Netflix Q4 earnings: the balancing act between growth and margin

Netflix (NASDAQ:NFLX) is set to disclose its Q4 2023 earnings report on January 23rd, 2024 after the US markets close. What are the expectations, and what is the outlook for the stock price?

Source: Bloomberg

Source: Bloomberg

Netflix earnings date

Netflix (NASDAQ:NFLX) is set to disclose its Q4 2023 earnings report on January 23rd, 2024 after the US markets close.

Netflix earnings key expectations

|

|

Q4 Expectation

|

Q3 reported |

Q4,2022 |

QOQ |

YOY |

|

EPS:

|

$2.15 |

$3.49 |

$0.51 |

-38% |

322% |

|

Revenue:

|

8.7B |

8.54B |

7.86B |

2% |

+11% |

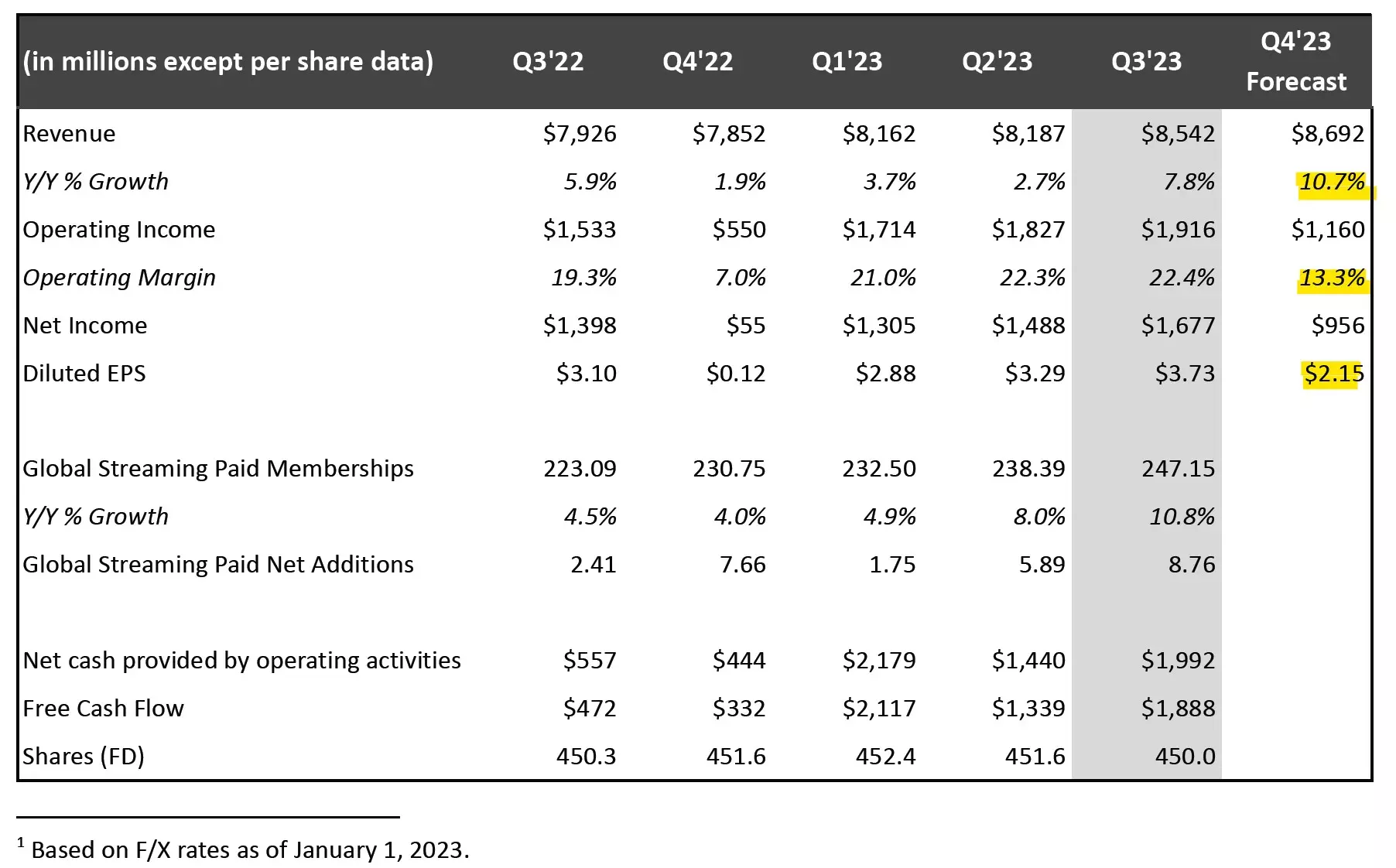

Source: Netflix

Netflix earnings key watches

Strong growth momentum

Netflix's performance in the third quarter of 2023 was remarkable. The company achieved an impressive 8% growth in revenue, reaching a record high level, primarily attributed to the higher-than-expected paid membership growth. Its global expansion of its streaming services played a crucial role, with a net addition of 8.76 million paid memberships in Q3 alone, pushing the total paid membership to a new record high of 247 million.

Into the fourth quarter, the company remains optimistic about its growth prospects and anticipates the continuation of robust user growth momentum.According to forecasts from the streaming giant, its Q4 revenue is projected to increase by 11% year-over-year, reaching $8.7 billion. The net addition of paid memberships is projected to be close to the previous quarter, potentially with another 8-9million new subscribers.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Netflix Q4, 2023 Forecast

Source: Netflix

Source: Netflix

Cost and margin headwind

The streaming king’s rosy outlook does not come without challenges.

Netflix’s operating margin is projected to take a dip in the fourth quarter. After reaching a 22.4% record high in the Q3, the notably surging content costs combined with a moderating global ARM (Average Revenue per Membership) are likely to mark an inflection point in Netflix’s profitability from Q4 2023 and onwards.

Earlier this month, Citigroup revised down its rating on Netflix from "Buy" to "Hold" emphasising its concerns about the stream king’s falling margins. Citigroup projected that Netflix's content spending would rise to around $20.4 billion by 2025, casting doubt on the company's profitability in the next two years. Based on the company’s forecast, its operating margin could plunge to 13% in Q4 from 22% in the recent quarter.

Additionally, Netflix also admitted that a strong US dollar versus other currencies would cost roughly $200M on the company’s Q4 revenue and ARM.

Netflix stock price and technical analysis

Before we embark on another year of uncertainties for price movements, let's first take a glance in the rear-view mirror at Netflix stock's past performance.

Over the last three years, Netflix's share price has experienced a rollercoaster ride, recording gains of 11% in 2021, a significant decline of -51% in 2022, and a juicy 65% gain in 2023. In contrast, the S&P 500 exhibited returns of 27% in 2021, faced a downturn of -19% in 2022, and rebounded with a 24% rise in 2023. It’s also not hard to see from the comparison charts below that Netflix's share price has demonstrated wilder volatility compared to the key benchmark in the past five years.

Source: Tradingview

Source: Tradingview

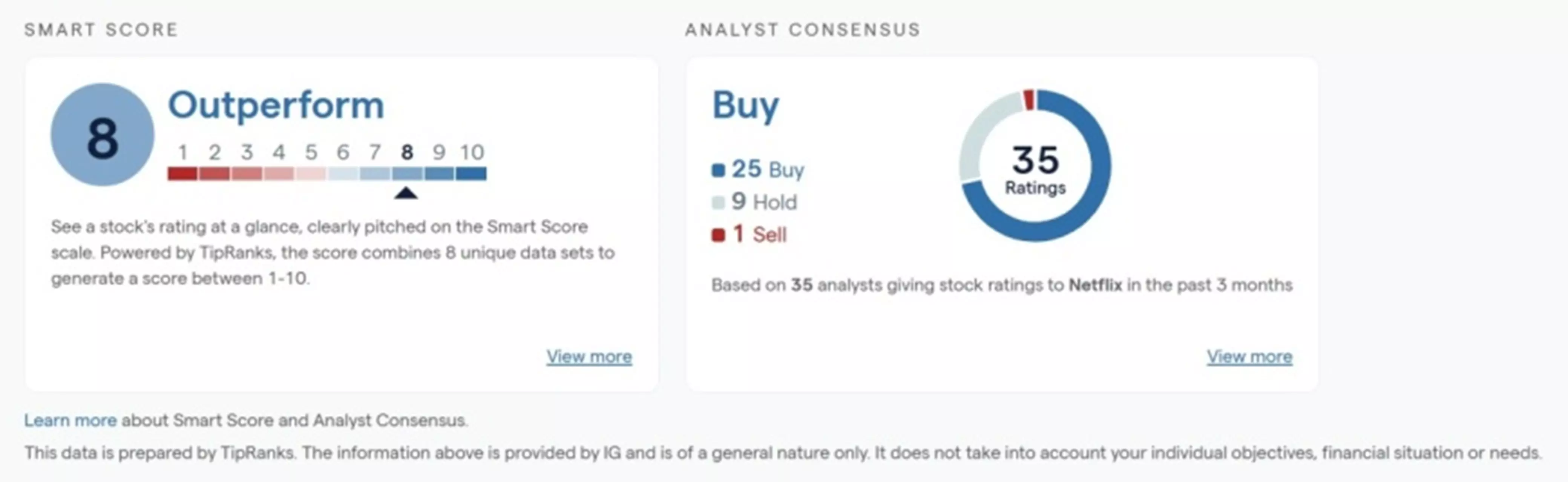

At the moment, Netflix's share price is hovering around the key threshold of $500, maintaining a clear and valid uptrend since July 2022 with the prices trading above all the major moving averages. Its remarkable performance in the past 18 months has earned an 8 out of 10 score rating by TipRanks, coupled with a strong endorsement from 25 buy ratings out of 35 global analysts in the past three months.

Source: IG

Source: IG

In the short term, trend followers may welcome the breakout from the $500 hurdle as a robust bullish momentum in harmony with the longer-term uptrend, and set their sights on the next target, near $560.

Nevertheless, it's worth noting that the range between $500 and $560 might pose a greater challenge, considering its historical congestion patterns dating back to June 2020 to August 2021 (as highlighted in the chart).

Conversely, a breach below the $480-$490 range could potentially serve as an early warning sign for a correction risk, as the ascending trajectory formed since October 2023 would lose its efficacy.

Source: IG

Source: IG

Netflix Q4 earnings preview summary

Overall, I believe the crucial watch for the impending earnings would be on Netflix's strategy and outlook to navigate declining profitability while sustaining its growth trajectory. In terms of stock prices, the upcoming quarterly update is poised to play a crucial role in determining if the stock price can successfully surpass the significant psychological level of $500.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

0 Comments

Recommended Comments

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now