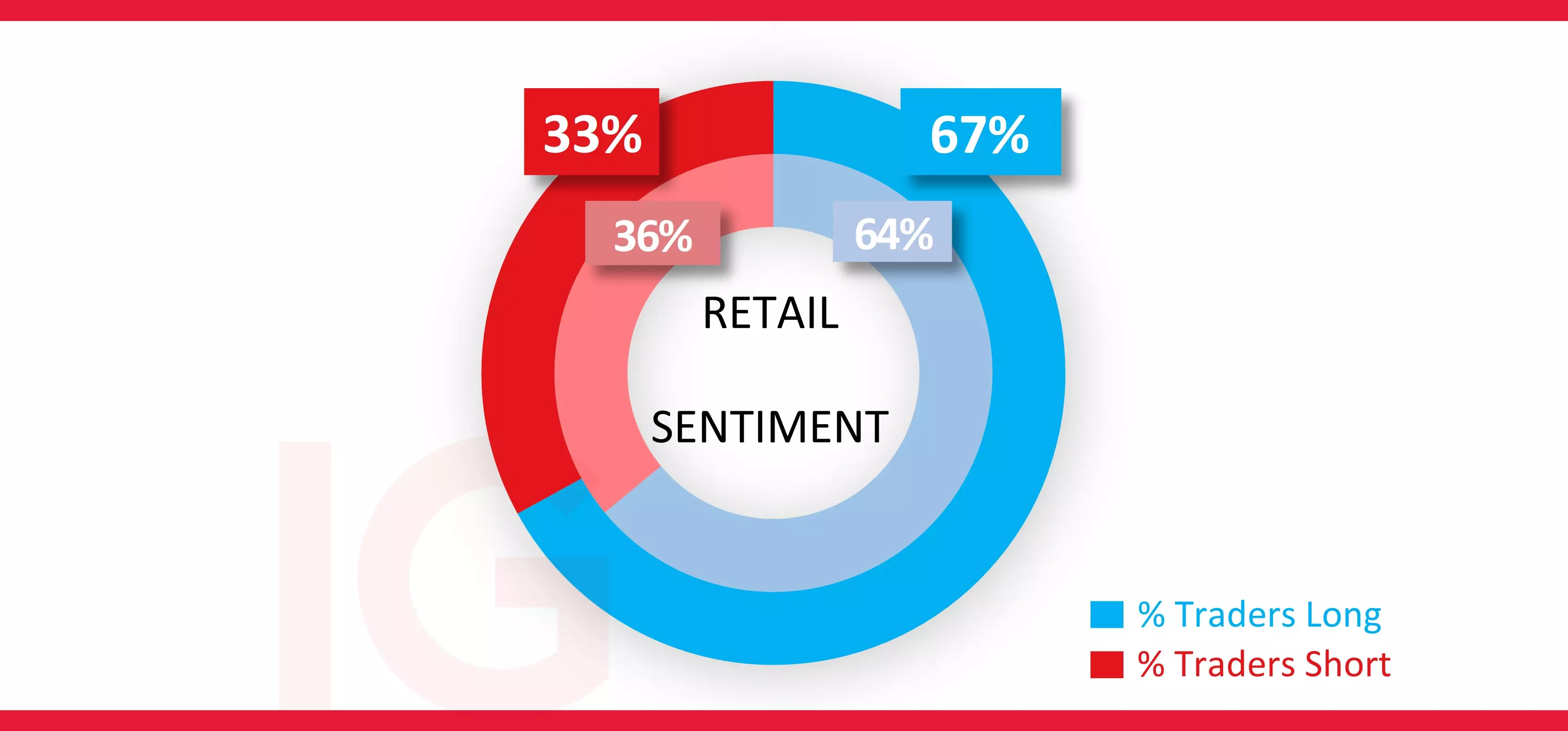

IG Client sentiment* and short interest for Tesla shares

Looking at the weekly chart, where the IG client sentiment (as an average for the week) is plotted as a blue-dotted line with the left axis representing % long, it's clear that the majority have remained in buy territory throughout this period. They reached extreme levels when prices dipped beneath $150, but fell back closer to heavy buy during the recovery. The latest reading from this morning (see image below) shows a heavy long position of 67% among retail traders, higher than the 64% at the start of this month.

Short interest has averaged higher over the past quarter, reaching over 96.48m shares, now representing 3.04% of the total, up from 2.7% at the start of the second quarter. These figures, however, are nowhere near the levels seen in 2019 when they briefly topped 600m (source: Refinitiv).

Source: IG

Source: IG

*The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1%, as of the start of the week for the outer circle. Inner circle is from the first trading day of this month, Monday, July 3rd.

.jpeg.98f0cfe51803b4af23bc6b06b29ba6ff.jpeg)

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now